EUR/AUD Daily Outlook

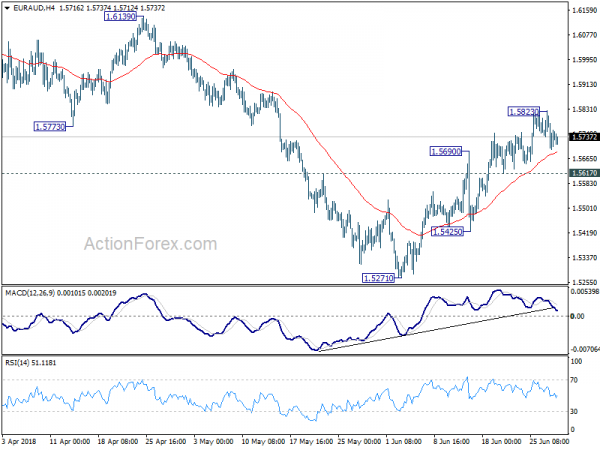

Daily Pivots: (S1) 1.5682; (P) 1.5755; (R1) 1.5813;

A temporary top is formed again at 1.5823 and intraday bias is turned neutral. Another rise is expected as long as 1.5617 holds. Above 1.5823 will extend the rebound from 1.5271 towards 1.6139 high. However, break of 1.5617 will turn bias to the downside for 1.5425 minor support first.

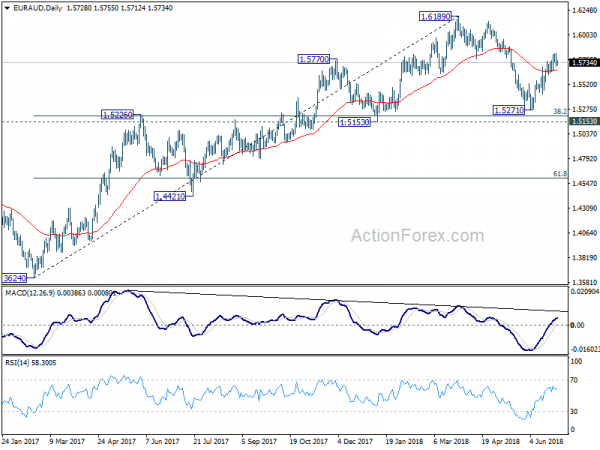

In the bigger picture, current development suggests that fall from 1.6189 is a corrective move and has completed at 1.5217 already. Key support levels of 1.5153 and 38.2% retracement of 1.3624 to 1.6189 at 1.5209 were defended. And rise medium term rise from 1.3624 (2017 low) is not completed yet. Break of 1.6189 will target 1.6587 key resistance (2015 high).

EUR/GBP Daily Outlook

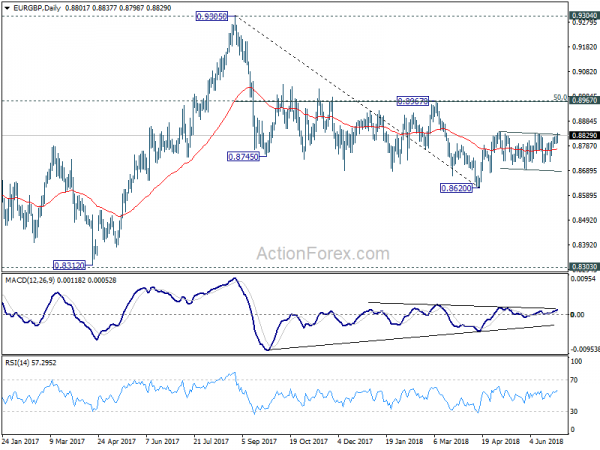

Daily Pivots: (S1) 0.8793; (P) 0.8811; (R1) 0.8829;

EUR/GBP rises to as high as 0.8837 so far with focus now on 0.8844 resistance. Firm break there will confirm resumption of rebound from 0.8620. In such case, further rise to be seen to 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963) next. Rejection by 0.8844 will extend recent sideway trading. Still, further rally is expected as long as 0.8693 support holds.

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.