EUR/CHF Daily Outlook

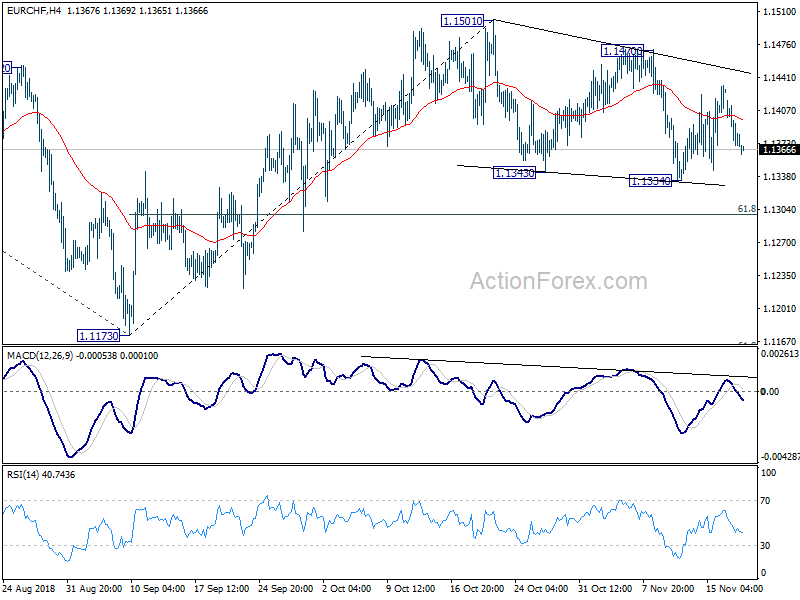

Daily Pivots: (S1) 1.1359; (P) 1.1392; (R1) 1.1414

No change in EUR/CHF’s outlook. The structure of price actions from 1.1501 suggests it’s a consolidation pattern. In case of another fall, downside should be contained by 61.8% retracement of 1.1173 to 1.1501 at 1.1298 to bring rebound. On the upside, break of 1.1470 resistance will argue that rise from 1.1173 is resuming. Break of 1.1501 will revive the case of bullish trend reversal.

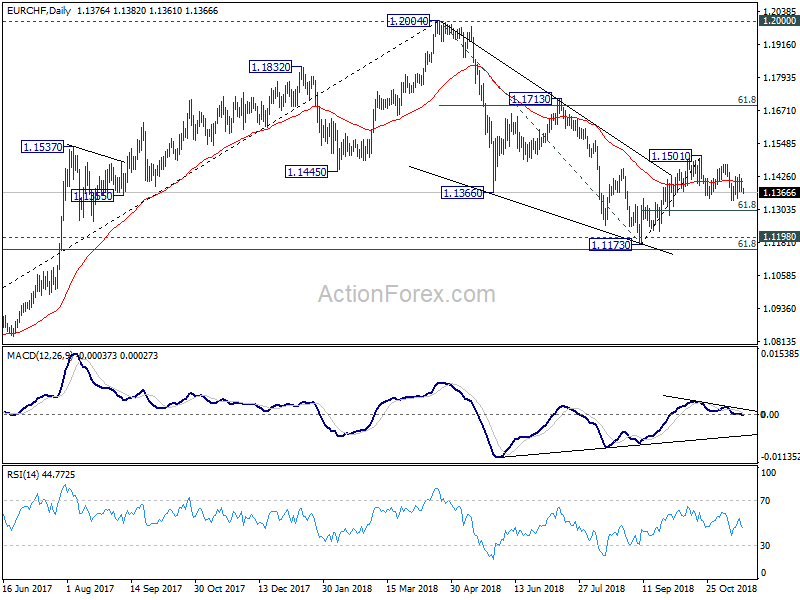

In the bigger picture, price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1261) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.

EUR/GBP Daily Outlook

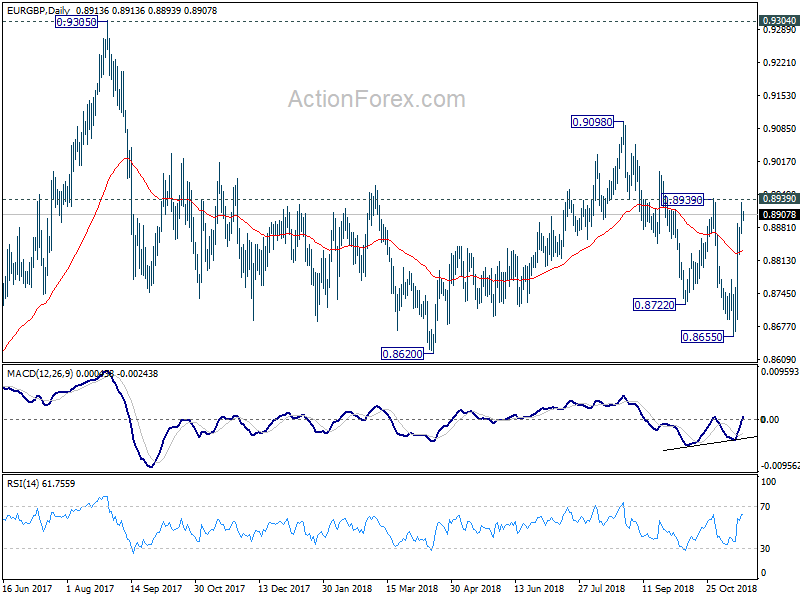

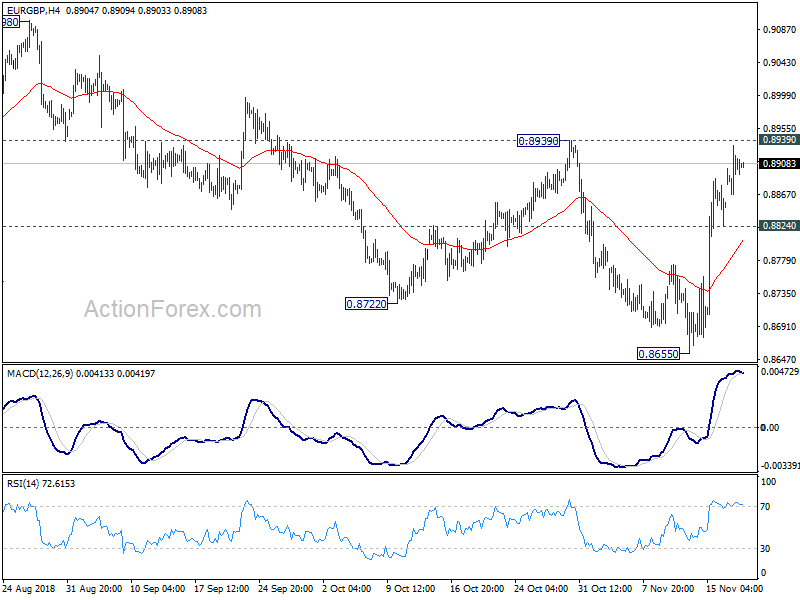

Daily Pivots: (S1) 0.8877; (P) 0.8903; (R1) 0.8938

EUR/GBP is losing some upside momentum as seen in 4 hour MACD. But further rise is expected as long as 0.8824 support holds. Decisive break of 0.8939 resistance will pave the way to 0.9098 high. However, break of 0.8824 will now suggest completion of the rebound from 0.8655. Intraday bias will be turned back to the downside instead.

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Medium term fall from 0.9305 is possibly in progress and could extend through 0.8620. On the upside, break of 0.8939 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain cautiously bearish even in case of rebound.