EUR/AUD Daily Outlook

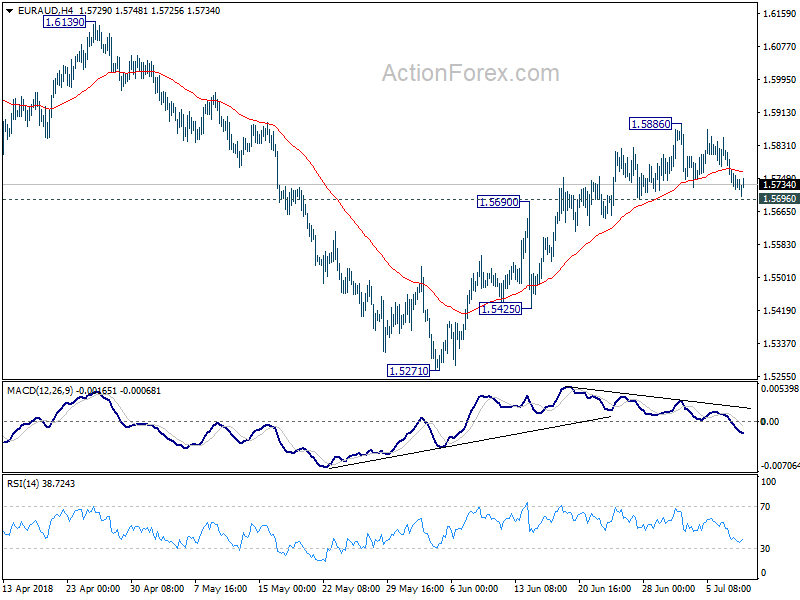

Daily Pivots: (S1) 1.5700; (P) 1.5761; (R1) 1.5800;

EUR/AUD’s consolidation from 1.5886 is still in progress and outlook is unchanged. Intraday bias stays neutral and further rally is expected with 1.5696 minor support intact. On the upside, break of 1.5886 will resume the rebound from 1.5271 and target 1.6189 high. However, as the rebound from 1.5271 is not clearly impulsive yet and momentum isn’t too convincing. Break of 1.5695 minor support could be an early sign of near term topping. In such case, bias will be turned back to the downside for 1.5425 support.

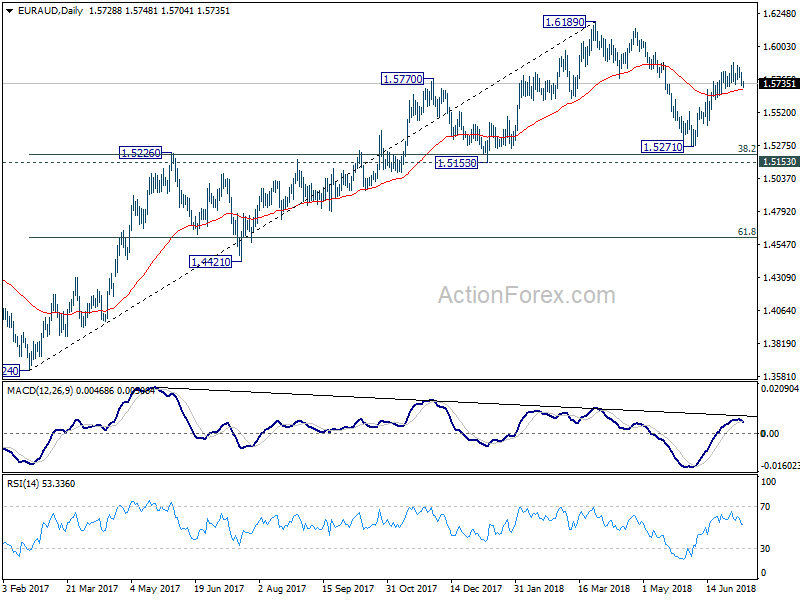

In the bigger picture, current development suggests that fall from 1.6189 is a corrective move and has completed at 1.5217 already. Key support levels of 1.5153 and 38.2% retracement of 1.3624 to 1.6189 at 1.5209 were defended. And medium term rise from 1.3624 (2017 low) is still in progress. Break of 1.6189 will target 1.6587 key resistance (2015 high).

EUR/GBP Daily Outlook

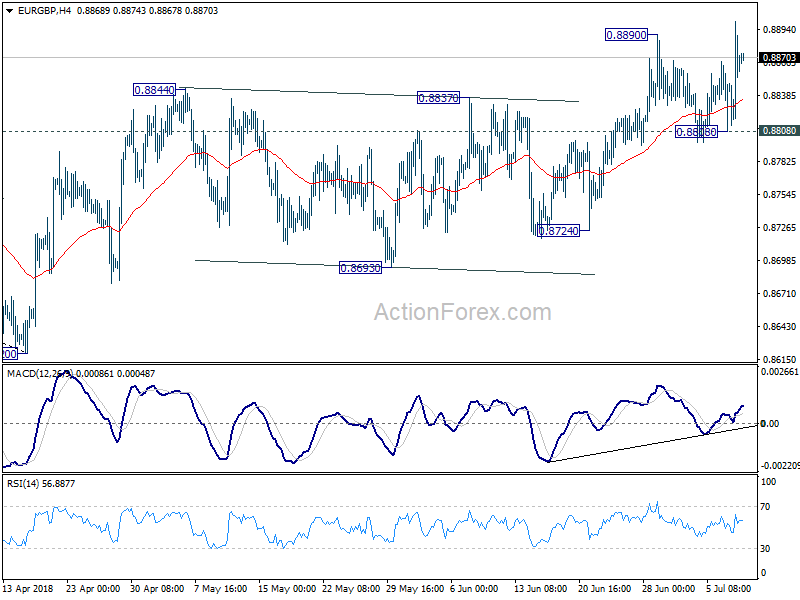

Daily Pivots: (S1) 0.8817; (P) 0.8859; (R1) 0.8905;

EUR/GBP’s break of 0.8890 resistance suggests resumption of rise from 0.8620. Intraday bias is now on the upside. Current rally would target 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963). However, upside momentum is rather unconvincing. Break of 0.8808 support will be the first sign that whole rebound from 0.8620 is completed. Deeper fall would then be seen to 0.8724 support for confirmation.

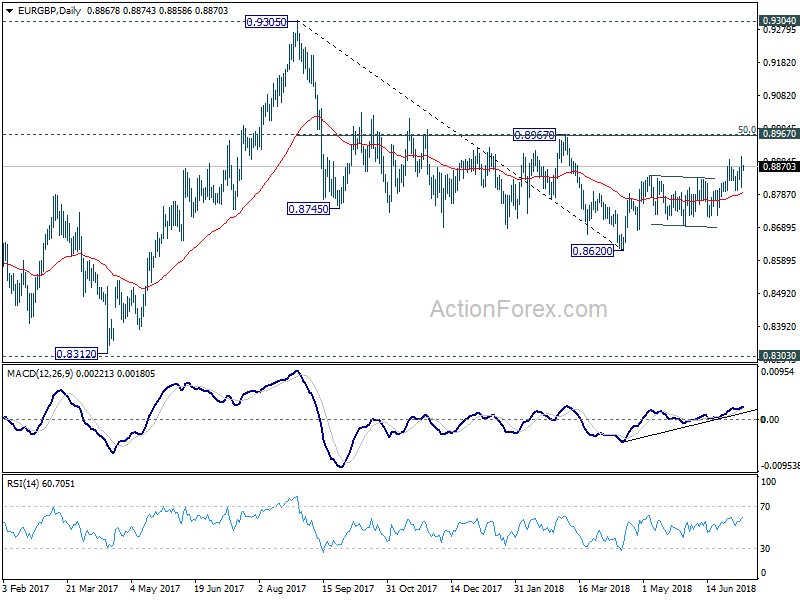

In the bigger picture, EUR/GBP is staying in long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.