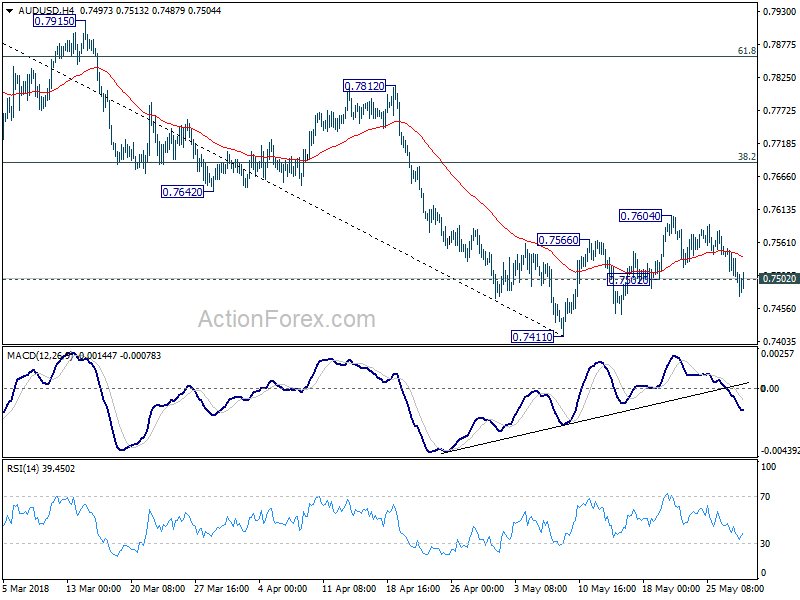

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7485; (P) 0.7519; (R1) 0.7540;

The break of 0.7502 minor support suggests that corrective rise from 0.7411 has completed at 0.7604 already. Intraday bias is turned back to the downside for 0.7411 first. Break will resume the larger decline from 0.8135 to cluster support at 0.7328 (61.8% retracement of 0.6826 to 0.8135 at 0.7326). On the upside, above 0.7604 will delay the bearish case and extend the correction from 0.7411 with another rise.

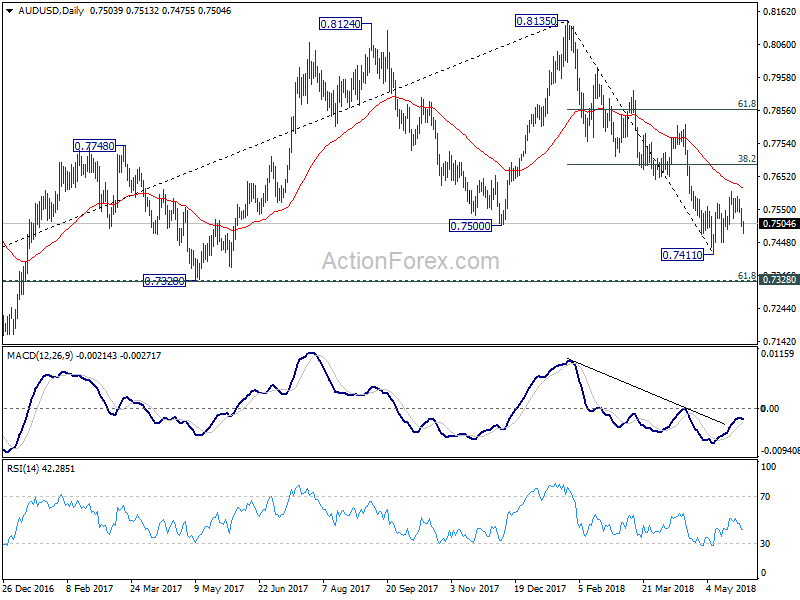

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Prior break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

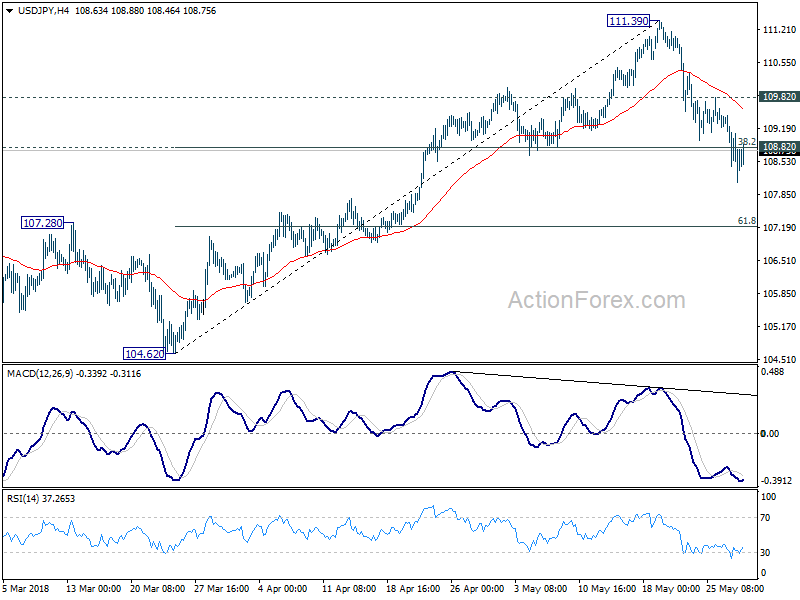

USD/JPY Daily Outlook

Daily Pivots: (S1) 108.10; (P) 108.78; (R1) 109.46;

The break of 108.82 key cluster support now argues that rise from 104.62 has completed at 111.39. Intraday bias stays on the downside for 61.8% retracement of 104.62 to 111.39 at 107.20. Break will resume larger decline from 118.65 for a new low below 104.62. On the upside, break of 109.82 is needed to confirm completion of the fall from 111.39. Otherwise, near term outlook will be mildly bearish even in case of recovery.

In the bigger picture, USD/JPY remains bounded in medium term falling channel from 118.65 (2016 high). The development. Current deeper than expected fall from 111.39 argues that fall from 118.65 is not finished. Break of 104.62 low would target 98.97 or even below. Though, break of 111.39 will revive the case that fall from 118.65 has completed and turn focus to 114.73 for confirmation.