EUR/AUD Daily Outlook

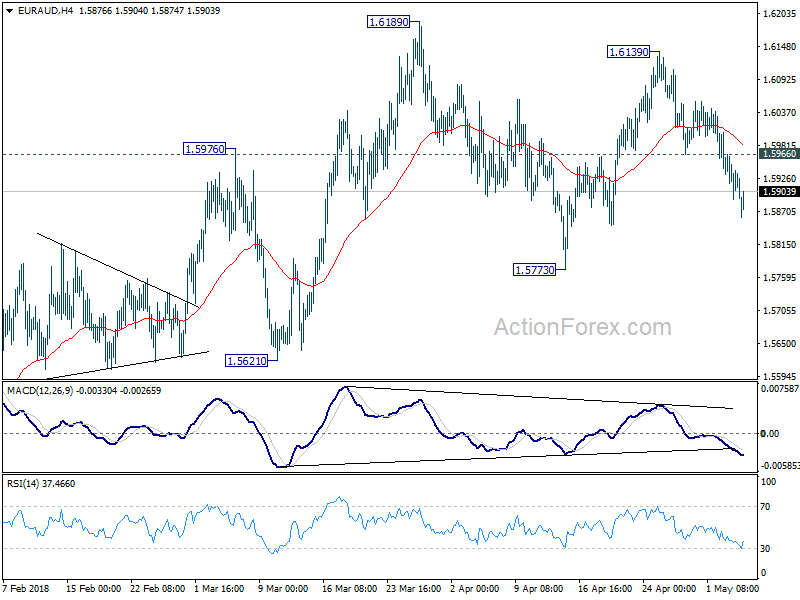

Daily Pivots: (S1) 1.5881; (P) 1.5924; (R1) 1.5956;

Intraday bias in EUR/AUD remains on the downside for 1.5773 support and possibly below. Still, price actions from 1.6189 are seen as a consolidation pattern. Hence, downside should be contained above 1.5621 to bring rise resumption. On the upside, above 1.5966 support turned resistance will turn bias to the upside for 1.6139 and then 1.6189 high.

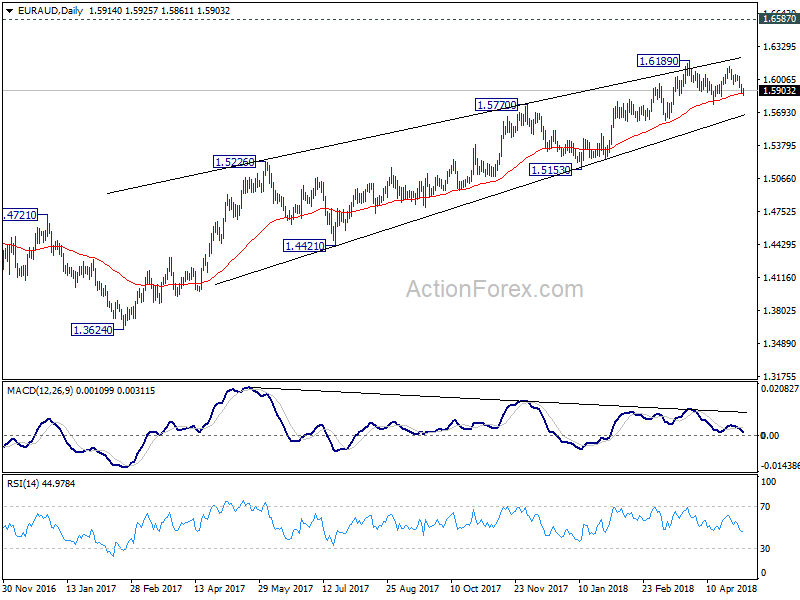

In the bigger picture, while there is bearish divergence condition in daily MACD, there is no clear sign of reversal yet. EUR/AUD also drew strong support from 55 day EMA and rebounded. Current rally from 1.3624 could still extend to 1.6587 key resistance (2015 high). Nonetheless, we’d expect further loss of upside momentum, and strong resistance from 1.6587 to limit upside and bring reversal. On the downside, sustained break of 1.5621 support should confirm reversal and turn outlook bearish for 1.5153 support and below.

EUR/GBP Daily Outlook

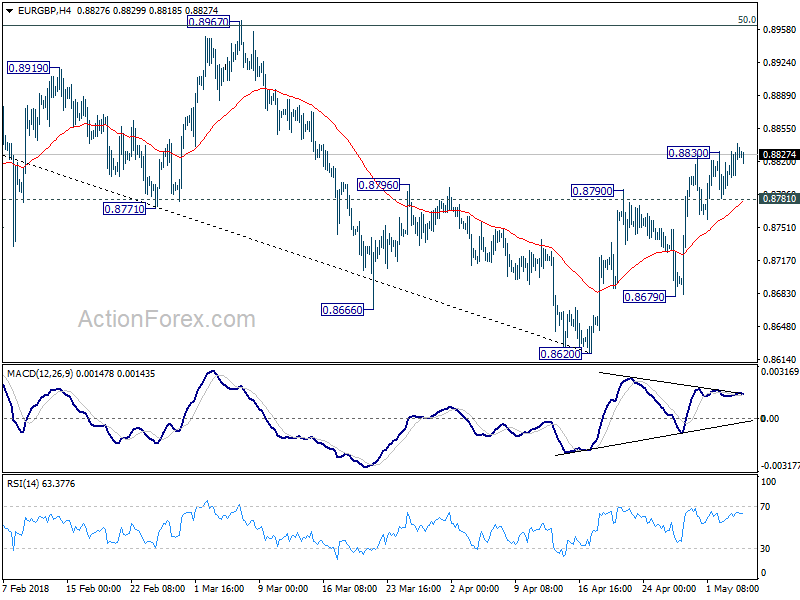

Daily Pivots: (S1) 0.8805; (P) 0.8823; (R1) 0.8847;

Intraday bias in EUR/GBP is back on the upside as rebound from 0.8620 resumes. Further rise would be seen to 0.8967 cluster resistance next (50% retracement of 0.9305 to 0.8620 at 0.8963). Firm break there will confirm neat term reversal. On the downside, below 0.8781 minor support will turn focus back to 0.8679 support. Break there will suggests that larger decline from 0.9305 is resuming.

- advertisement -

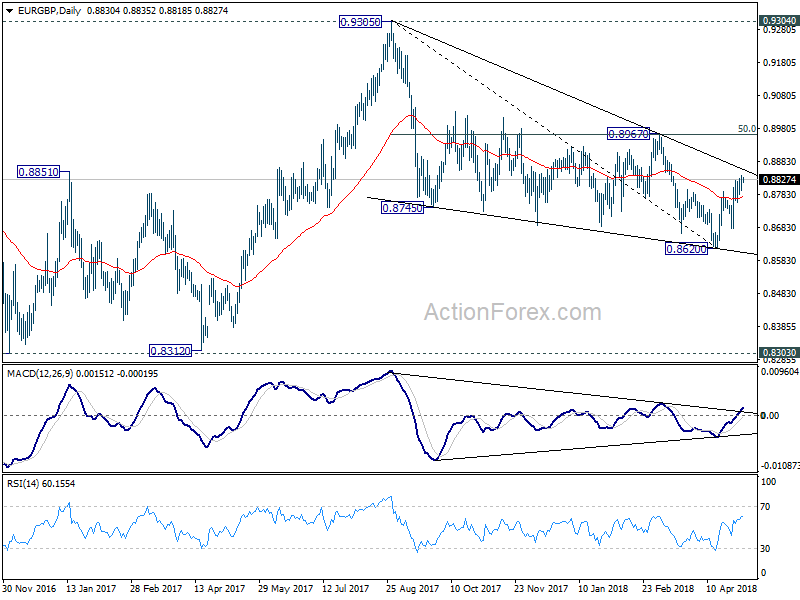

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.