EUR/AUD Daily Outlook

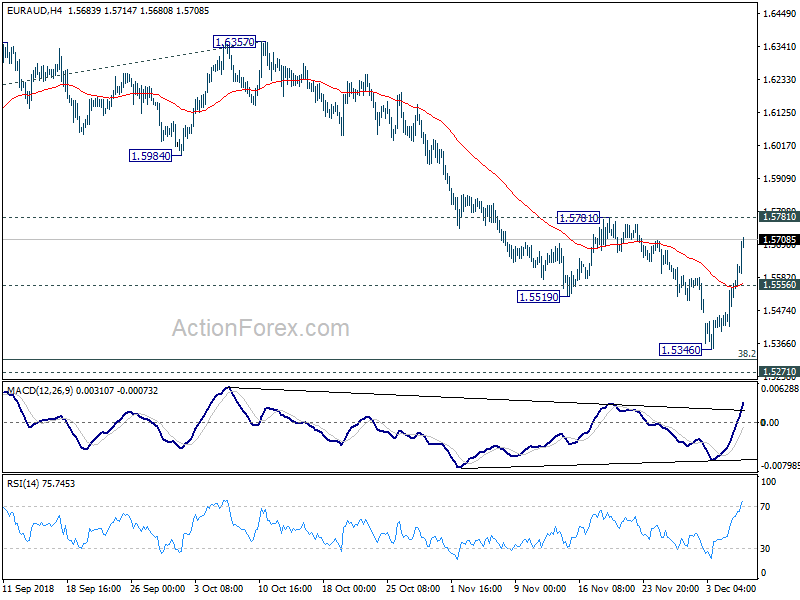

Daily Pivots: (S1) 1.5475; (P) 1.5551; (R1) 1.5680;

EUR/AUD’s rebound from 1.5346 accelerates higher today and focus is back on 1.5781 resistance. Decisive break there will suggest that corrective fall from 1.6357 has completed earlier than expected. Near term outlook will be turned bullish for retesting 1.6357 high. On the downside, below 1.5556 minor support will turn bias back to the downside for 1.5346 and then 1.5271/5313 cluster support zone.

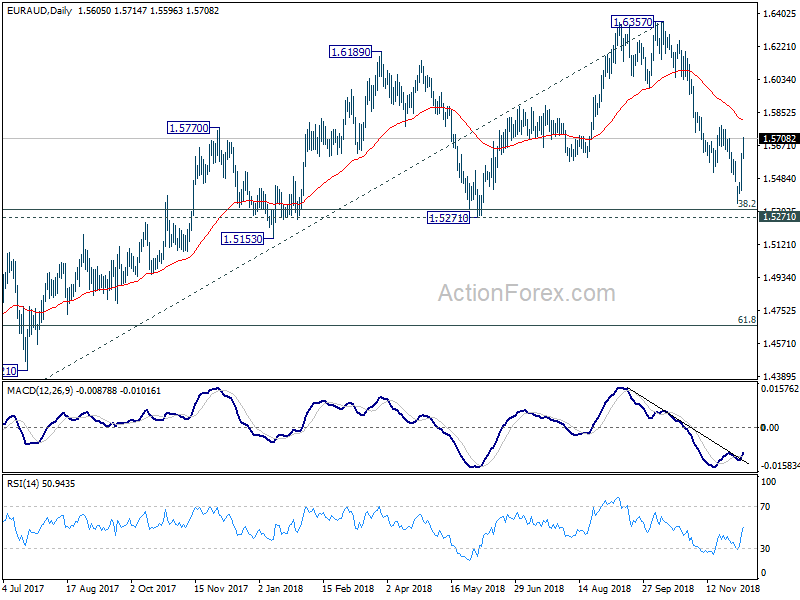

In the bigger picture, current development argues that up trend from 1.3624 (2017 low) is possibly completed at 1.6357, ahead of 1.6587 (2015 high). Fall from 1.6357 should be corrective such up trend and would target 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313). Break will extend the correction to Break will target 61.8% retracement at 1.4668. Nevertheless, firm break of 1.5781 will suggest that the pull back has already completed. And larger uptrend from 1.3624 might be ready to resume.

EUR/GBP Daily Outlook

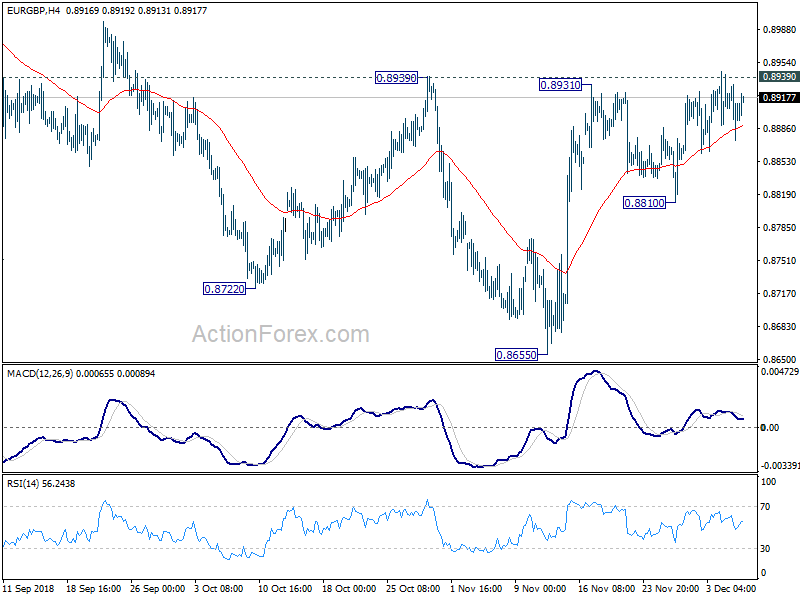

Daily Pivots: (S1) 0.8878; (P) 0.8906; (R1) 0.8936;

EUR/GBP is still limited below 0.8939 resistance and intraday bias remains neutral. On the upside, firm break of 0.8939 resistance will confirm completion of the fall from 0.9098 and turn outlook bullish for this resistance. On the downside, below 0.8810 will turn bias to the downside for 0.8655 low instead.

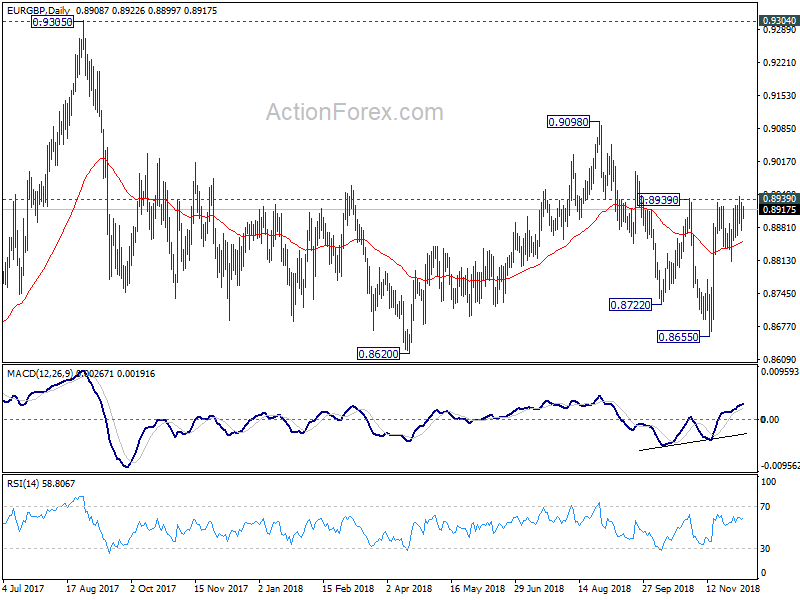

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Sustained break of 0.8939 resistance will confirm that it’s in a medium term rising leg for 0.9098 and above. And for now, in case of another fall, downside will likely be contained by 0.8620/55 support zone to bring rebound.