AUD/USD Daily Outlook

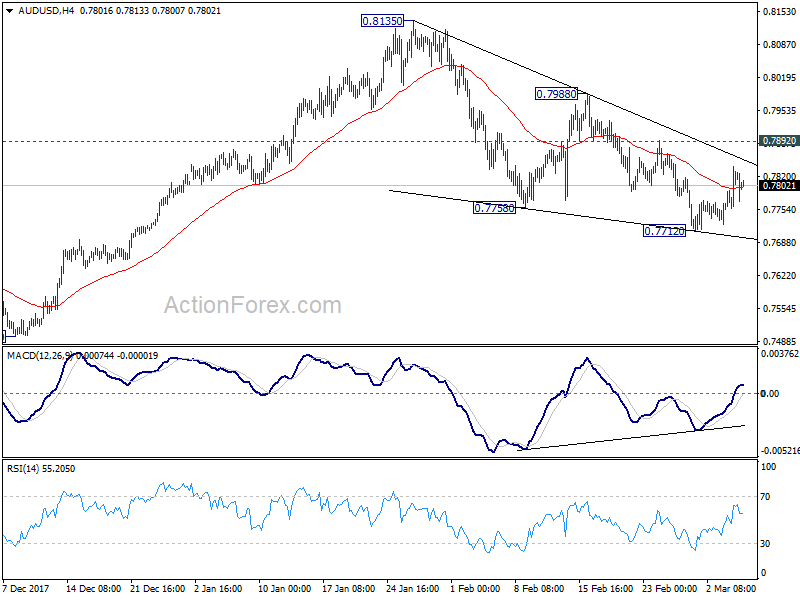

Daily Pivots: (S1) 0.7775; (P) 0.7808; (R1) 0.7861;

At this point, AUD/USD is staying in range above 0.7712 temporary low. Intraday bias remains neutral first. Near term outlook will remains mildly bearish as long as 0.7892 minor resistance holds. But still it’s limited below 0.7892 resistance. Such rebound could still be a corrective move only. Intraday bias stays neutral first. On the downside, break of 0.7712 will extend the fall from 0.8135 towards 0.7500 key support level. However, break of 0.7892 will suggest that the pull back from 0.8135 is already completed. In such case, intraday bias will be turned back to the upside for 0.7988 and then 0.8135 again.

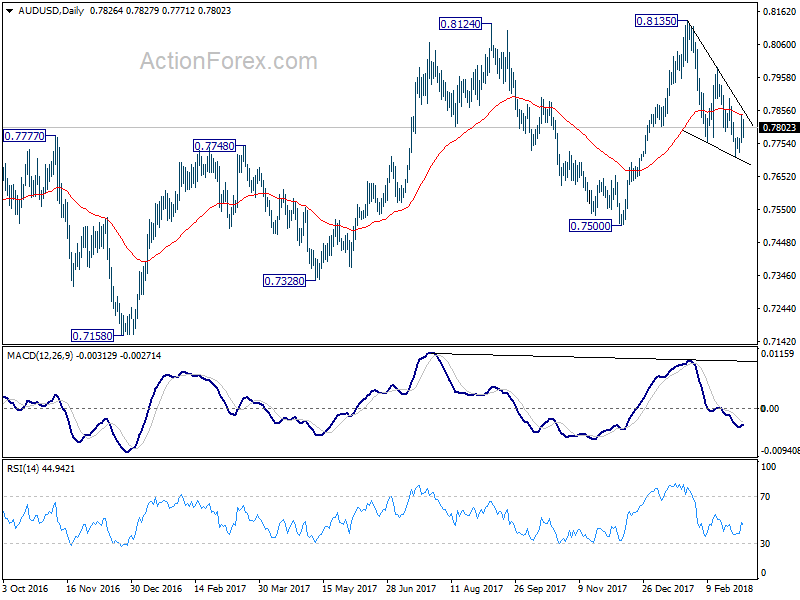

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed.

EUR/USD Daily Outlook

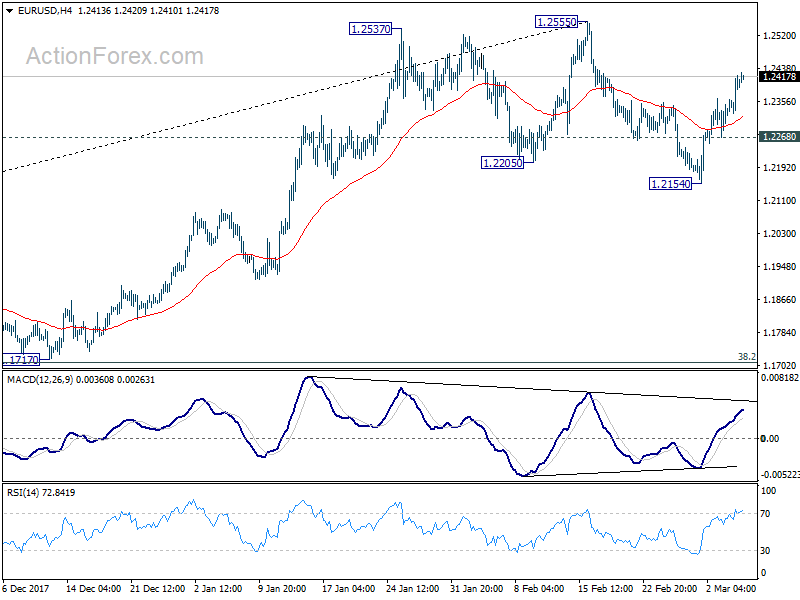

Daily Pivots: (S1) 1.2347; (P) 1.2384 (R1) 1.2440;

EUR/USD’s rebound from 1.2154 is still in progress. Intraday bias remains on the upside for retesting 1.2555 high. The corrective structure of the fall from 1.2555 to 1.2154 argues that larger rally is not finished. More importantly, firm break of 1.2555 and 1.2516 long term fibonacci level will carry larger bullish implications. On the downside, below 1.2268 minor support will turn bias back to the downside for 1.2154 instead.

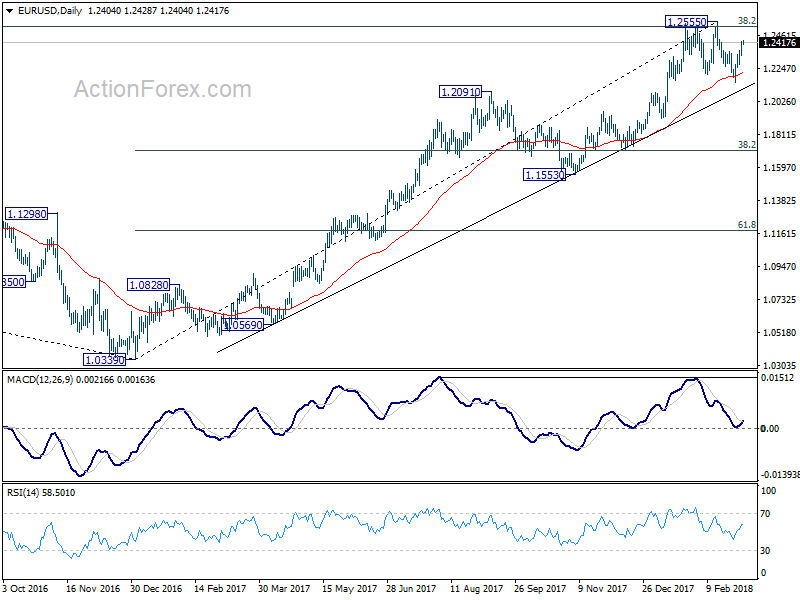

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.