EUR/AUD Daily Outlook

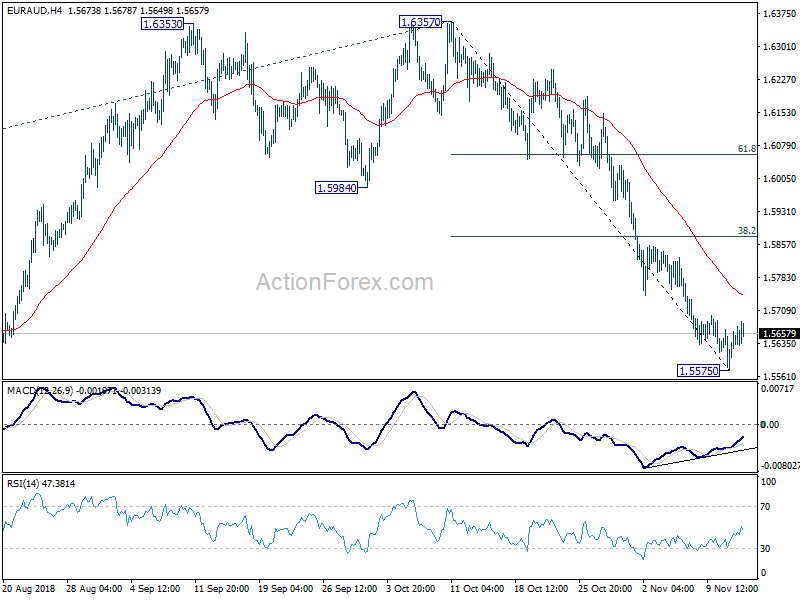

Daily Pivots: (S1) 1.5586; (P) 1.5627; (R1) 1.5681;

EUR/AUD formed a temporary low at 1.5575 and recovered. Intraday bias is turned neutral first. Stronger recovery might be seen to 4 hour 55 EMA (now at 1.5741. But upside should be limited by 38.2% retracement of 1.6357 to 1.5575 at 1.5874) to bring fall resumption. On the downside, below 1.5575 will target 1.5271/5313 cluster support zone next.

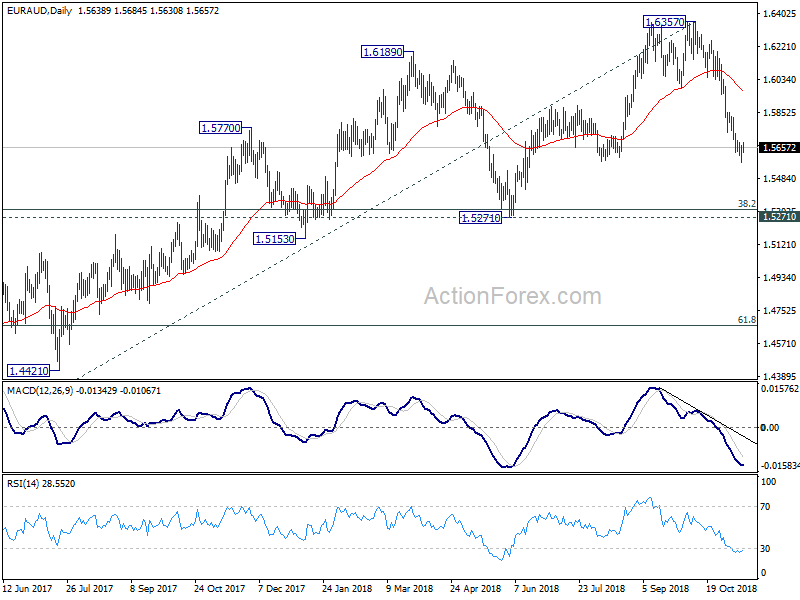

In the bigger picture, current development argues that up trend from 1.3624 (2017 low) is possibly completed at 1.6357, ahead of 1.6587 (2015 high). This is supported by bearish divergence condition in weekly MACD. Deeper decline is now in favor to 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313). Break will target 61.8% retracement at 1.4668. On the upside, break of 1.5984 support turned resistance is now needed to revive the prior medium term up trend. Otherwise, further decline will be in favor even in case of interim rebound.

EUR/GBP Daily Outlook

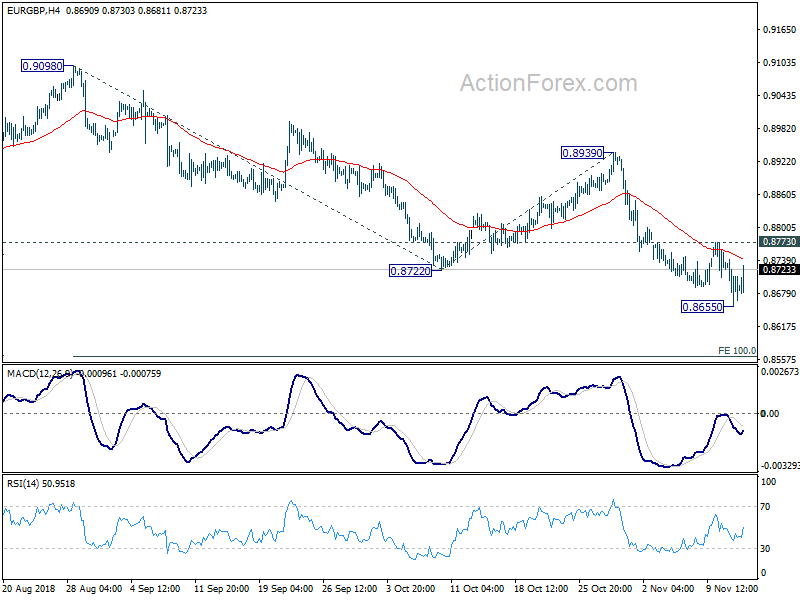

Daily Pivots: (S1) 0.8660; (P) 0.8702; (R1) 0.8748;

EUR/GBP dropped further to 0.8655 but recovered notably. Still, further decline is expected as long as 0.8773 minor resistance holds. Below 0.8665 will target 0.8620 support first. Break will target 100% projection of 0.9098 to 0.8722 from 0.8939 at 0.8563 next. However, break of 0.8773 minor resistance will turn focus back to 0.8939 resistance instead.

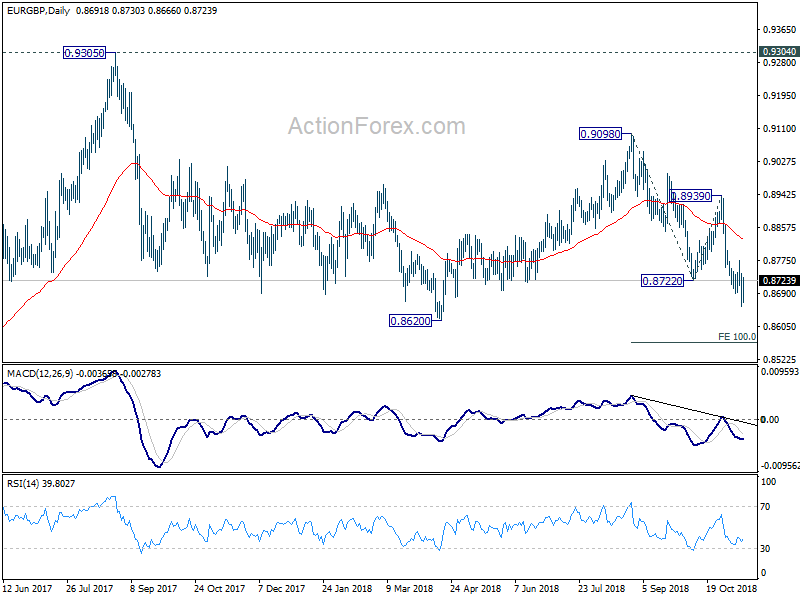

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Medium term fall from 0.9305 is possibly in progress and could extend through 0.8620. On the upside, break of 0.8939 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain cautiously bearish even in case of rebound.