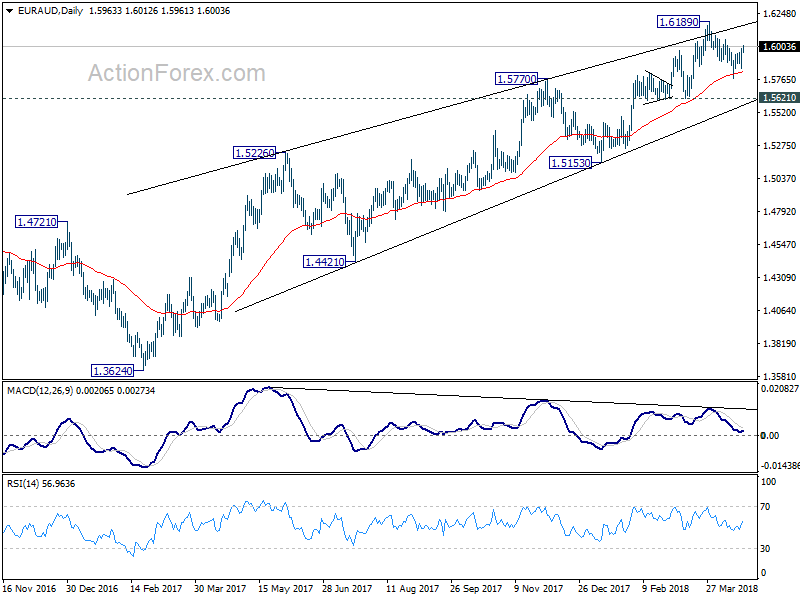

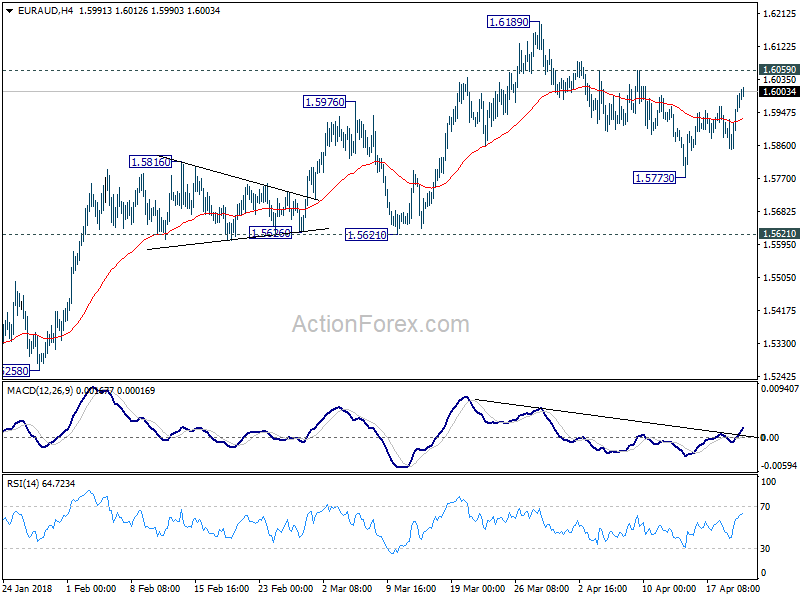

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5882; (P) 1.5936; (R1) 1.6025;

EUR/AUD’s recovers again but stays in range of 1.5773/6059. Intraday bias remains neutral first. Another fall is in favor as long as 1.6059 holds. Break of 1.5773 will target 1.5621 support first. Decisive break there will be another indication of medium term trend reversal. However, break of 1.6059 will turn bias back to the upside and target a test on 1.6189 high instead.

In the bigger picture, the case for medium term reversal is building up in EUR/AUD. Bearish divergence condition in daily MACD indicates further loss of upside momentum ahead of 1.6587 key resistance (2015 high). Break of 1.5621 should confirm medium term topping and bring deeper fall back to 1.5153 and possibly below. Meanwhile, even in case of up trend resumption, we’d be cautious on strong resistance from 1.6587 to limit upside and bring reversal.

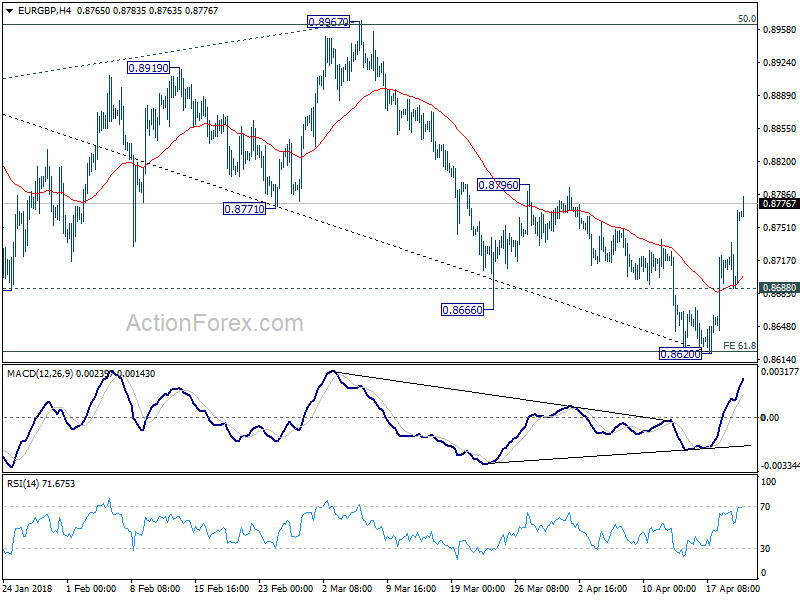

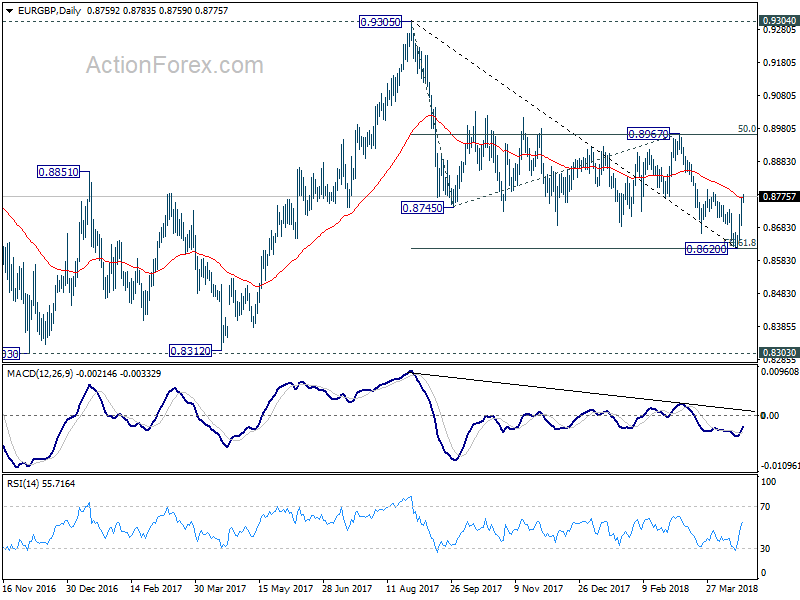

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8713; (P) 0.8741; (R1) 0.8794;

EUR/GBP’s strong rebound and firm break of 0.8739 indicates near term reversal. And whole decline from 0.9305 has likely completed after hitting 61.8% projection of 0.9305 to 0.8745 from 0.8967 at 0.8621. Intraday bias is back on the upside for 0.8796 first. Firm break there will target key cluster resistance at 0.8967 (50% retracement of 0.9305 to 0.8620 at 0.8963) next. On the downside, break of 0.8688 minor support will dampen the bullish case and turn focus back to 0.8620 instead.

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.