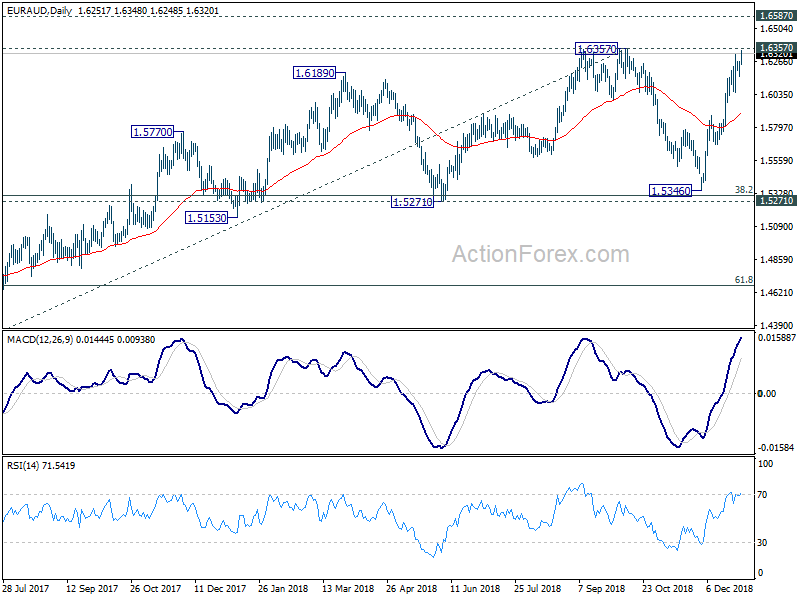

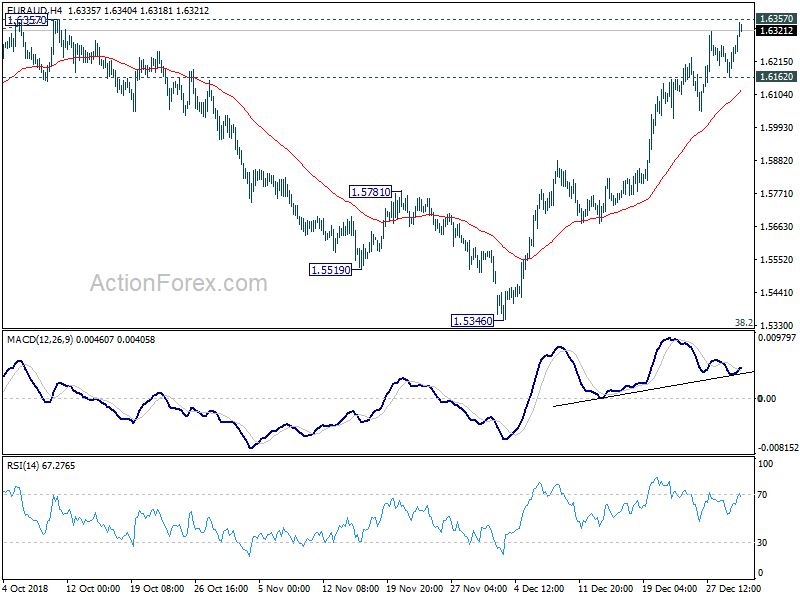

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6123; (P) 1.6291; (R1) 1.6423;

EUR/AUD’s rally extends after a brief retreat and reaches as high as 1.6348 so far. The intraday bias stays on the upside for the 1.6357 high. At this point, we’d be cautious on topping around there to bring pull back. On the downside, a break of 1.6162 will turn bias to the downside for the pullback. Meanwhile, a sustained break of 1.6357 will confirm an uptrend resistance for next key resistance at 1.6587.

In the bigger picture, there is no change in the view that the 1.6357 is a medium-term top. But the strong rebound ahead of the 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313) suggests price actions from 1.6357 are developing into sideways consolidation, rather than a deep correction. The range of 1.5271/6357 is likely to set for the consolidation. We don’t expect a break of the range any time soon. A A decisive break of 1.6357 will resume the larger uptrend from the 1.3624 (2017 low) to the 1.6587 (2015 high).

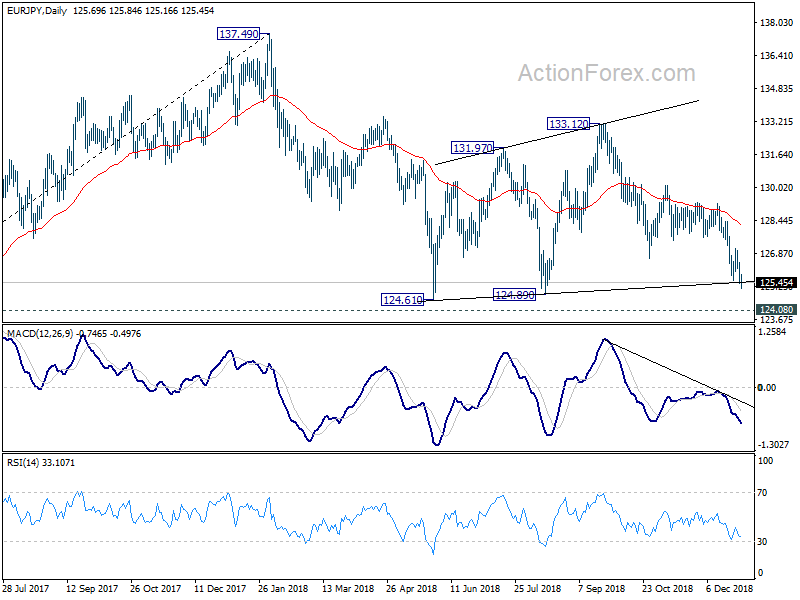

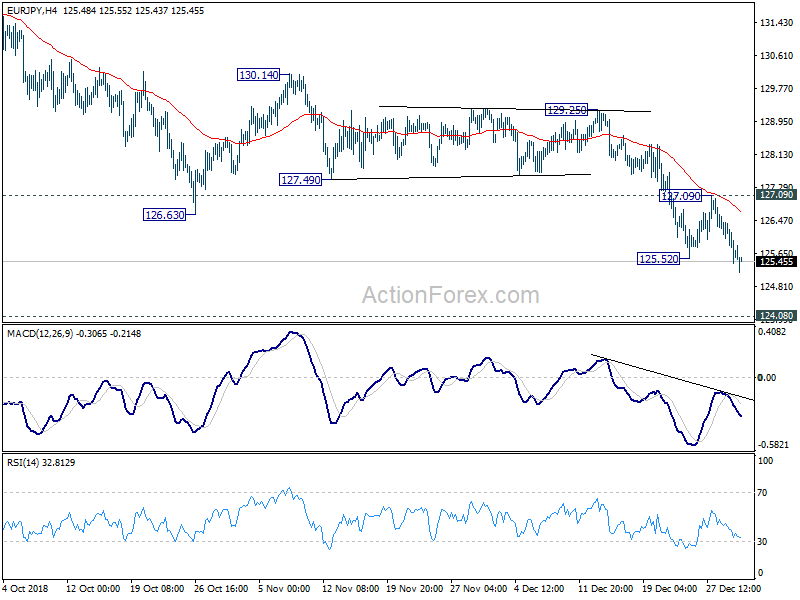

EUR/JPY Daily Outlook

Daily Pivots: (S1) 125.24; (P) 126.15; (R1) 126.74;

EUR/JPY’s fall resumed by taking out 125.52 and reaches as low as 125.16 so far. The intraday bias is back on the downside. The current decline from 133.12 should target the 124.08/89 support zone next. On the upside, break of the 127.09 resistance is needed to indicate short term bottoming. Otherwise, a near-term outlook will remain bearish even in case of recovery.

In the bigger picture, with the current decline, the focus would be back on the 124.08 key resistance turn supported holds. A decisive break of 124.08 will argue that such a rise from 109.03 (2016 low) has completed and turned the outlook bearish. In that case, a deeper fall would be seen to a 61.8% retracement of 109.03 to 137.49 at 119.90. Meanwhile, strong rebound from 124.08, followed by a break of 129.25 resistance will retain medium term bullishness. Rise 109.03 could still extend through 137.49 resistance in that case.