AUD/USD Daily Outlook

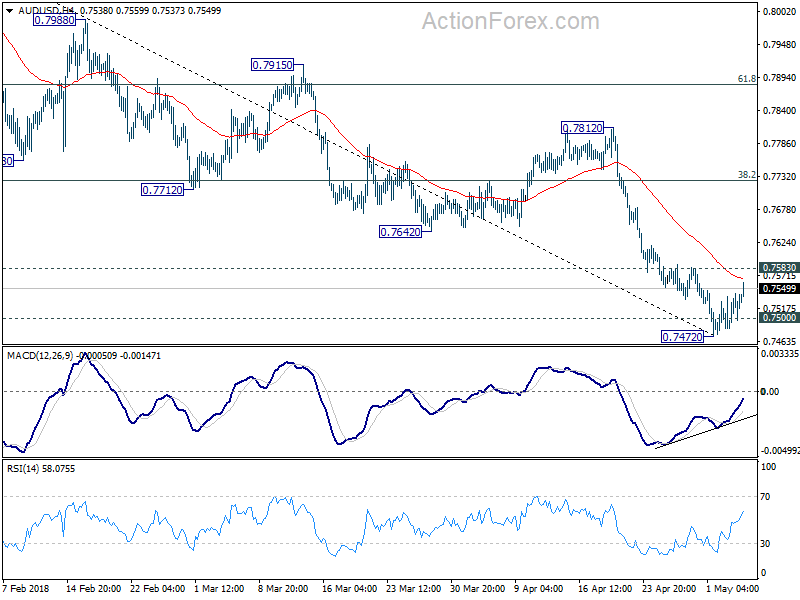

Daily Pivots: (S1) 0.7495; (P) 0.7519; (R1) 0.7554;

AUD/USD’s recovery from 0.7472 extends today but it’s staying below 0.7583 minor resistance. Intraday bias remains neutral at this point and further decline is expected. As noted before, sustained break of of 0.7500 key support level will indicate medium term reversal and target next support at 0.7328. However, break of 0.7583 will indicate short term bottoming, on bullish convergence condition in 4 hour MACD. And stronger rebound could be seen back to 38.2% retracement of 0.8135 to 0.7472 at 0.7725 and possibly above.

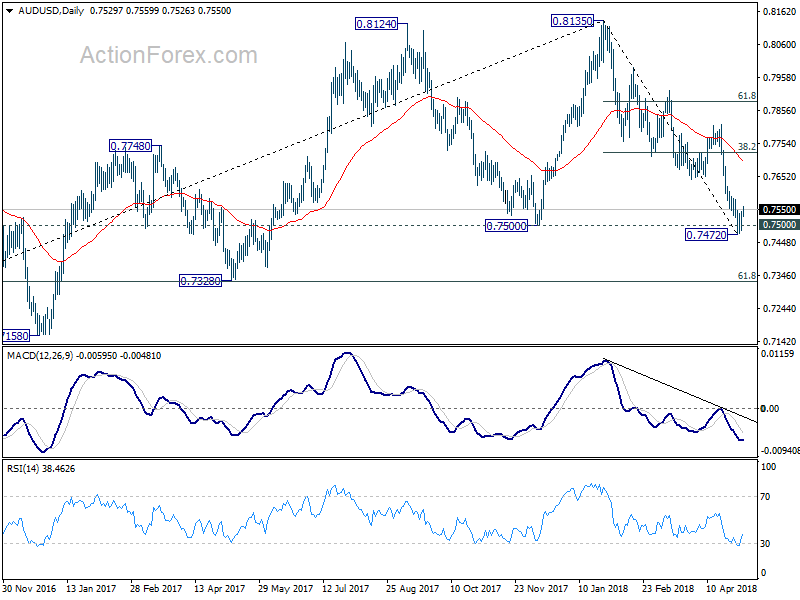

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support will suggest that such correction is completed. In that case, deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

USD/CAD Daily Outlook

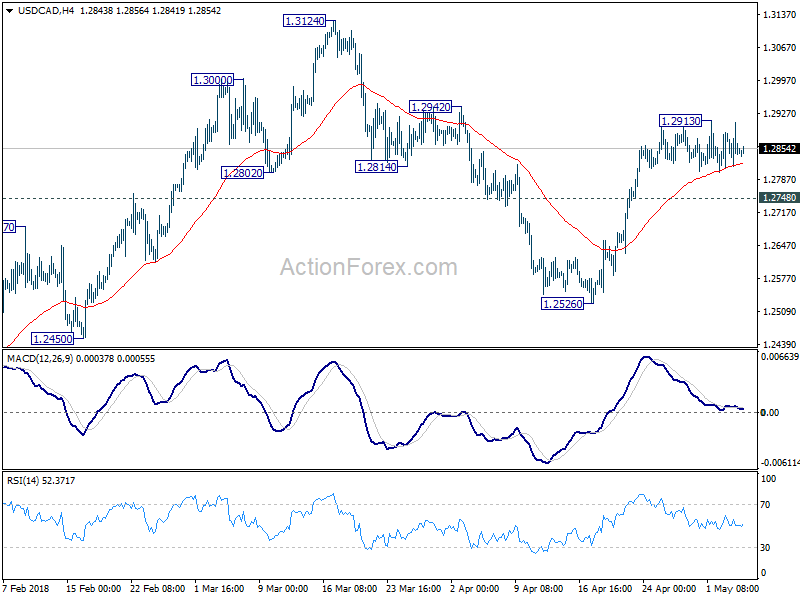

Daily Pivots: (S1) 1.2827; (P) 1.2857; (R1) 1.2912;

USD/CAD is still bounded in range below 1.2913 temporary top and intraday bias remains neutral. More consolidation could be seen. But another rise is expected with 1.2748 minor support intact. On the upside, break of 1.2913 will resume the rise from 1.2526 and target 1.3124 high. However, break of 1.2748 will turn focus back to 1.2526 support instead.

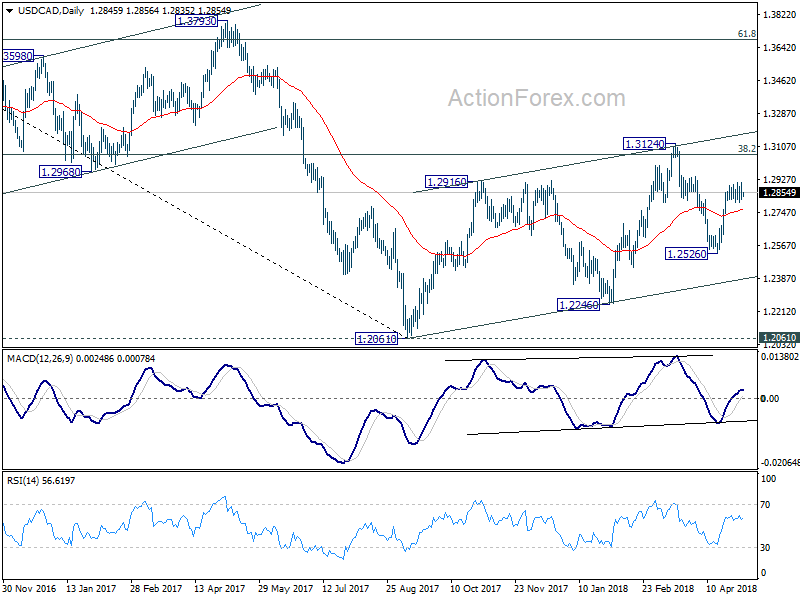

In the bigger picture, current development suggests that rebound from 1.2061 has not completed yet. Focus is back on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685.