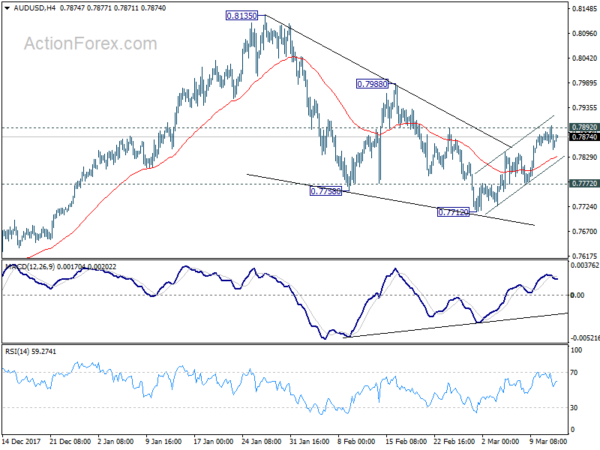

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7836; (P) 0.7867; (R1) 0.7888;

AUD/USD lost momentum after failing to stay above 0.7892 resistance. Intraday bias is turned neutral first. We’re slightly favoring the case that corrective pull back from 0.8135 has completed with three waves down to 0.7712. Further rise is expected as long as 0.7772 minor support holds. Above 0.7892 again will target 0.7988 resistance. Decisive break there will bring larger rally resumption. Nonetheless, on the downside. On the downside, below 0.7772 will turn bias to the downside for 0.7712. Break there will resume whole fall from 0.8135.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.12; (P) 106.70; (R1) 107.16;

USD/JPY’s corrective trading from 105.24 continues and retreated after losing momentum ahead of 107.67 resistance. Intraday bias remains neutral as consolidation from 105.24 might extend. Also, another decline will remain in favor as long as 107.67 holds. On the downside, break of 105.24 will resume larger decline from 118.65 and target 100% projection of 118.65 to 108.12 from 114.73 at 104.20 next. On the upside, firm break of 107.67 resistance will indicate near term reversal, on bullish convergence condition in 4 hour MACD. In such case, outlook will be turned bullish for 110.47 resistance next.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. The solid break of 61.8% retracement of 98.97 to 118.65 at 106.48 now suggests that the pattern from 125.85 high is possibly extending. Deeper fall could be seen through 98.97 key support (2016 low). This bearish case will now be favored as long as 110.47 resistance holds.