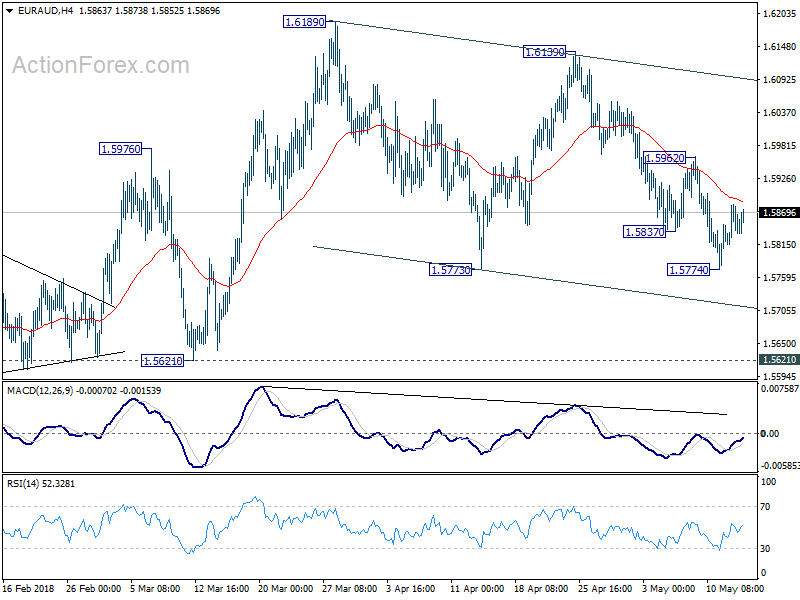

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5815; (P) 1.5850; (R1) 1.5886;

Intraday bias in EUR/AUD remains neutral at this point. Consolidation pattern from 1.6189 is till unfolding. Deeper decline could be seen through 1.5773 support. But we’d expect downside to be contained above 1.5621 support to bring rebound. On the upside, above 1.5962 will turn bias to the upside for 1.6139 resistance and above.

In the bigger picture, while there is bearish divergence condition in daily MACD, there is no clear sign of reversal yet. Current rally from 1.3624 could extend to 1.6587 key resistance (2015 high). Nonetheless, we’d expect further loss of upside momentum, and strong resistance from 1.6587 to limit upside and bring reversal. On the downside, sustained break of 1.5621 support should confirm reversal and turn outlook bearish for 1.5153 support and below.

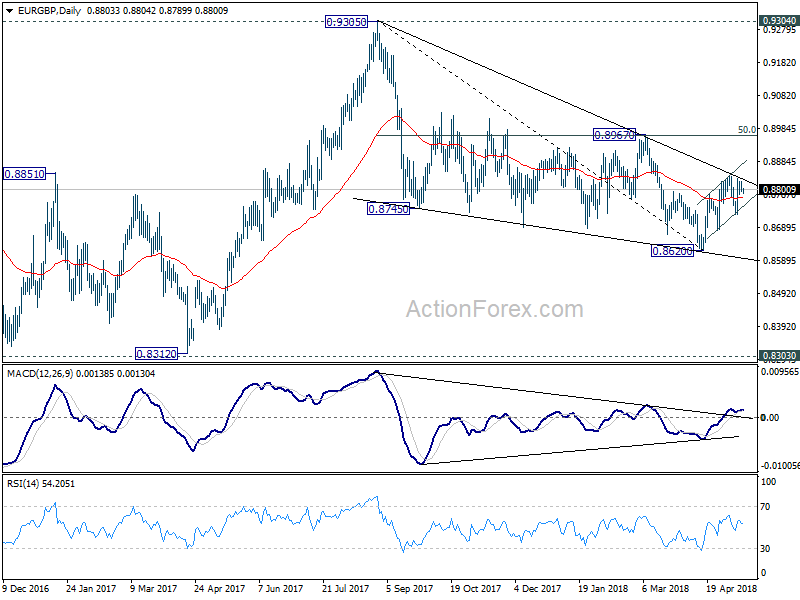

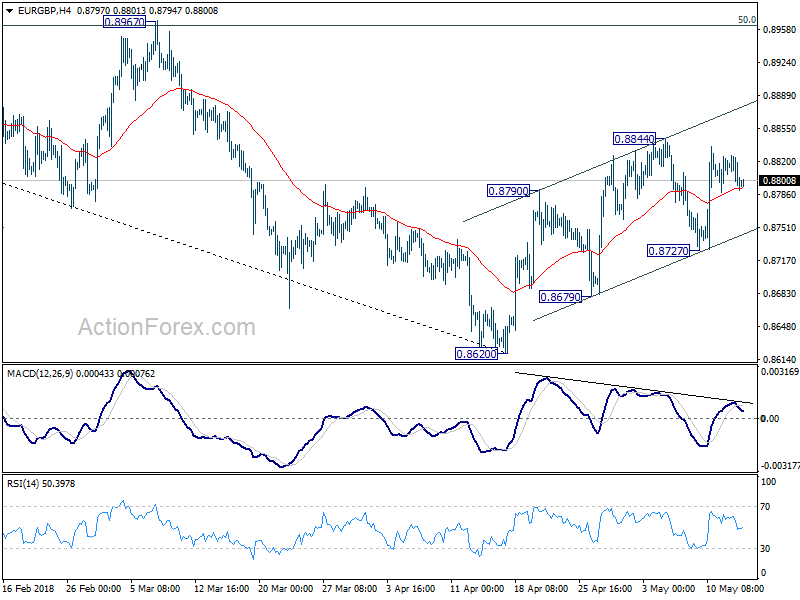

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8786; (P) 0.8808; (R1) 0.8820;

Intraday bias in EUR/GBP stays neutral for the moment and near term outlook is a bit mixed. On the upside, break of 0.8844 will revive the case of bullish trend reversal. Intraday bias will be turned back to the upside for 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963) to confirm. On the downside, however, below 0.8727 will target a test on 0.8620 low instead.

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.