EUR/AUD Daily Outlook

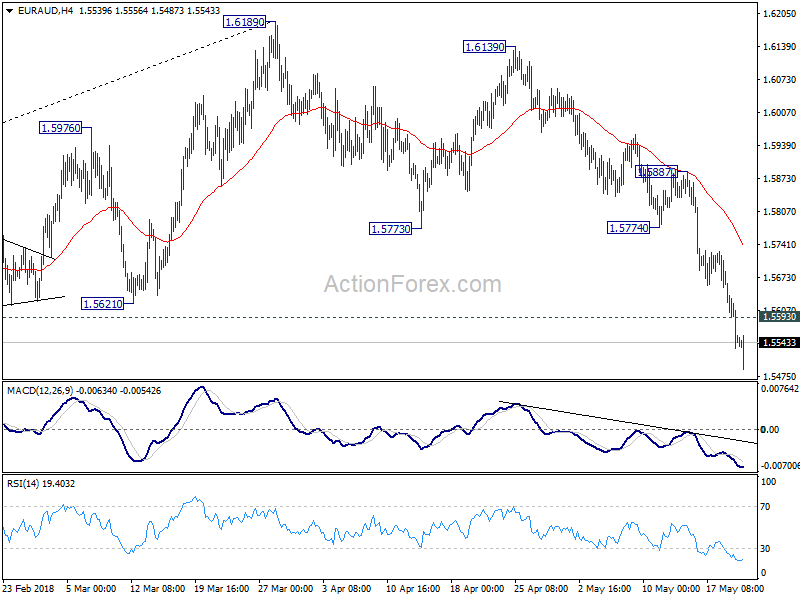

Daily Pivots: (S1) 1.5500; (P) 1.5583; (R1) 1.5634;

EUR/AUD’s decline accelerates to as low as 1.5487 so far and intraday bias remains on the upside. Prior break of 1.5621 support is taken as an indication of medium term reversal. Current fall should target 1.5153 support next. On the upside, above 1.5593 minor resistance will turn bias neutral and bring consolidations. But recovery should be limited well below 1.5773 resistance to bring fall resumption.

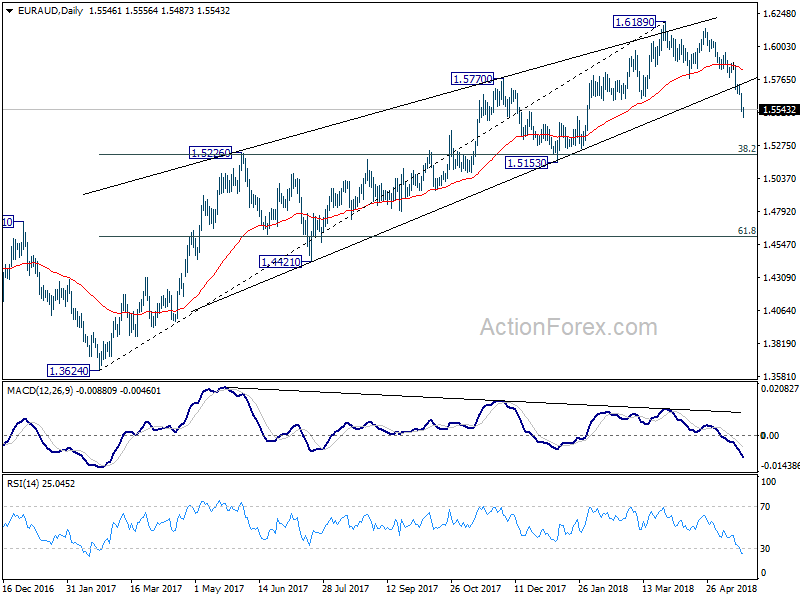

In the bigger picture, rally from 1.3624 (2017 low) should have completed at 1.6189 already, ahead of 1.6587 key resistance (2015 high). 1.6189 is seen as a medium term top. Deeper fall would be seen to 38.2% retracement of 1.3624 to 1.6189 at 1.5209 first. Decisive break there will pave the way to 61.8% retracement at 1.4604. In that case, we’ll look for bottoming again below 1.4604. On the upside, break of 55 day EMA (now at 1.5849) is needed to indicate completion of the fall from 1.6189. Otherwise, further fall is expected in medium term, even in case of strong rebound.

EUR/JPY Daily Outlook

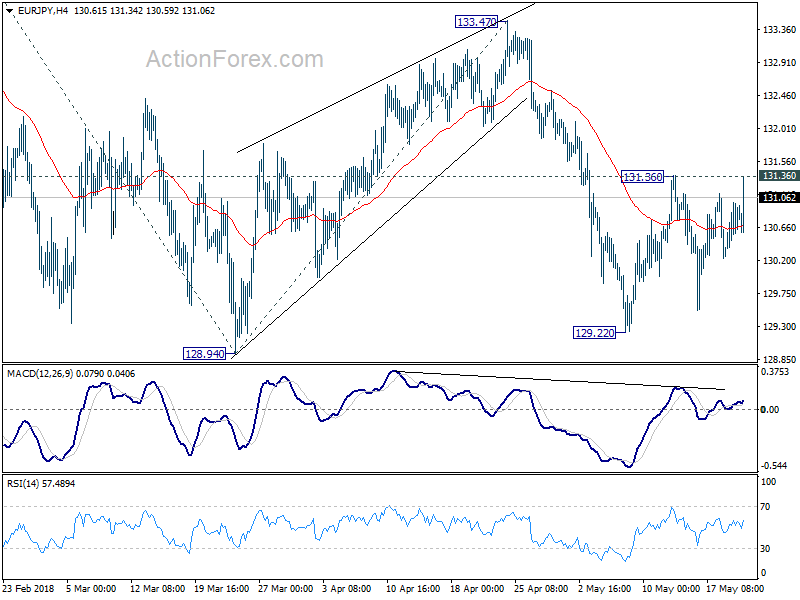

Daily Pivots: (S1) 130.50; (P) 130.75; (R1) 131.18;

EUR/JPY rebounds strongly but stays below 131.36 resistance Outlook remains bearish and further decline is expected. Break of 129.22 will target 128.94 first. Break will resume whole fall from 137.49 and target 61.8% projection of 137.49 to 128.94 from 133.47 at 128.18, and possibly further to 126.61 medium term fibonacci level. Nonetheless, break of 131.36 will dampen our bearish view and turn focus back to 133.47 resistance instead.

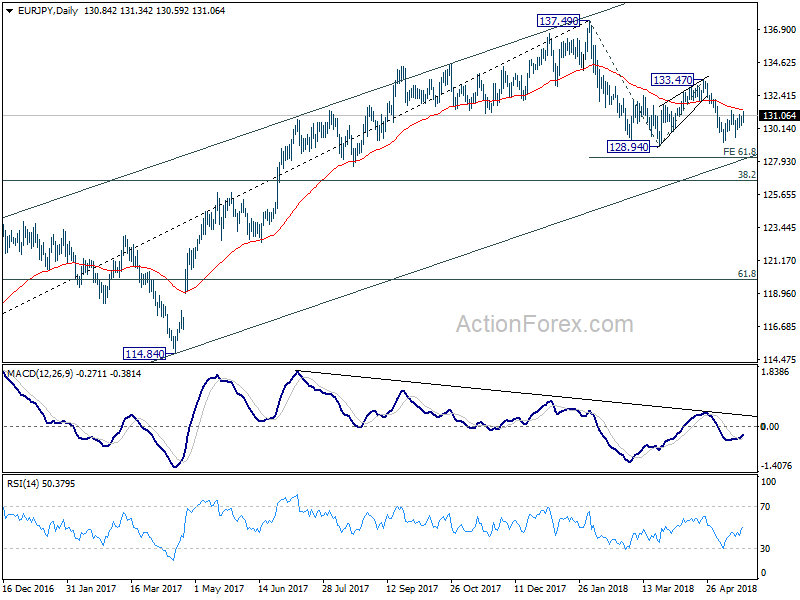

In the bigger picture, for now, price actions from 137.49 are viewed as a corrective pattern only. Hence, while deeper decline would be seen, strong support is expected at 38.2% retracement of 109.03 to 137.49 at 126.61 to contain downside and bring rebound. Up trend from 109.03 (2016 low) is expected to resume afterwards. Though, sustained break of 126.61 will be an important sign of trend reversal and will turn focus to 124.08 resistance turned support.