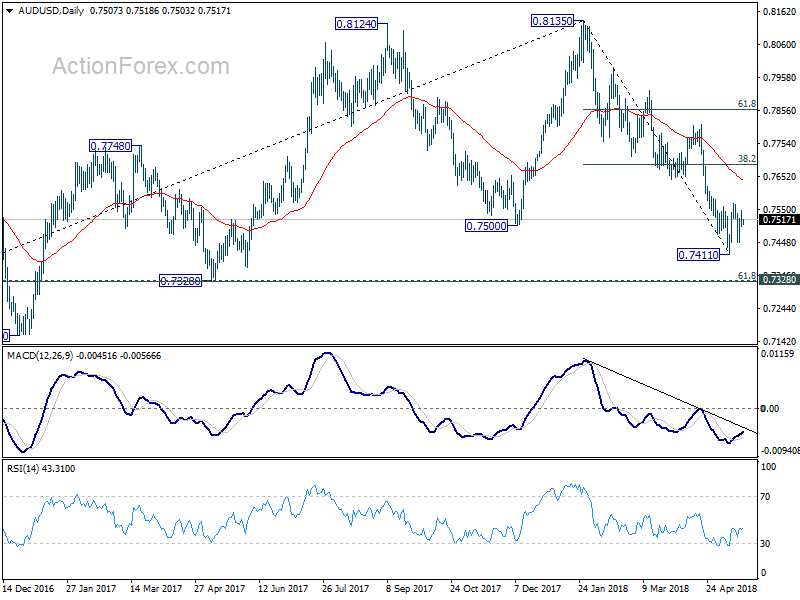

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7489; (P) 0.7519; (R1) 0.7540;

AUD/USD is bounded in range of 0.7411/7566 and intraday bias remains neutral first. On the upside, above 0.7566 will bring stronger recovery. But upside should be limited by 38.2% retracement of 0.8135 to 0.7144 at 0.7688 to bring decline resumption. On the downside, break of 0.7411 will resume the fall from 0.8135 and target cluster support at 0.7328 (61.8% retracement of 0.6826 to 0.8135 at 0.7326).

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

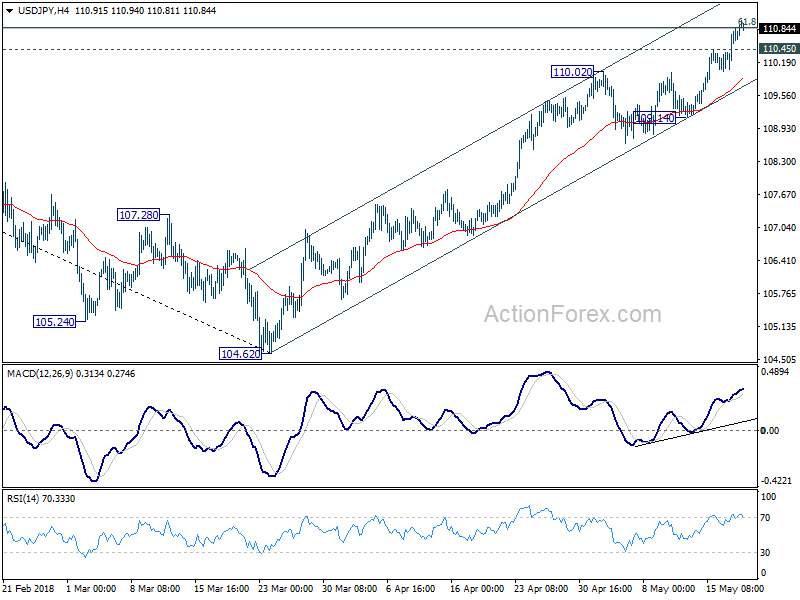

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.27; (P) 110.57; (R1) 110.06;

USD/JPY’s rally is still in progress and intraday bias remains on the upside. 61.8% retracement of 114.73 to 104.62 at 110.86 is already met. Next target is trend line resistance at 112.43. On the downside, below 110.45 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 109.13 support holds.

- advertisement -

In the bigger picture, corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Rise from 104.62 is possibly resuming the up trend from 98.97 (2016 low). This will be the preferred case as long as 55 day EMA (now at 108.30) holds. Decisive break of 114.73 resistance will confirm our view and target 118.65 and above.