EUR/CHF Daily Outlook

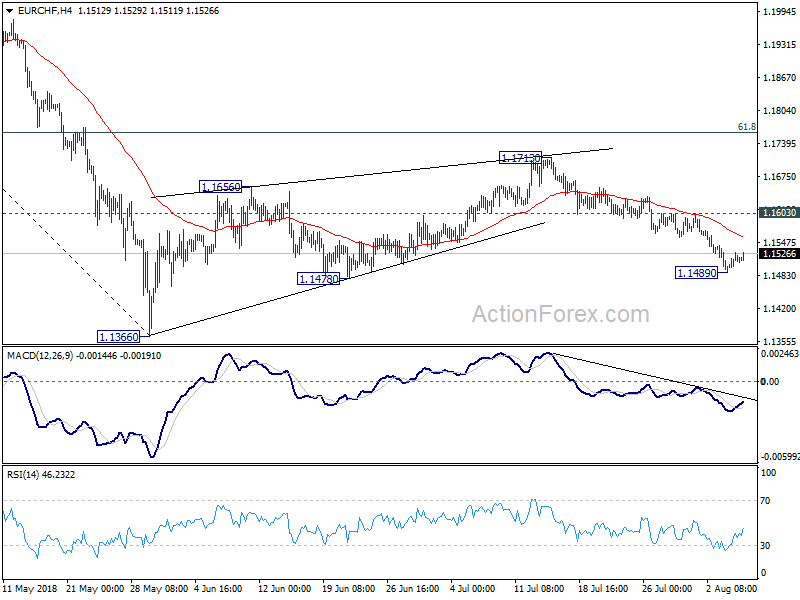

Daily Pivots: (S1) 1.1491; (P) 1.1510; (R1) 1.1533;

A temporary low in formed at 1.14879 in EUR/CHF and intraday bias is turned neutral for some consolidation. But upside of recovery should be limited by 1.1603 minor resistance to bring fall resumption. We’re holding on to the view that corrective rebound from 1.1366 has completed at 1.1713. Break of 1.1478 support will confirm and target 1.1366 low and below. However, break of 1.1603 will turn bias back to the upside for 1.1713 resistance instead.

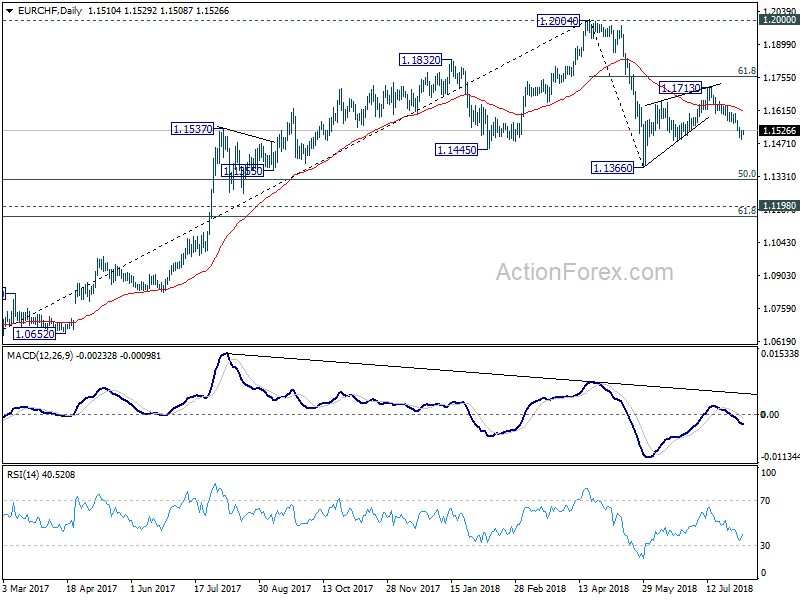

In the bigger picture, 1.2004 is seen as a medium term top with bearish divergence condition in daily and weekly MACD. 1.2000 is also an important resistance level. Hence, the corrective pattern from 1.2004 is expected to extend for a while before completion. We’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.

EUR/AUD Daily Outlook

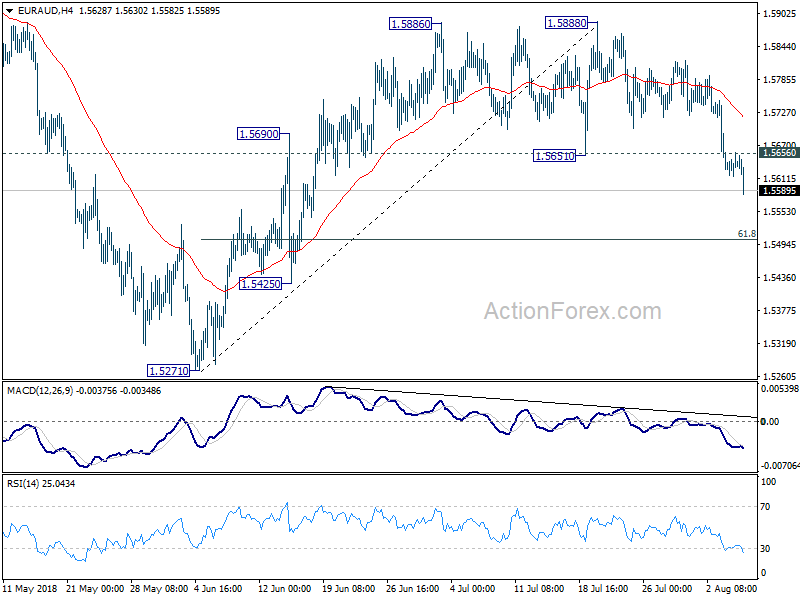

Daily Pivots: (S1) 1.5614; (P) 1.5638; (R1) 1.5660;

EUR/AUD reaches as low as 1.5582 so far today as fall from 1.5888 resume extends. Intraday bias stays on the downside for 61.8% retracement of 1.5271 to 1.5888 at 1.5507. Sustained break there will pave the way to retest 1.5271 low. On the upside, above 1.5656 minor resistance will turn bias neutral and bring recovery, before staging another decline.

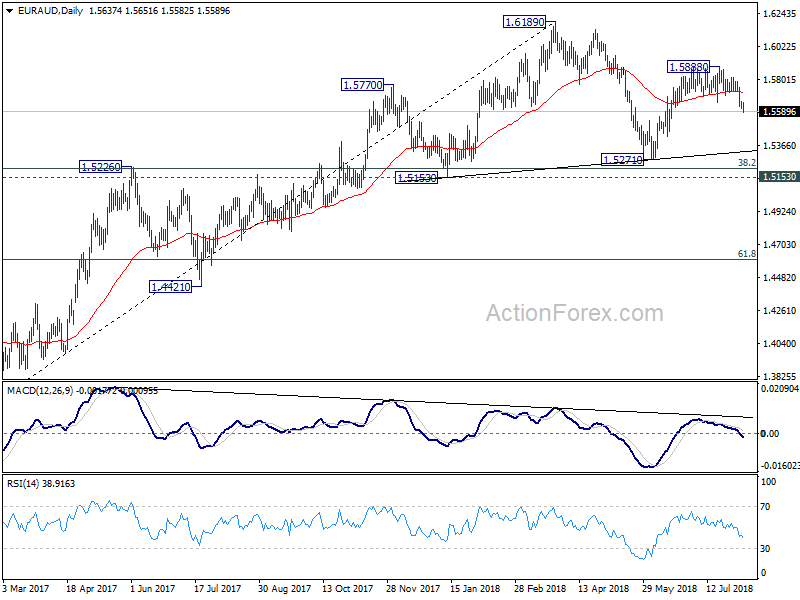

In the bigger picture, the rebound from 1.5271 was somewhat weaker than expected. EUR/AUD also failed to sustain above 55 day EMA and hints on some underlying bearishness. Though, for now, as long as 1.5271 support holds, medium term rise from m 1.3624 (2017 low) is still mildly in favor to extend through 1.6189 high, to 1.6587 key resistance (2015 high). Nevertheless, firm break of 1.5271 will complete a head and shoulder top pattern (ls: 1.5770, h: 1.6189, rs: 1.5888). That would indicate medium term reversal and turn outlook bearish.