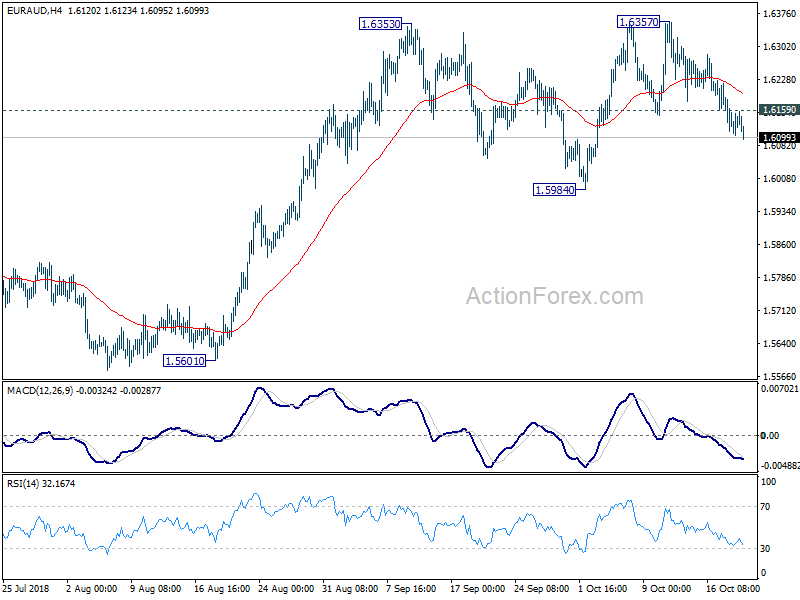

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6093; (P) 1.6140; (R1) 1.6179;

EUR/AUD’s fall from 1.6357 is still in progress and intraday bias stays on the downside for 1.5984 support. For now, we’re still viewing price actions from 1.6353 as a consolidation pattern. Thus, downside should be continued by 1.5984 to bring up trend resumption eventually. On the upside, above 1.6159 minor resistance will turn bias back to the upside for retesting 1.6357 first.

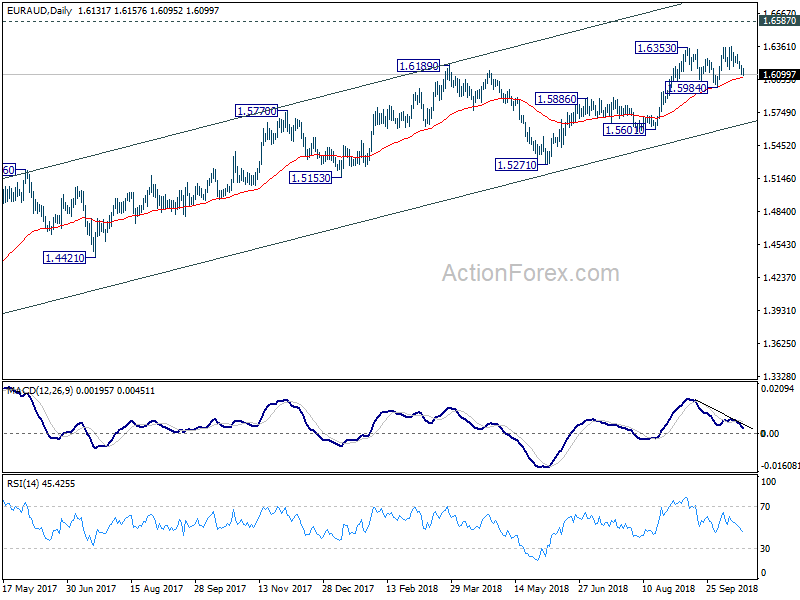

In the bigger picture, up trend from 1.3624 (2017 low) is still in progress. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5984 support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back. However, sustained break of 1.5984 will be an early sign of trend reversal.

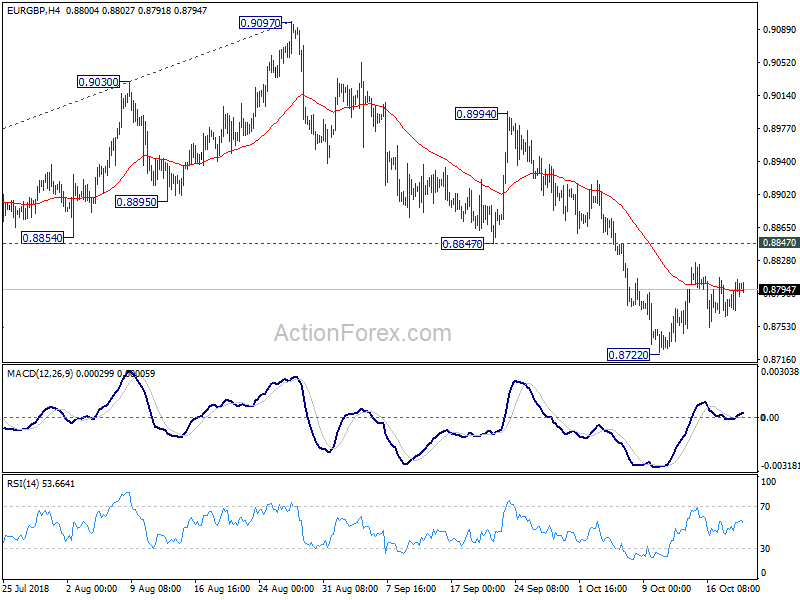

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8776; (P) 0.8792; (R1) 0.8815;

Intraday bias in EUR/GBP remains neutral for consolidation above 0.8722. With 0.8847 support turned resistance intact, further fall is expected. On the downside, break of 0.8772 will target 0.8620 low first. Decisive break there will resume whole down trend from 0.9304. In that case, next target will be 100% projection of 0.9305 to 0.8620 from 0.9097 at 0.8412.

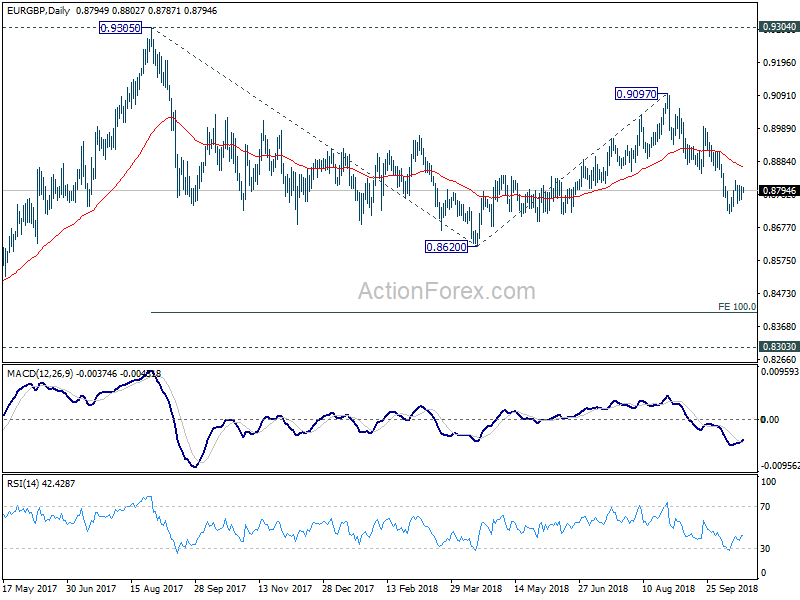

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Current development suggests that fall from 0.9303, as a down leg in the pattern, is still in progress. But in case of deeper fall, downside should be contained by 0.8116 cluster support, 50% retracement of 0.6935 (2015 low) to 0.9304 at 0.8120, to bring rebound.