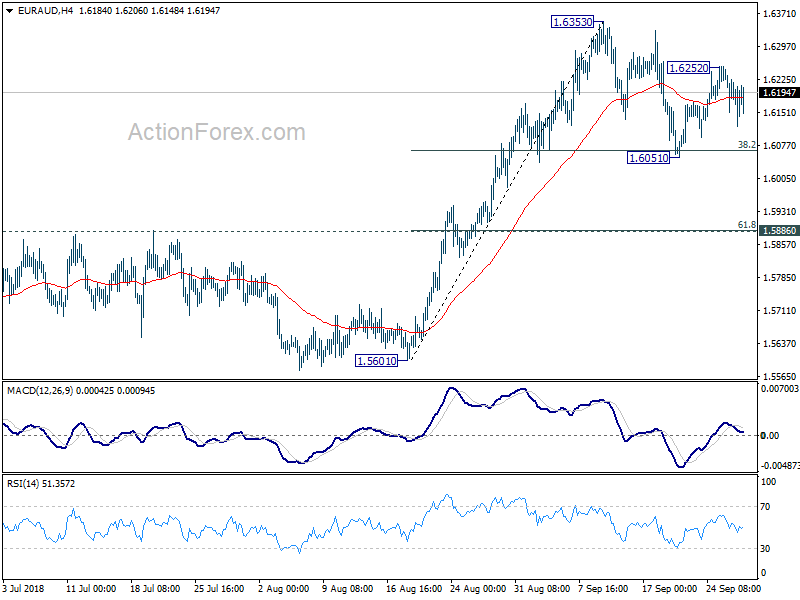

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6113; (P) 1.6185; (R1) 1.6249;

Intraday bias in EUR/AUD remains neutral at this point. On the downside, break of 1.6051 will extend the correction from 1.6353. But downside should be contained well above 1.5886 cluster support (61.8% retracement of 1.5601 to 1.6353 at 1.5888) to bring rise resumption. On the upside, above 1.6252 will target a retest on 1.6353. Break there will resume larger up trend and should target 1.6587 key resistance next.

In the bigger picture, up trend from 1.3624 (2017 low) is still in progress. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5886 resistance turned support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back.

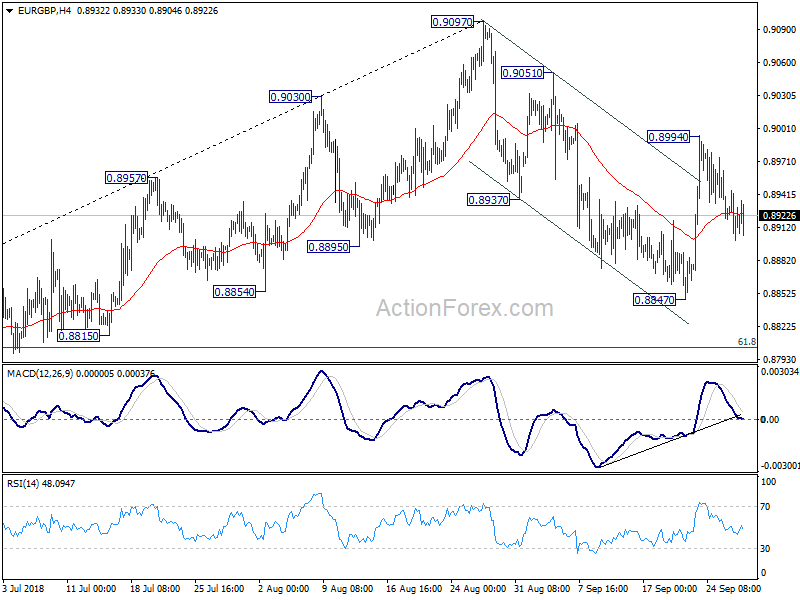

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8896; (P) 0.8922; (R1) 0.8943;

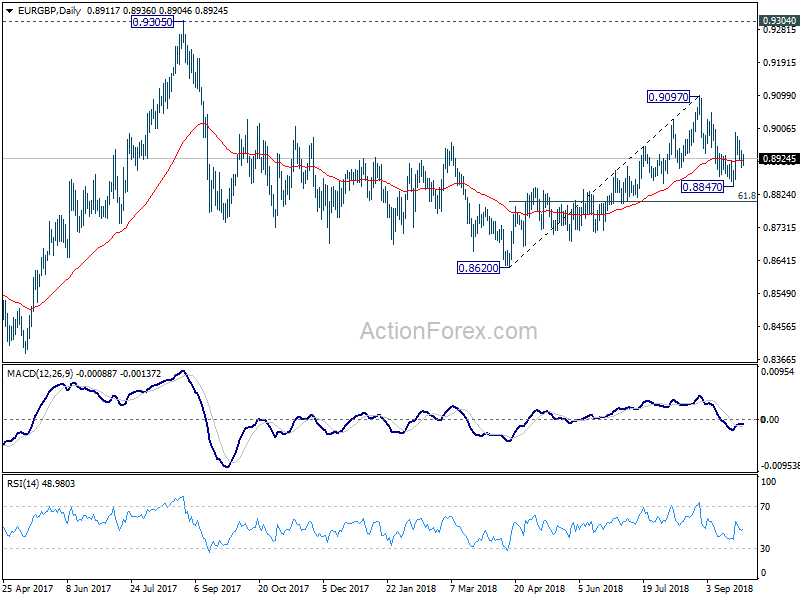

Intraday bias in EUR/GBP remains neutral for the moment. For now, we’re holding on to the view that pull back from 0.9097 has completed at 0.8847 already. Further rise remains in favor. On the upside, above 0.8994 will target 0.9097 resistance first. Firm break there will resume the rise from 0.8620 towards 0.9305 high.

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). At this point, there is no clear sign of range break out yet. And more corrective trading would continue. On the upside, in case of another rise, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.