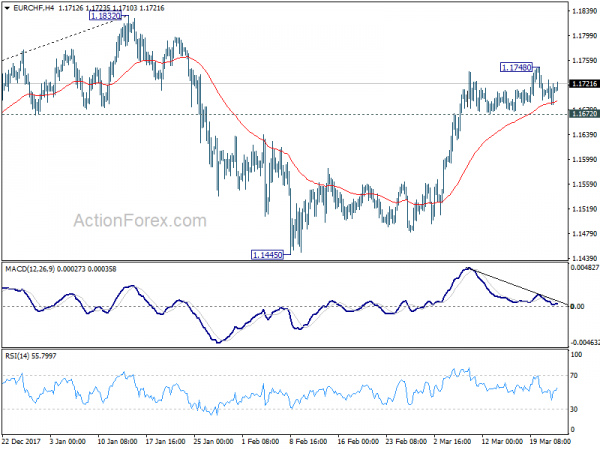

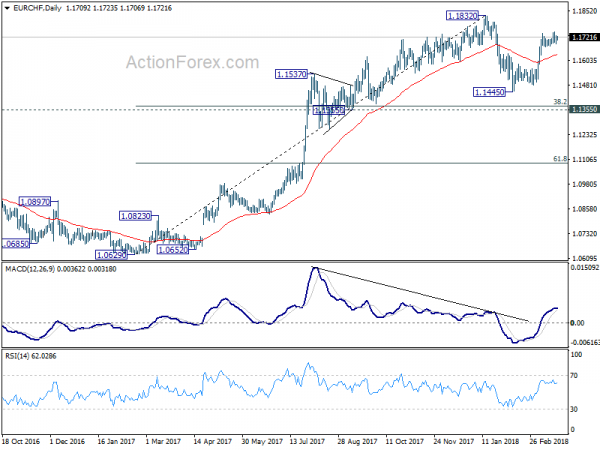

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1691; (P) 1.1709; (R1) 1.1731;

Intraday bias in EUR/CHF remains neutral for consolidation below 1.1748 temporary top. With 1.1672 minor support intact, further rise is still expected. Break of 1.1748 will target at test on 1.1832 high. At this point, we’ll stay cautious strong resistance from there to bring another fall. Corrective pattern from 1.1832 might still have an attempt on 1.1355 cluster support (38.2% retracement of 1.0629 to 1.1832 at 1.1372) before completion. On the downside, below 1.1672 minor support will target 1.1445 low again. However, decisive break of 1.1832 will confirm up trend resumption for 1.2 handle next.

In the bigger picture, a medium term top should be in place at 1.1832 on bearish divergence condition in daily MACD. But there is no indication of long term reversal yet. As long as 1.1198 resistance turned support holds, we’d still expect another rise through prior SNB imposed floor at 1.2000.

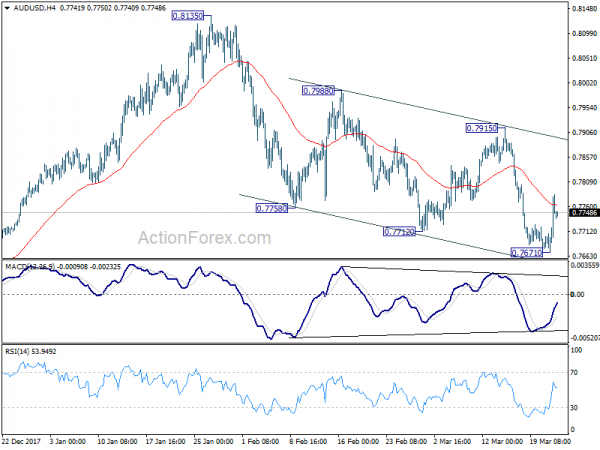

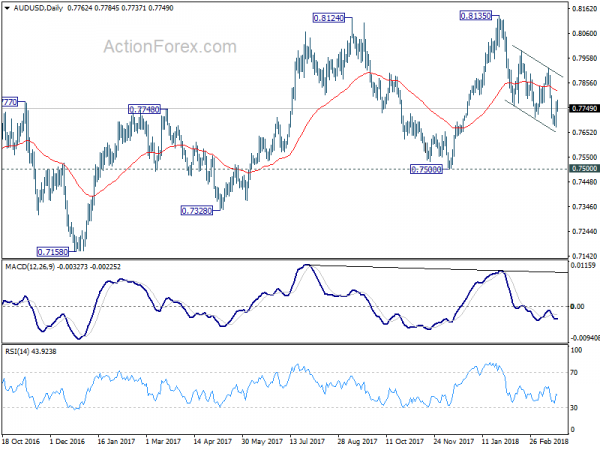

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7698; (P) 0.7739; (R1) 0.7805;

AUD/USD rebounded after hitting 0.7671 and intraday bias is turned neutral first. At this point, the pair is staying in a near term falling channel. And, with 0.7915 resistance intact, deeper fall is still expected. Below 0.76171 will turn bias to the downside and resume whole fall from 0.8135 to 0.7500 key support level.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.