EUR/AUD Daily Outlook

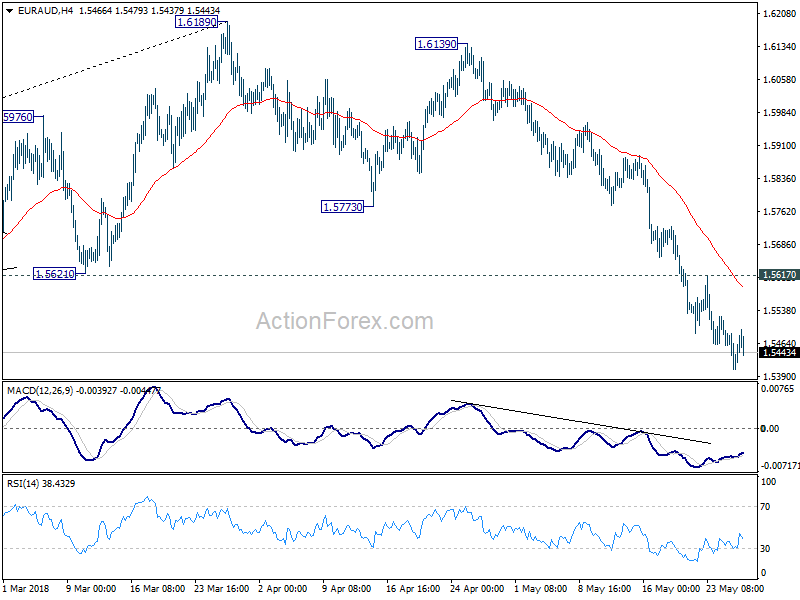

Daily Pivots: (S1) 1.5397; (P) 1.5443; (R1) 1.5482;

Near term outlook in EUR/AUD remains bearish with 1.5617 resistance intact. Current fall from 1.6189 should target 1.5153 key support level next. On the upside, break of 1.5617 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

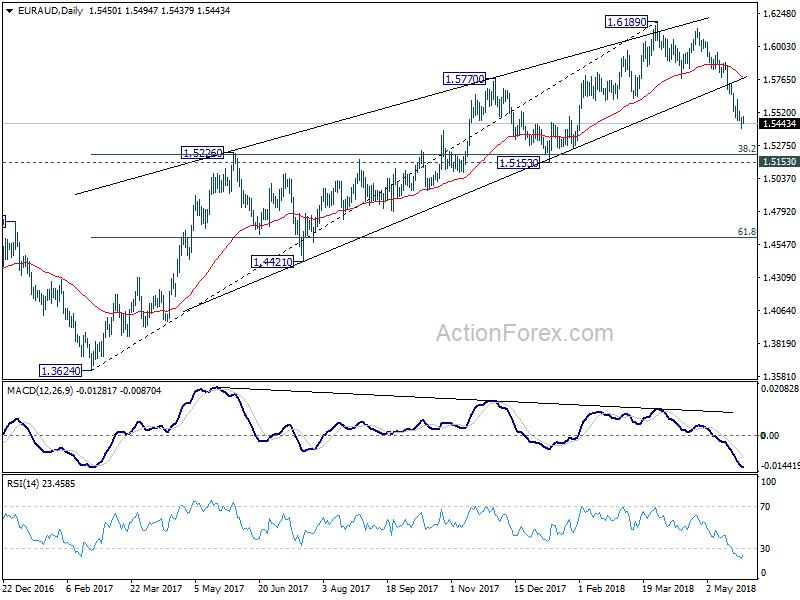

In the bigger picture, rally from 1.3624 (2017 low) should have completed at 1.6189 already, ahead of 1.6587 key resistance (2015 high). 1.6189 is seen as a medium term top. Deeper fall would be seen to 38.2% retracement of 1.3624 to 1.6189 at 1.5209 first. Decisive break there will pave the way to 61.8% retracement at 1.4604. In that case, we’ll look for bottoming again below 1.4604. On the upside, firm break of 1.5773 support turned resistance is needed to indicate completion of the fall from 1.6189. Otherwise, further decline is expected in medium term, even in case of strong rebound.

EUR/JPY Daily Outlook

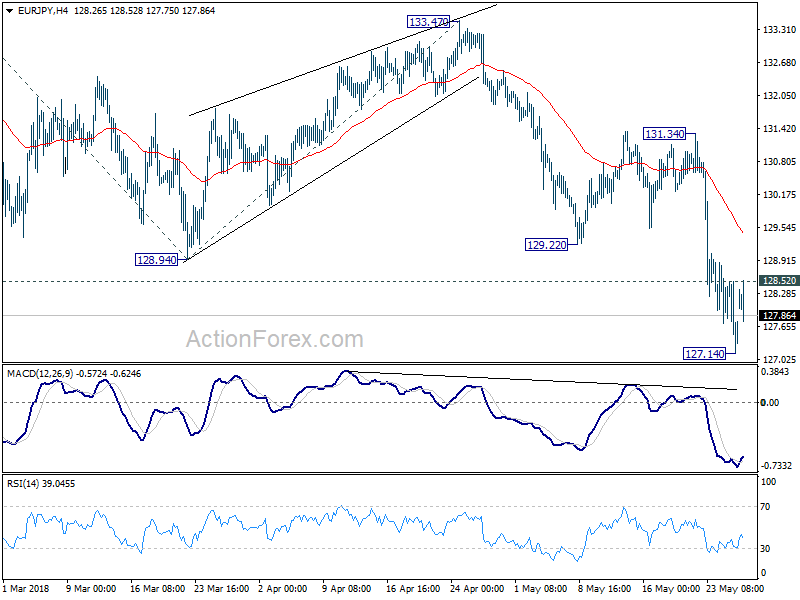

Daily Pivots: (S1) 126.86; (P) 127.70; (R1) 128.25;

A temporary low is in place at 127.14 in EUR/JPY and intraday bias is turned neutral first. Some consolidations could be seen. but outlook will stay bearish as long as 131.34 resistance holds. On the downside, below 127.14 will resume the fall from 133.47 to 126.61 medium term fibonacci level. But based on current momentum, EUR/JPY could dive through this level to 100% projection of 137.49 to 128.94 from 133.47 at 124.92.

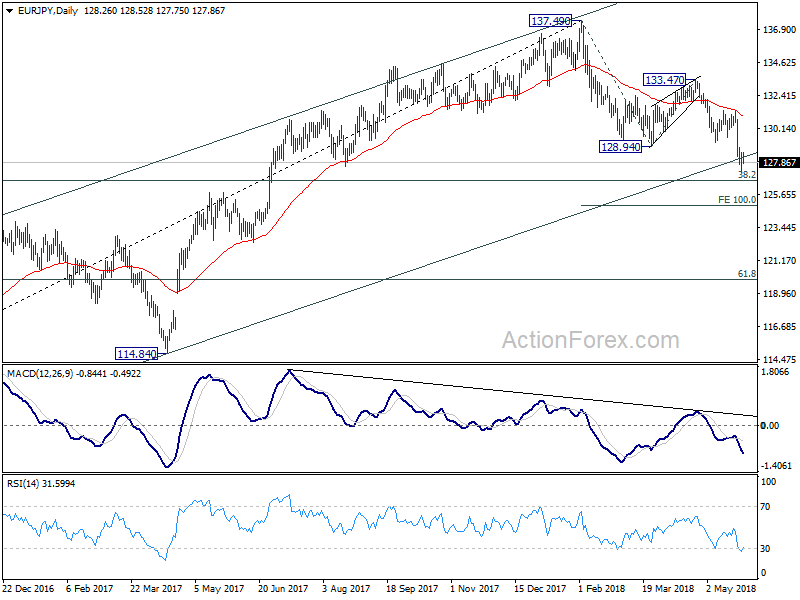

In the bigger picture, bearish divergence in daily MACD and current strong downside momentum is raising the chance of medium term trend reversal. Sustained break of 38.2% retracement of 109.03 to 137.49 at 126.61 will argue that whole up trend from 109.03 has completed at 137.49 already. And, deeper decline would be seen to 61.8% retracement at 119.90 and below. Though, strong support from 126.61 and rebound from there would revive medium term bullish for another high above 137.49.