EUR/AUD Daily Outlook

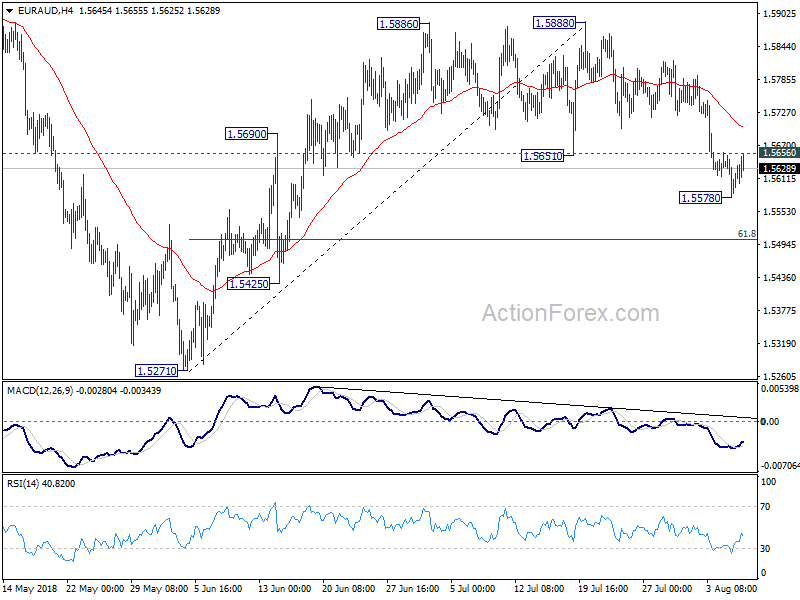

Daily Pivots: (S1) 1.5586; (P) 1.5628; (R1) 1.5675;

A temporary low is in place at 1.5578 with 4 hour MACD crossed above signa line. Intraday bias is turned neutral first. Upside of recovery should be limited 4 hour 55 EMA (now at 1.5703) to bring another fall. Below 1.5578 will target 61.8% retracement of 1.5271 to 1.5888 at 1.5507. Sustained break there will pave the way to retest 1.5271 low. Overall, even in case of stronger rebound, risk will stay on the downside as long as 1.5888 resistance holds.

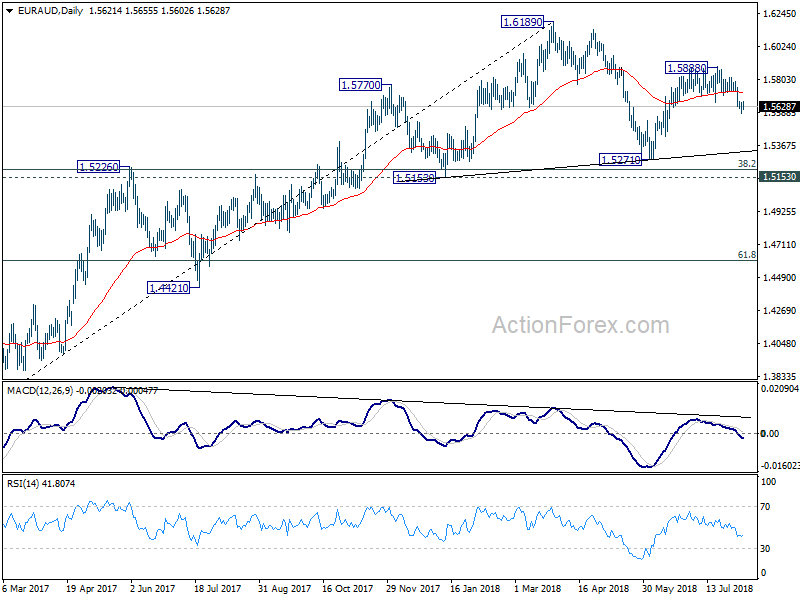

In the bigger picture, the rebound from 1.5271 was somewhat weaker than expected. EUR/AUD also failed to sustain above 55 day EMA and hints on some underlying bearishness. Though, for now, as long as 1.5271 support holds, medium term rise from m 1.3624 (2017 low) is still mildly in favor to extend through 1.6189 high, to 1.6587 key resistance (2015 high). Nevertheless, firm break of 1.5271 will complete a head and shoulder top pattern (ls: 1.5770, h: 1.6189, rs: 1.5888). That would indicate medium term reversal and turn outlook bearish.

EUR/GBP Daily Outlook

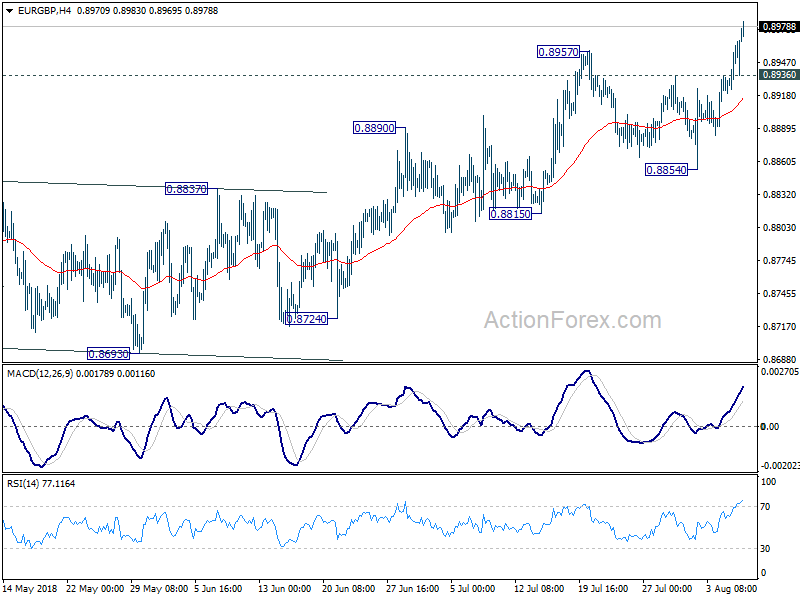

Daily Pivots: (S1) 0.8937; (P) 0.8952; (R1) 0.8982;

EUR/GBP surges to as high as 0.8983 so far today. The solid break of 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963) firstly indicates resumption of rise from 0.8620. It also confirms completion of whole decline from 0.9305. Intraday bias is back on the upside for 61.8% retracement at 0.9043 next. On the downside, below 0.8936 minor support will turn intraday bias neutral first. But outlook will remain bullish as long as 0.8854 support holds and further rise is expected.

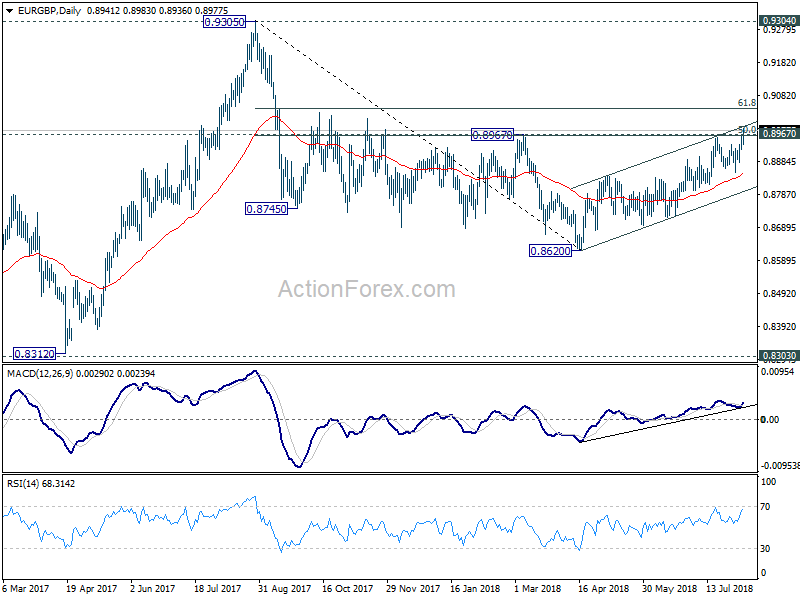

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). The corrective structure of the fall from 0.9305 to 0.8620 is raising the chance that rise from 0.8312 to 0.9305 is an impulsive move. But we’re not too confident on it yet. In any case, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.