EUR/CHF Daily Outlook

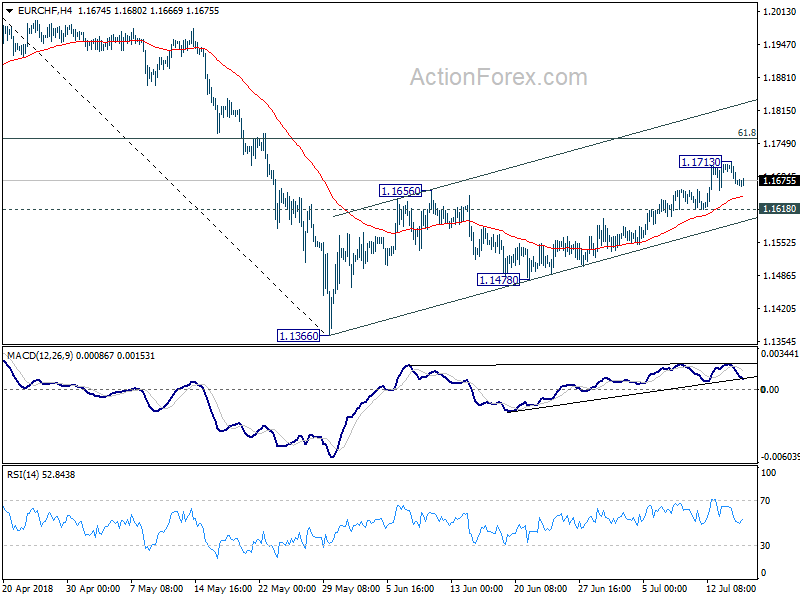

Daily Pivots: (S1) 1.1655; (P) 1.1687; (R1) 1.1704;

Intraday bias in EUR/CHF is turned neutral with the retreat from 1.1713 temporary top. Another rise could still be seen to 61.8% retracement of 1.2004 to 1.1366 at 1.1760. However, as rebound from 1.1366 is seen as the second leg of the corrective pattern from 1.2004, we’d expect strong resistance from 1.1760 to limit upside. On the downside, below 1.1618 will turn bias back to the downside for 1.1478 support and below. However, sustained trading above 1.1760 will pave the way to retest 1.2004 high next.

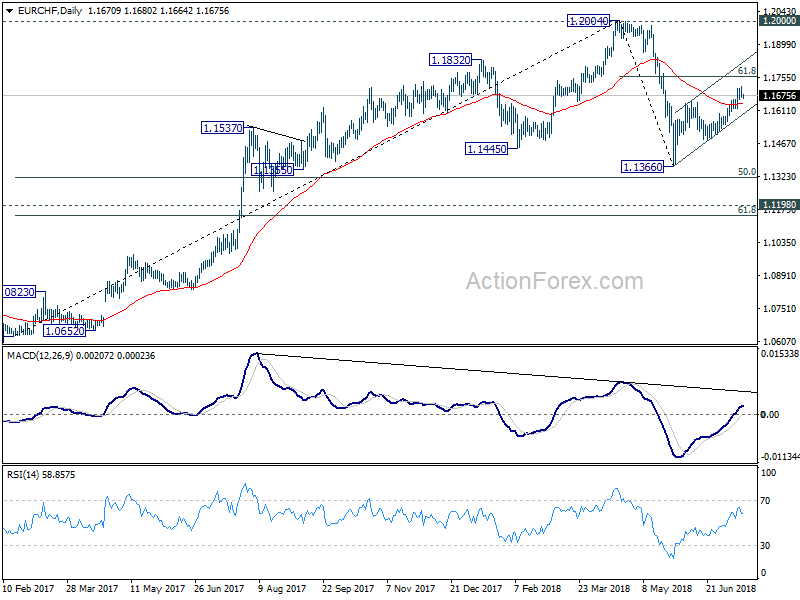

In the bigger picture, 1.2004 is seen as a medium term top with bearish divergence condition in daily and weekly MACD. 1.2000 is also an important resistance level. Hence, the corrective pattern from 1.2004 is expected to extend for a while before completion. Hence, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.

EUR/AUD Daily Outlook

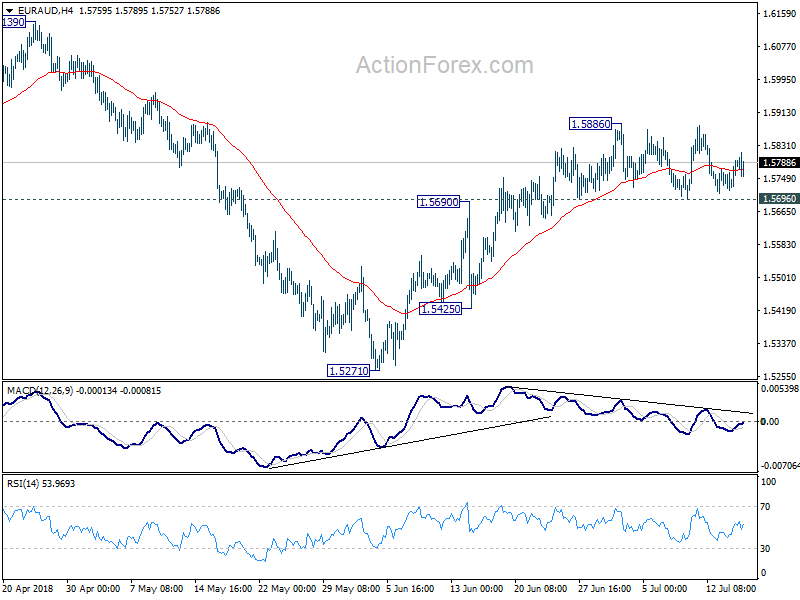

Daily Pivots: (S1) 1.5732; (P) 1.5765; (R1) 1.5814;

Intraday bias in EUR/AUD remains neutral for range trading below 1.5886. Further rise is expected as long as 1.569 minor support holds. On the upside break of 1.5886 will resume the rebound from 1.5271 and target a test on 1.6189 high. Nonetheless, the momentum and structure of such rise from 1.5271 are not too convincing. Break of 1.5696 will suggest near term reversal and turn bias to the downside for 1.5425 support for confirmation.

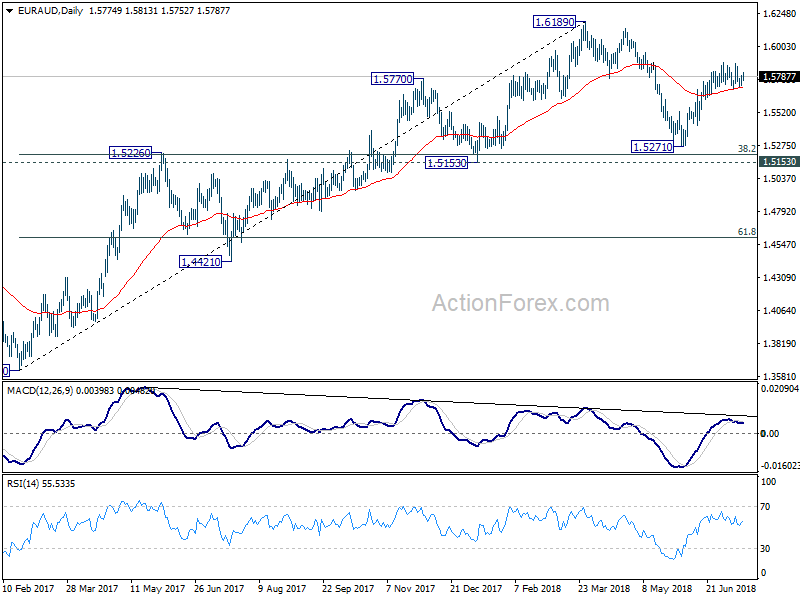

In the bigger picture, current development suggests that fall from 1.6189 is a corrective move and has completed at 1.5217 already. Key support levels of 1.5153 and 38.2% retracement of 1.3624 to 1.6189 at 1.5209 were defended. And medium term rise from 1.3624 (2017 low) is still in progress. Break of 1.6189 will target 1.6587 key resistance (2015 high).