EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6266; (P) 1.6311; (R1) 1.6341;

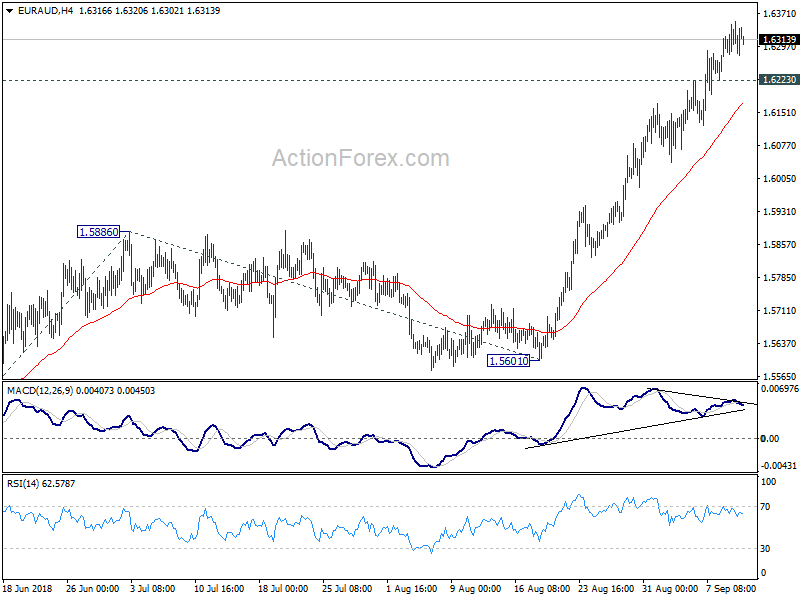

With 1.6223 minor support intact, intraday bias in EUR/AUD stays on the upside for further rally. Current rise should target 161.8% projection of 1.5271 to 1.5886 from 1.5601 at 1.6596, which is close to another key resistance level at 1.6587. Considering bearish divergence condition in 4 hour MACD, break of 1.6223 will indicate short term topping. And lengthier consolidation would be seen before another rally.

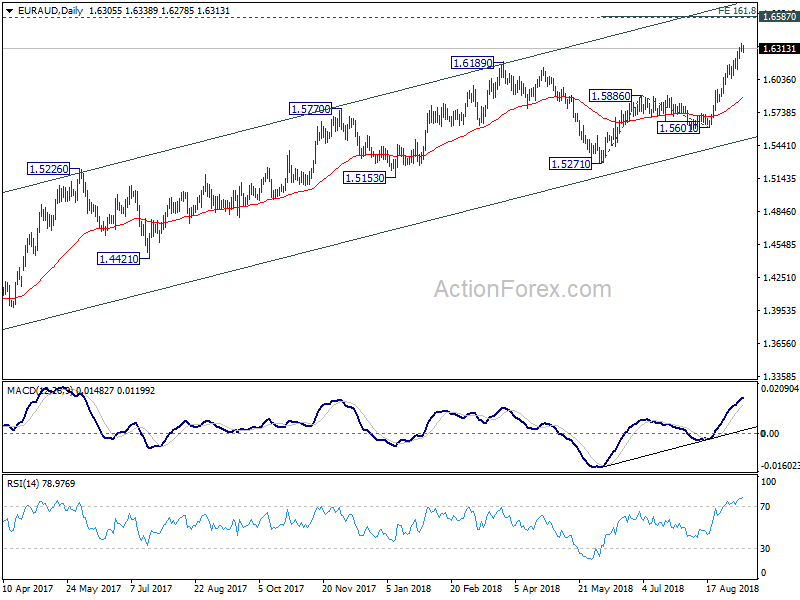

In the bigger picture, up trend from 1.3624 (2017 low) has just resumed. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5601 support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back.

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8885; (P) 0.8907; (R1) 0.8926;

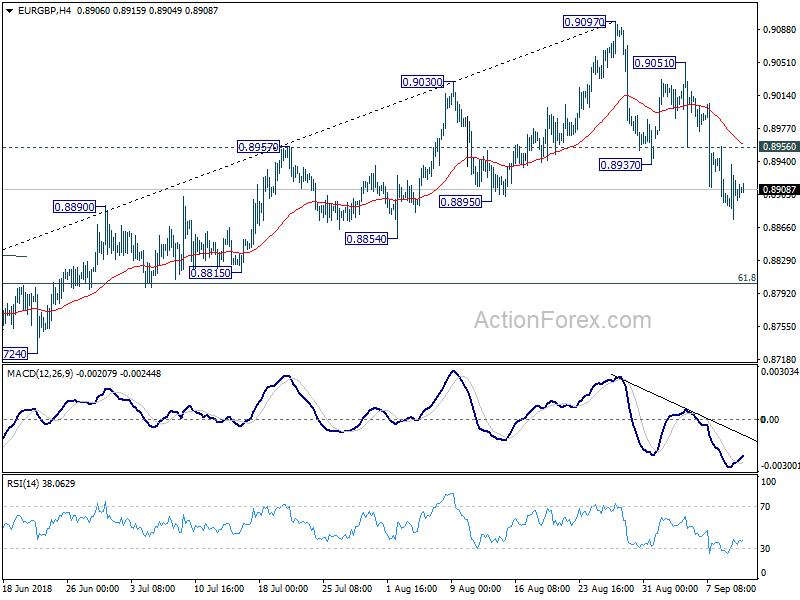

With 0.8956 minor resistance intact, intraday bias in EUR/GBP stays mildly on the downside despite diminishing downside momentum. As noted before, corrective rise from 0.8620 could have completed at 0.9097 already. Current fall should target 61.8% retracement at 0.8802 and below. On the upside, above 0.8956 minor resistance will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 0.9051 resistance holds.

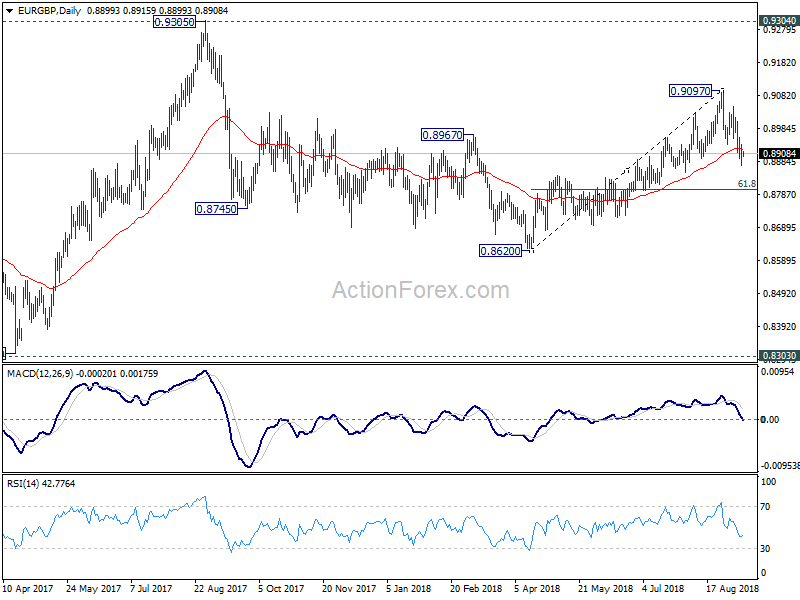

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). At this point, there is no clear sign of range break out yet. And more corrective trading would continue. On the upside, in case of another rise, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.