EUR/CHF Daily Outlook

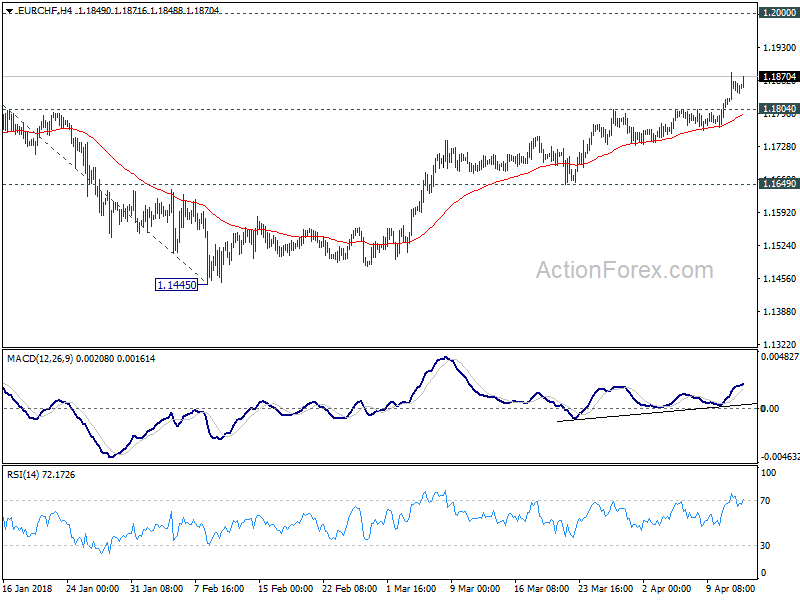

Daily Pivots: (S1) 1.1810; (P) 1.1845; (R1) 1.1878

Intraday bias in EUR/CHF remains on the upside for the moment. Medium term up trend has just resumed and further rise should be seen to 1.2 handle first. Break will target 61.8% projection of 1.0629 to 1.1832 from 1.1445 at 1.2188 next. On the downside, below 1.1804 minor support will turn intraday bias neutral first. But retreat should be contained well above 1.1649 support to bring another rise.

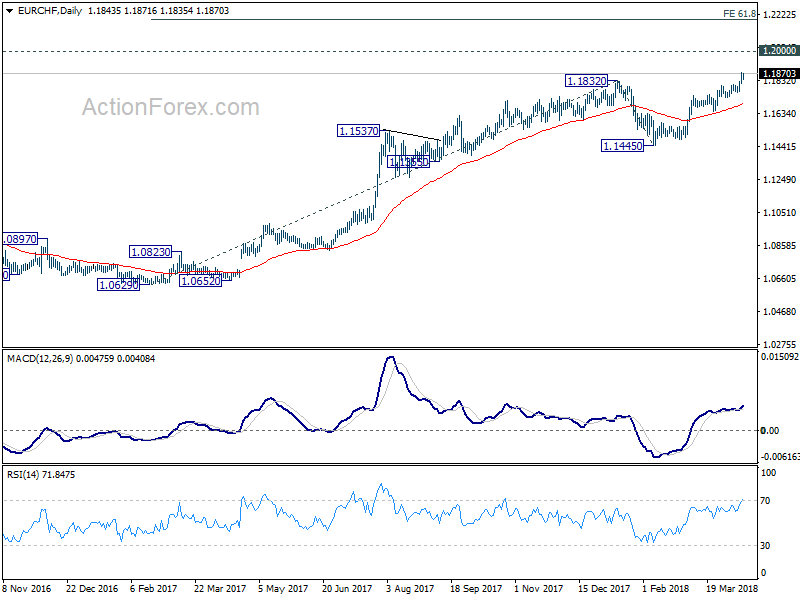

In the bigger picture, decisive break of 1.1832 should now extend the medium term up trend through prior SNB imposed floor at 1.2000. 2013 high at 1.2649should be the next target. Outlook will remain bullish as long as 1.1445 support holds, even in case of deep pull back.

GBP/JPY Daily Outlook

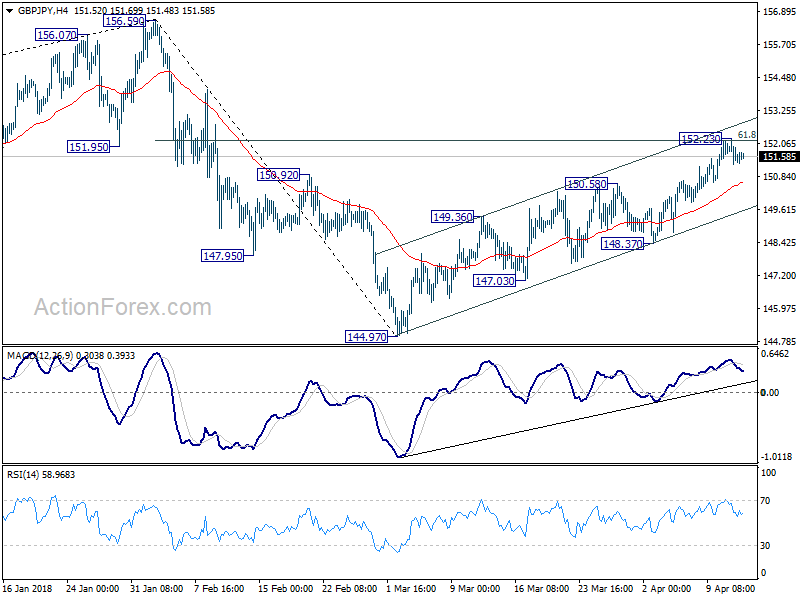

Daily Pivots: (S1) 151.06; (P) 151.59; (R1) 152.49

GBP/JPY lost upside momentum after meeting 61.8% retracement of 156.59 to 144.97 at 152.15. A temporary top is in place at 152.23 and intraday bias is turned neutral. Another rise is in favor as long as 148.37 minor support holds. But again, price actions from 144.97 are still seen as corrective looking. Hence, we’ll look for sign of loss of upside momentum as it approaches 156.59 high. Meanwhile, break of 148.37 will indicate completion of the rebound from 144.97 and bring retest of this low.

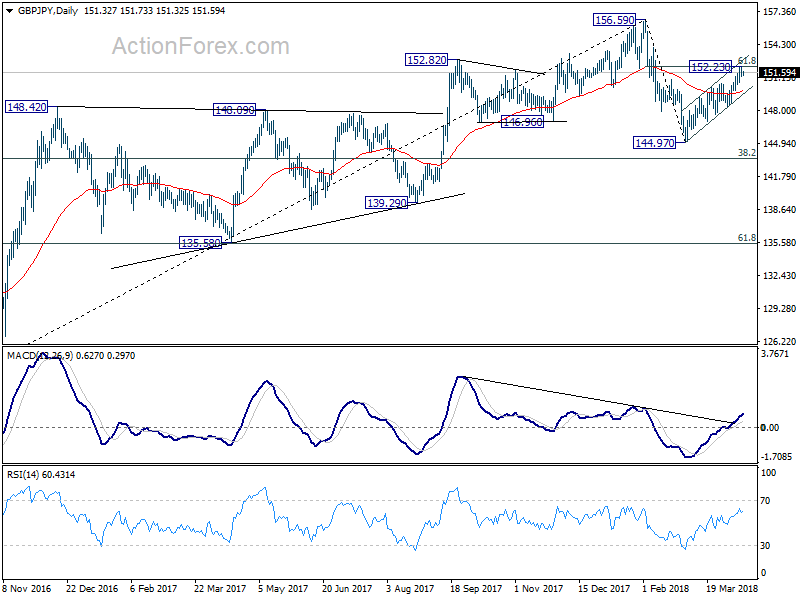

In the bigger picture, the outlook is turning mixed again. On the one hand, the cross was rejected by 55 month EMA (now at 154.20) after breaching it briefing. On the other hand, there was no sustainable selling pushing it through 38.2% retracement of 122.36 to 156.59 at 143.51. The most likely scenario is that GBP/JPY is turning into a sideway pattern between 143.51 and 156.59. And more range trading would now be seen before a breakout, possibly on the upside.