EUR/CHF Daily Outlook

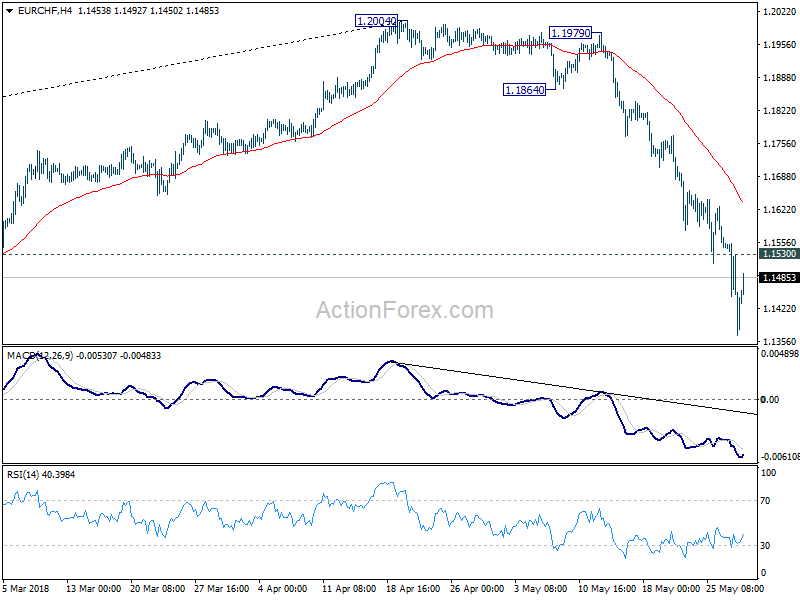

Daily Pivots: (S1) 1.1352; (P) 1.1454; (R1) 1.1540;

EUR/CHF breached 1.1445 support to as low as 1.1366 and recovered. There is no clear sign of bottoming yet and intraday bias stays on the downside. Sustained trading below 1.1445 will target next key support zone between 1.11543 and 1.1198. On the upside, above 1.1530 will turn intraday bias back to the upside and bring recovery first.

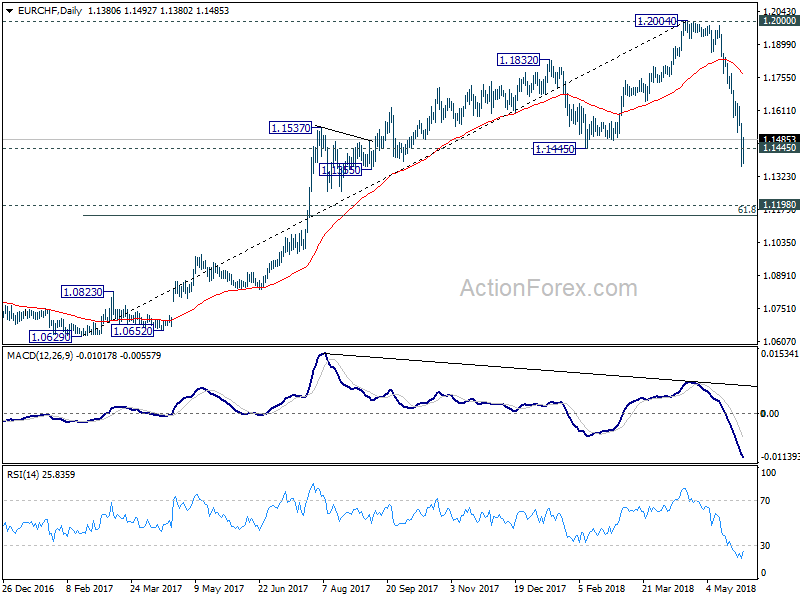

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. The cross has met 1.1445 already, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern. However, sustained break of 1.1445 will target next key cluster level at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154.

EUR/AUD Daily Outlook

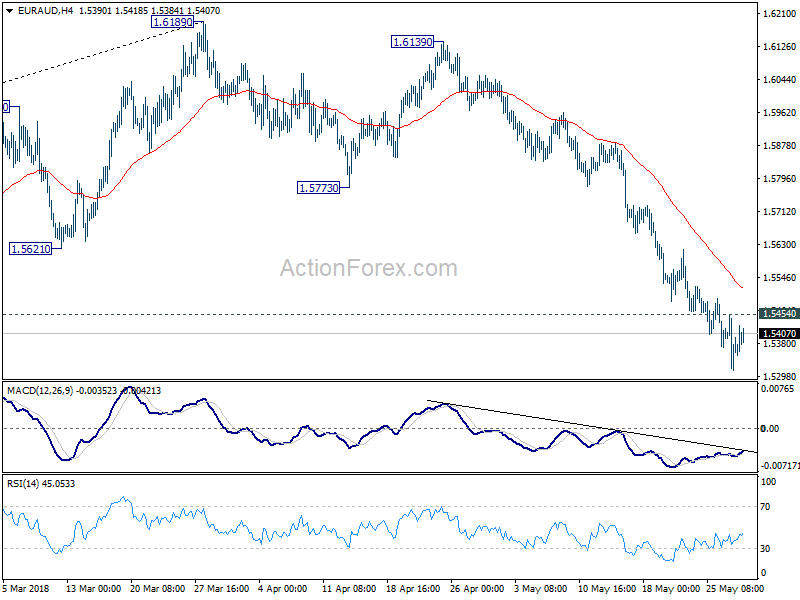

Daily Pivots: (S1) 1.5306; (P) 1.5382; (R1) 1.5448;

With 1.5454 minor resistance intact, intraday bias in EUR/AUD stays on the downside. Current fall from 1.6189 should target 1.5153 key support level next. On the upside, above 1.5454 minor resistance will turn intraday bias neutral and bring consolidation, before staging another decline.

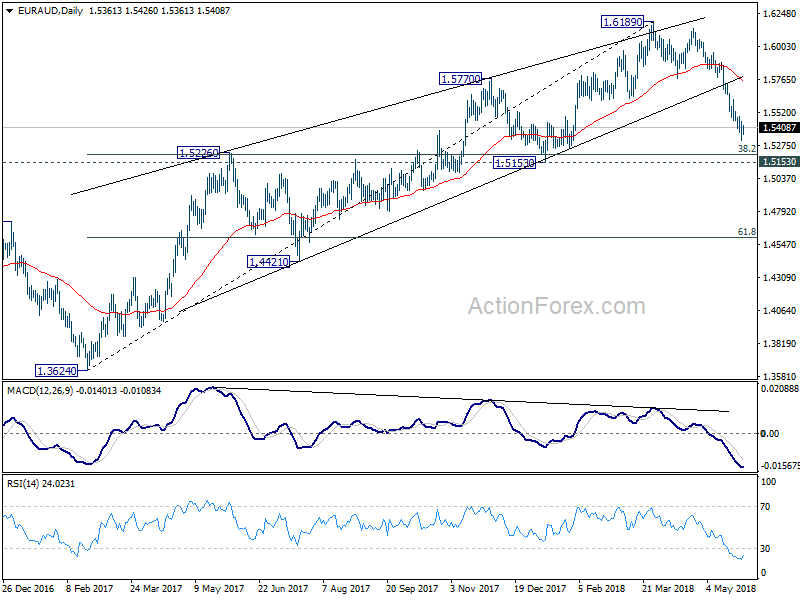

In the bigger picture, rally from 1.3624 (2017 low) should have completed at 1.6189 already, ahead of 1.6587 key resistance (2015 high). 1.6189 is seen as a medium term top. Deeper fall would be seen to 38.2% retracement of 1.3624 to 1.6189 at 1.5209 first. Decisive break there will pave the way to 61.8% retracement at 1.4604. In that case, we’ll look for bottoming again below 1.4604. On the upside, firm break of 1.5773 support turned resistance is needed to indicate completion of the fall from 1.6189. Otherwise, further decline is expected in medium term, even in case of strong rebound.