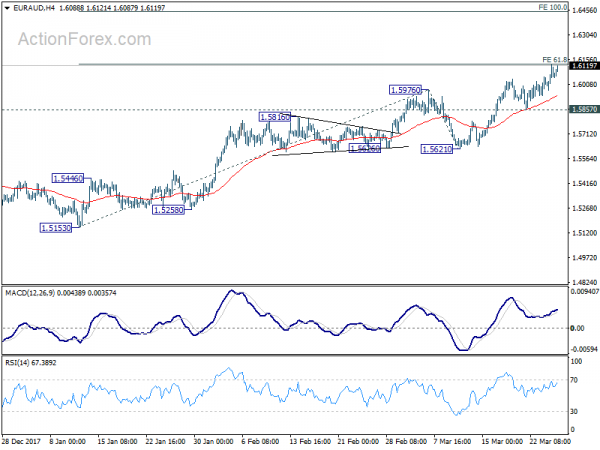

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5982; (P) 1.6056; (R1) 1.6138;

EUR/AUD reaches as high as 1.1631 so far as recent rally extends. Intraday bias remains on the upside at this point. Sustained break of 61.8% projection of 1.5130 to 1.5976 from 1.5621 at 1.6130 will target 100% projection at 1.6444 next. On the downside, break of 1.5857 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, current development suggests that rise from 1.3624 is not completed yet. And it’s still in progress for 1.6587 key resistance level. We’d be cautious on strong resistance from there to limit upside, on bearish divergence condition in daily MACD. But for now, break of 1.5621 support is needed to be the first sign of medium term reversal. Otherwise, outlook will stays bullish even in case of deep pull back.

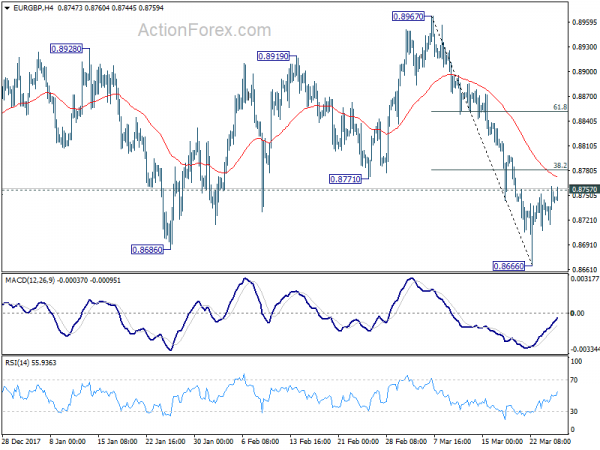

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8721; (P) 0.8742; (R1) 0.8767;

Breach of 0.8757 minor resistance argues that EUR/GBP formed a short term bottom at 0.8666 after failing to sustain below 0.8686. Intraday bias is turned back to the upside for 38.2% retracement of 0.8967 to 0.8666 at 0.8781 first. Break will target 61.8% retracement at 0.8852 and above. On the downside, firm break of 0.8666 will resume the decline from 0.9305 and pave the way to 0.8303 key support zone next.

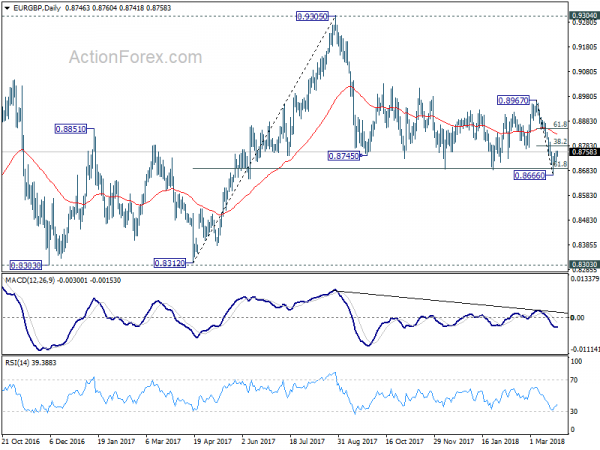

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.