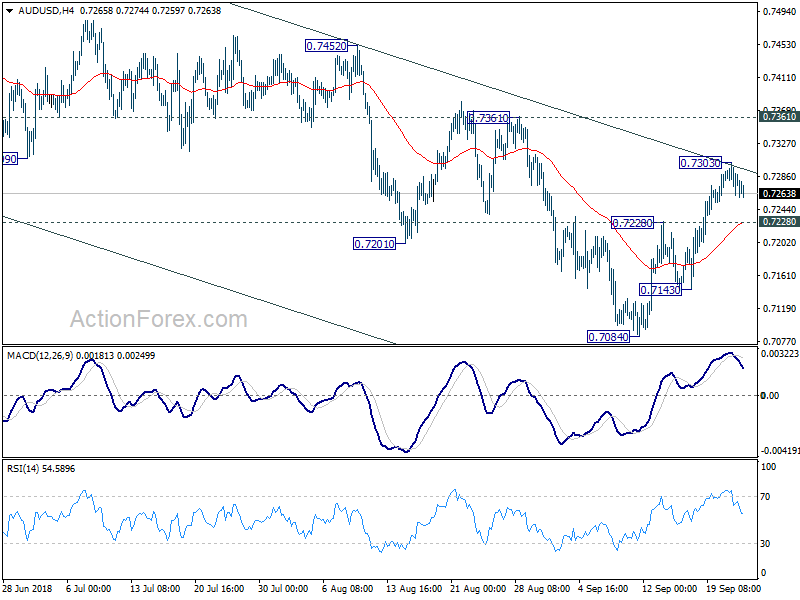

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7266; (P) 0.7285; (R1) 0.7307;

Intraday bias in AUD/USD remains neutral for the moment. On the upside, above 0.7303 will extend the corrective rise from 0.7084. But upside should be limited below 0.7361 resistance to complete the correction and bring down trend resumption. On the downside, below 0.7228 resistance turned support will turn bias back to the downside for 0.7143 first. Break there will likely resume larger fall from 0.8135 through 0.7084 low. However, sustained break of 0.7361 will carry larger bullish implication.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.

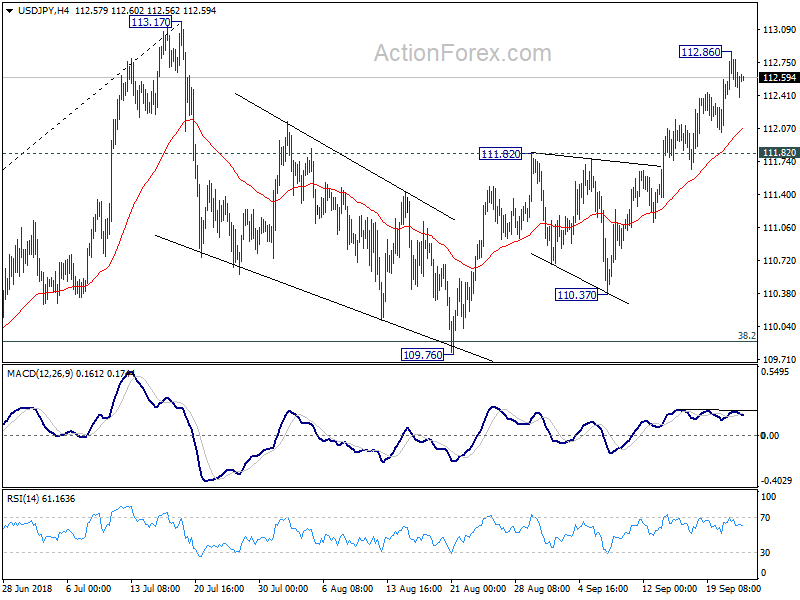

USD/JPY Daily Outlook

Daily Pivots: (S1) 112.36; (P) 112.62; (R1) 112.80;

A temporary top is in place at 112.86 with today’s retreat. Intraday bias in USD/JPY is turned neutral first, for some consolidations. Near term outlook will remain cautiously bullish as long as 111.82 resistance turned support holds. On the upside, above 112.86 will target 113.17 resistance. Decisive break there will resume whole rally from 104.62 and target 114.73 resistance next.

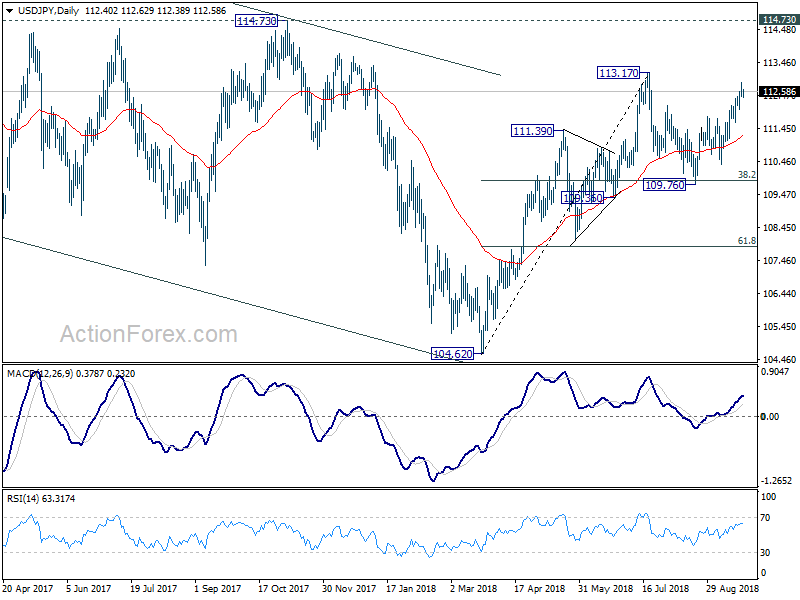

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.