EUR/AUD Daily Outlook

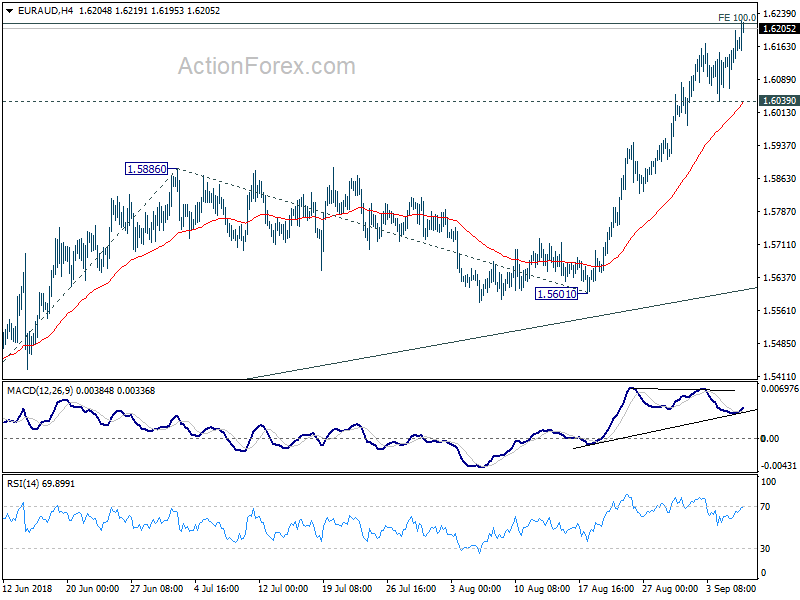

Daily Pivots: (S1) 1.6089; (P) 1.6146; (R1) 1.6221

EUR/AUD’s rally resumed after brief consolidation and reaches as high as 1.6220 so far. Intraday bias is back on the upside. Firm break of firm break of 100% projection of 1.5271 to 1.5886 from 1.5601 at 1.6216 will extend the larger up trend to 161.8% projection at 1.6596, which is close to another key resistance level at 1.6587. On the downside, though, break of 1.6039 support will indicate short term topping and bring lengthier consolidation first.

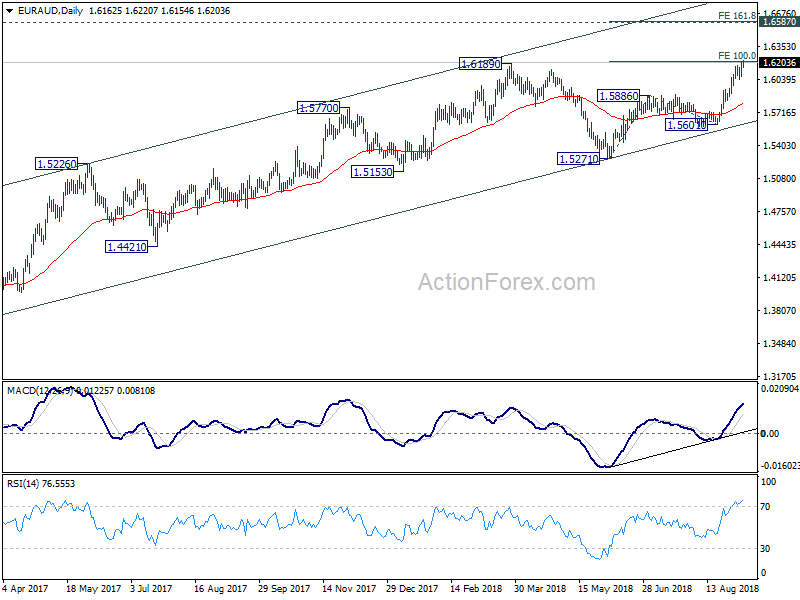

In the bigger picture, EUR/AUD drew strong support from 55 week EMA and rebounded. And the development argues that medium term rally from 1.3624 (2017 low) is still in progress. Firm break of 1.6189 will target a test on 1.6587 (2015 high). On the downside, break of 1.5601 support will now be the first sign of medium term reversal, and will bring a test on 1.5271 key support for confirmation.

EUR/GBP Daily Outlook

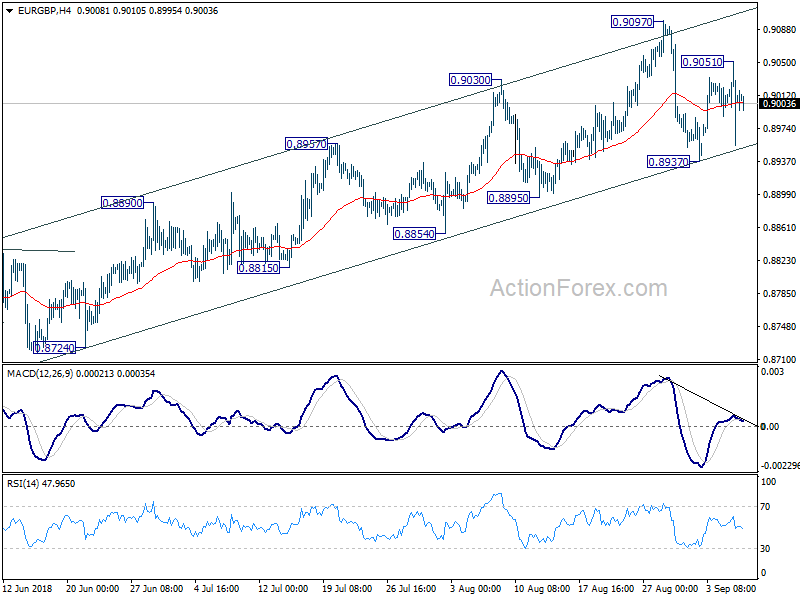

Daily Pivots: (S1) 0.8959; (P) 0.9007; (R1) 0.9057;

Much volatility is seen in EUR/GBP after the cross hit 0.9051. Intraday bias is turned neutral first. And, after all, it’s staying inside near term rising channel. Thus, outlook stay bullish for another rise. On the upside, above 0.9051 will target 0.9097 first. Break will resume the rally from 0.8620. However, break of 0.8937 support should have near term channel support firmly taken out. And that will indicate completion of rise from 0.8620 and turn outlook bearish.

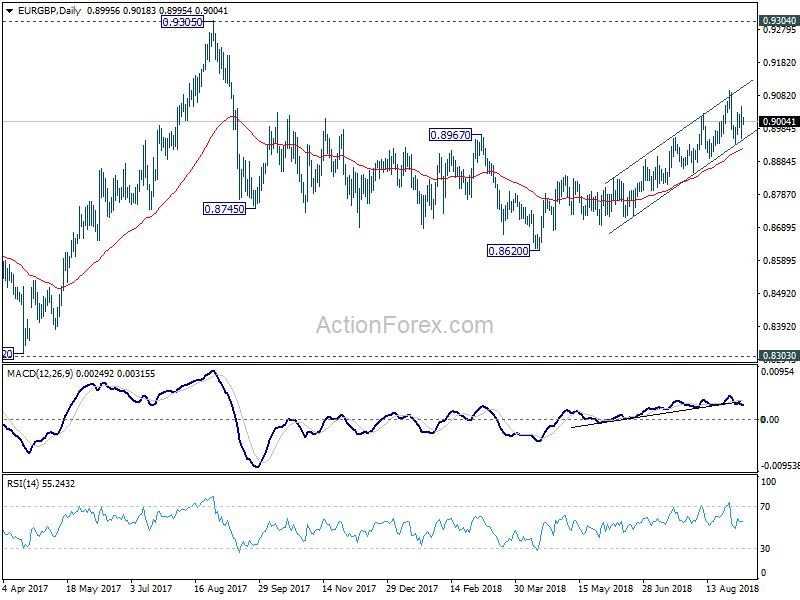

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). The corrective structure of the fall from 0.9305 to 0.8620 is raising the chance that rise from 0.8312 to 0.9305 is an impulsive move. But we’re not too confident on it yet. In any case, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.