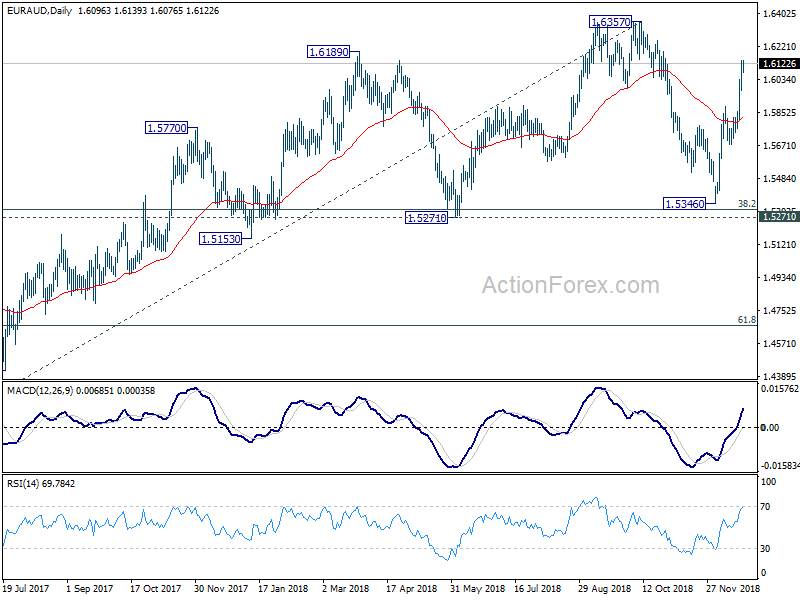

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5851; (P) 1.5947; (R1) 1.6099;

Intraday bias in EUR/AUD remains on the upside at this point. Current rise from 1.5346 is in progress for retesting 1.6357 high. At this point, we’d be cautious on topping around there to bring pull back. On the downside, break of 1.5887 resistance turned support is needed to indicate short term topping. Otherwise, near term outlook will remain bullish in case of retreat.

In the bigger picture, no change in the view that 1.6357 is a medium term top. But the strong rebound ahead of 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313) suggests price actions from 1.6357 are developing into sideway consolidation, rather than a deep correction. The range of 1.5271/6357 is likely set for the consolidation. And we don’t expect a break of the range any time soon. But decisive break of 1.6357 will resume the larger up trend from 1.3624 (2017 low) to 1.6587 (2015 high).

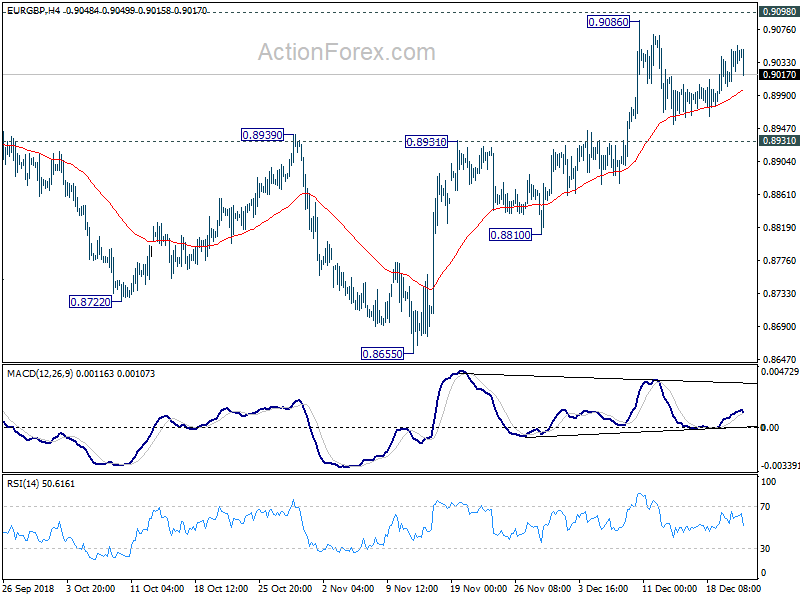

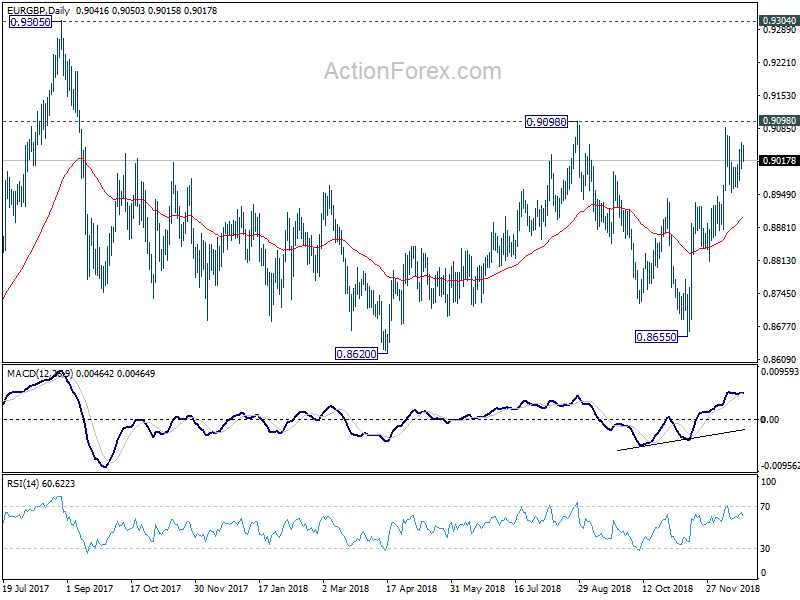

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.9015; (P) 0.9036; (R1) 0.9065;

EUR/GBP continues to stay in consolidation from 0.9086 and intraday bias remains neutral first. As long as 0.8931 resistance turned support holds, further rise is expected. On the upside, decisive break of 0.9098 resistance will extend the rally from 0.8655 and target 0.9304 key resistance next. However, considering bearish divergence condition in 4 hour MACD, firm break of 0.8931 will indicate near term reversal and target 0.8810 support and below.

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). It should be in medium term rising leg for 0.9304. Meanwhile, in case of another fall, down side should be contained by 0.8620/55 support zone to bring rebound.