EUR/CHF Daily Outlook

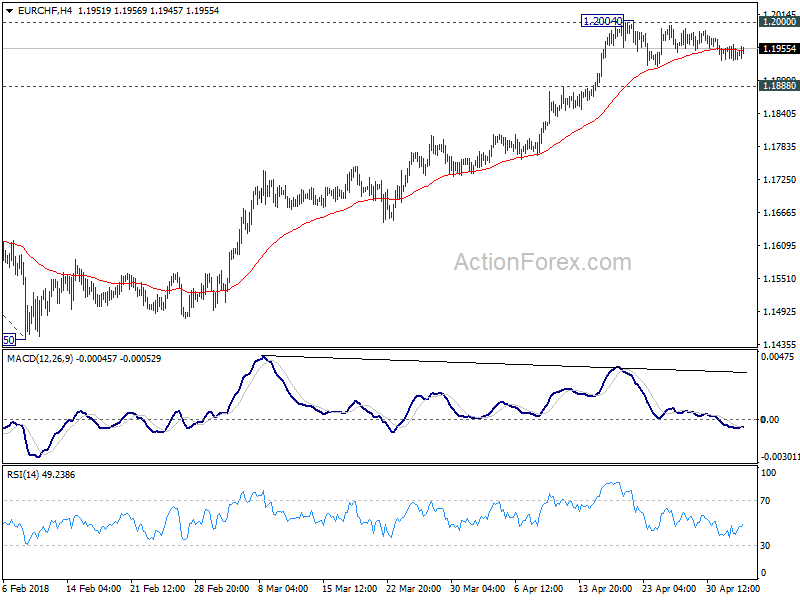

Daily Pivots: (S1) 1.1930; (P) 1.1946; (R1) 1.1959;

EUR/CHF remains bounded in tight range below 1.2004 as consolidation continues. Intraday bias stays neutral. Further rise is expected with 1.1888 minor support intact. On the upside side, decisive break of 1.2 will pave the way to 61.8% projection of 1.0629 to 1.1832 from 1.1445 at 1.2188. However, consider bearish divergence condition in 4 hour MACD, break of 1.1888 will indicate short term topping. In that case, deeper pull back would be seen back to 1.1445/1832 support zone.

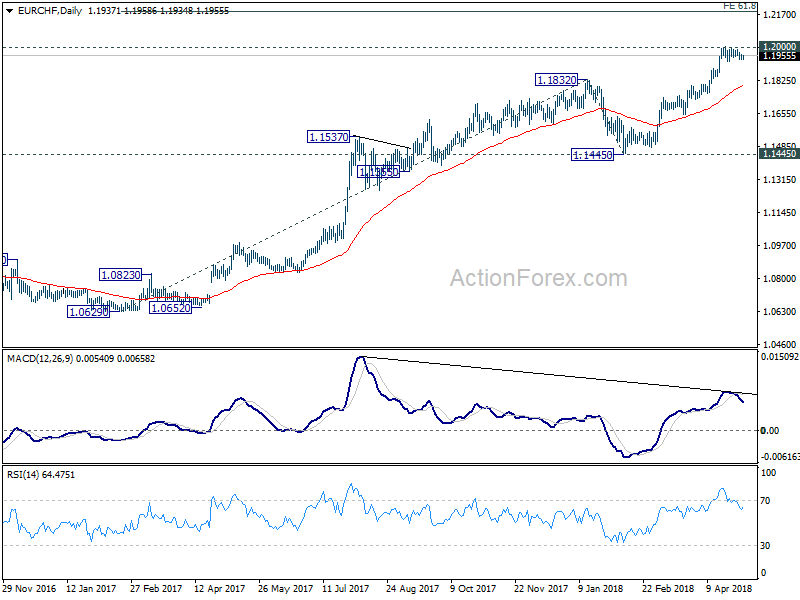

In the bigger picture, long term up trend in EUR/CHF is still in progress. Prior SNB imposed floor at 1.2003 was already met but there is no sign of reversal yet. As long as 1.1445 support holds, we’d expect the up trend to extend to 2013 high at 1.2649 next.

EUR/GBP Daily Outlook

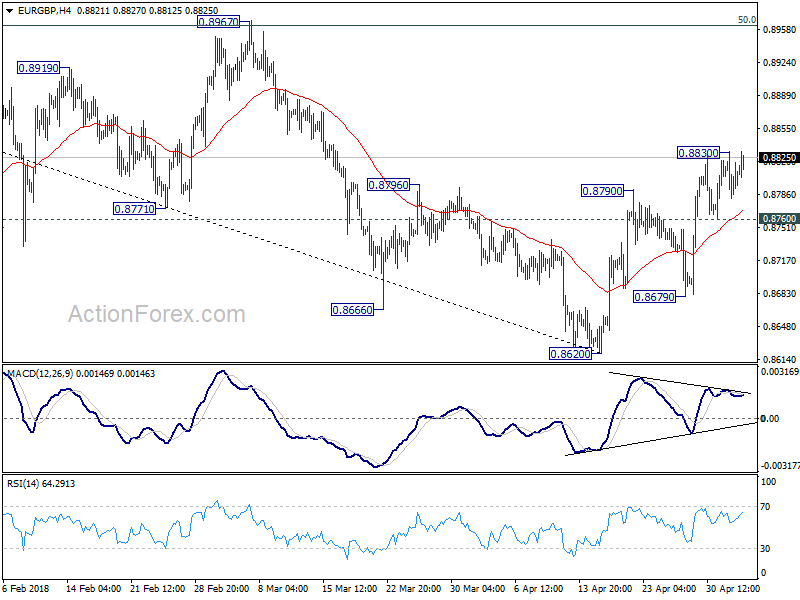

Daily Pivots: (S1) 0.8781; (P) 0.8805; (R1) 0.8829;

Intraday bias in EUR/GBP remains neutral at this point. Further rise is expected as long as 0.8760 minor support holds. On the upside, above 0.8830 will resume the rebound from 0.8620 and target 0.8967 cluster resistance next (50% retracement of 0.9305 to 0.8620 at 0.8963). Firm break there will confirm neat term reversal. On the downside, below 0.8760 minor support will turn focus back to 0.8679 support. Break there will suggests that larger decline from 0.9305 is resuming.

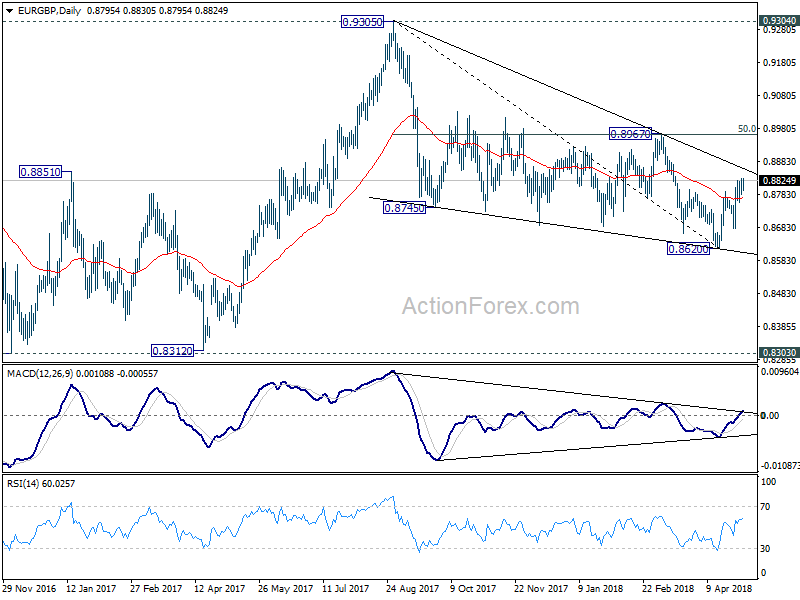

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.