EUR/AUD Daily Outlook

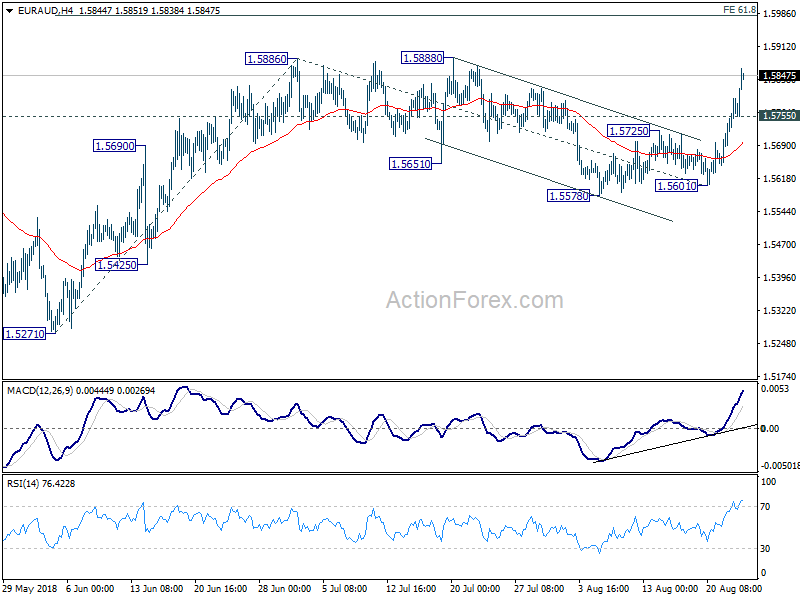

Daily Pivots: (S1) 1.5712; (P) 1.5756; (R1) 1.5817;

EUR/AUD surges to as high as 1.5863 so far today and intraday bias remains on the upside for 1.5886/8 resistance. Firm break there will resume the rise from 1.5271 and target 61.8% projection of 1.5271 to 1.5886 from 1.5601 at 1.5981 first. Break will target 100% projection at 1.6216, which is close to 1.6189 high. On the downside, below 1.5755 minor support will turn intraday bias neutral first.

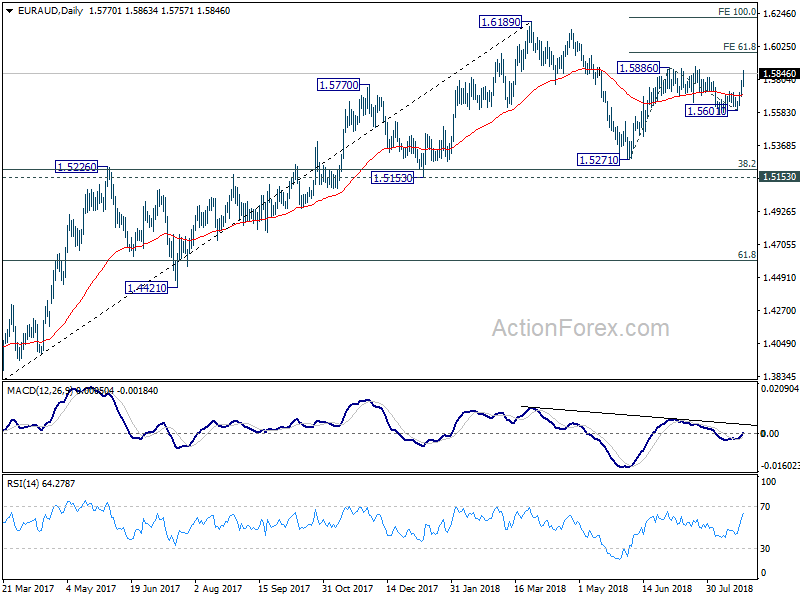

In the bigger picture, the rebound from 1.5271 was somewhat weaker than expected. EUR/AUD. But there is no confirmation of completion. Break of 1.5888 will likely target 1.6189 and above to resume the medium term rally from 1.3624 (2017 low). This will be the favored case as long as 1.5271 support holds.

EUR/GBP Daily Outlook

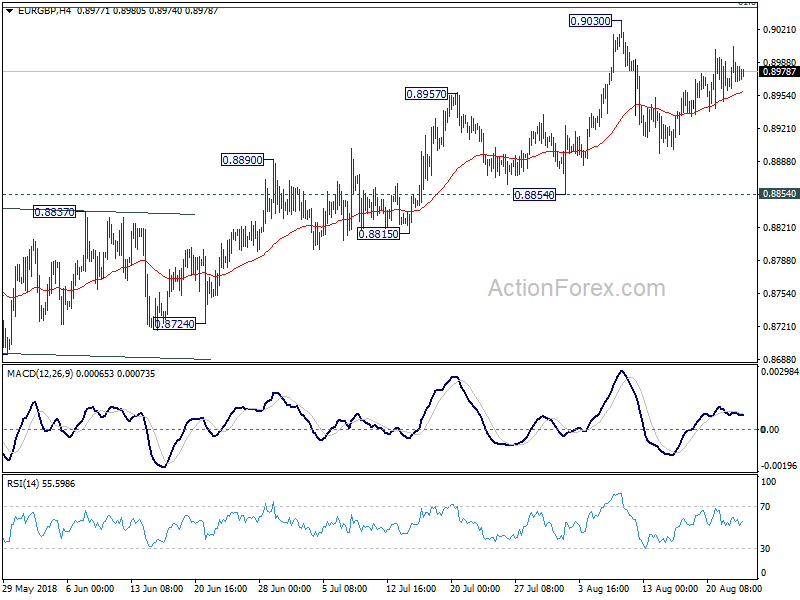

Daily Pivots: (S1) 0.8943; (P) 0.8973; (R1) 0.8997;

EUR/GBP is staying in consolidation from 0.9030 short term top and intraday bias remains neutral. The consolidation may extend with another fall. But downside should be contained by 0.8854 support to bring rally resumption. On the upside, firm break of 61.8% retracement of 0.9305 to 0.8620 at 0.9043 will pave the way to retest 0.9305 key resistance. However, sustained break of 0.8854 will indicate near term reversal and turn outlook bearish.

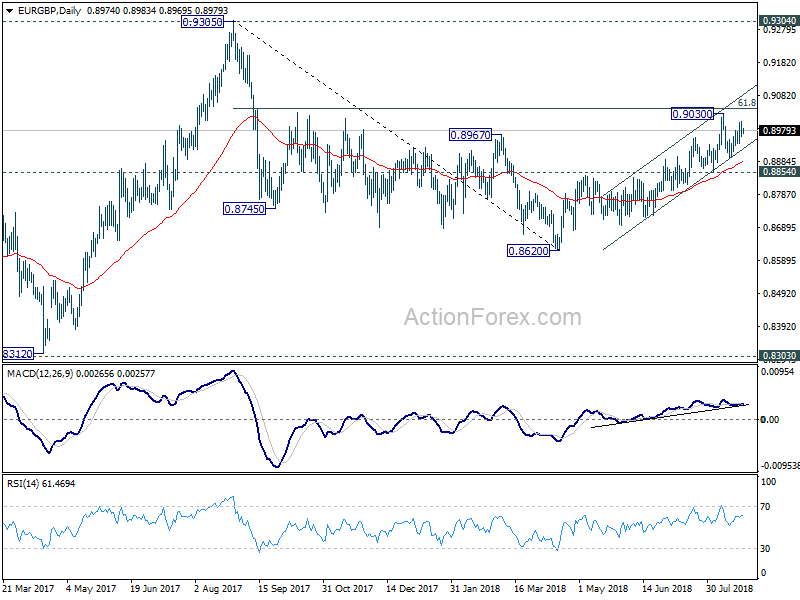

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). The corrective structure of the fall from 0.9305 to 0.8620 is raising the chance that rise from 0.8312 to 0.9305 is an impulsive move. But we’re not too confident on it yet. In any case, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.