AUD/USD Daily Outlook

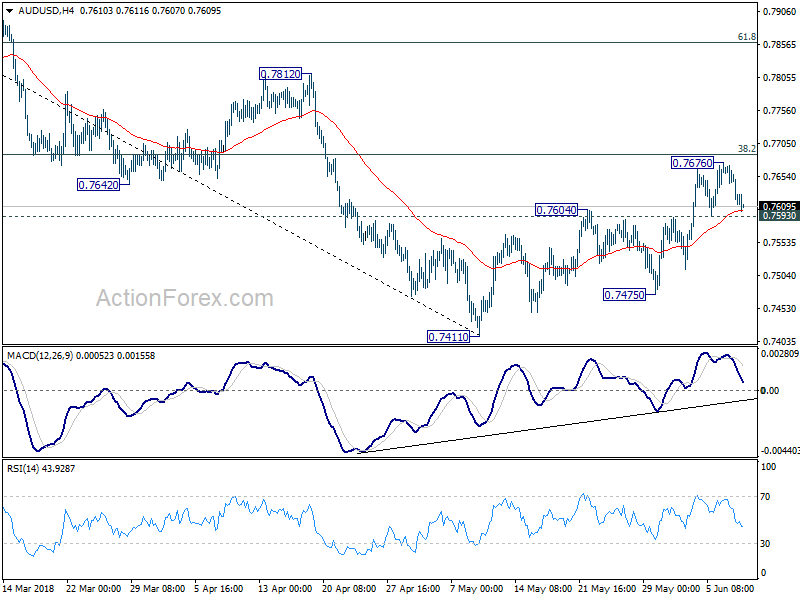

Daily Pivots: (S1) 0.7600; (P) 0.7637; (R1) 0.7661;

Intraday bias in AUD/USD stays neutral at this point and outlook is unchanged. Rebound from 0.7411 is seen as a correction. Hence, upside should be limited by 38.2% retracement of 0.8135 to 0.7144 at 0.7688. On the downside, below 0.7593 minor support will turn bias to the downside for 0.7475 first. Break there will likely resume larger fall through 0.7411 to 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326). However, sustained break of 0.7688 will dampen our bearish view and target 61.8% retracement at 0.7585 instead.

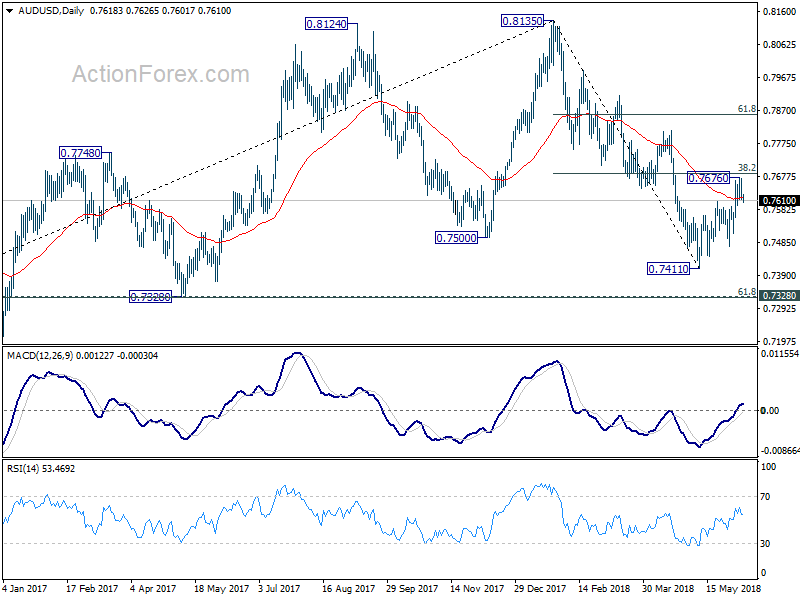

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Prior break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

EUR/CHF Daily Outlook

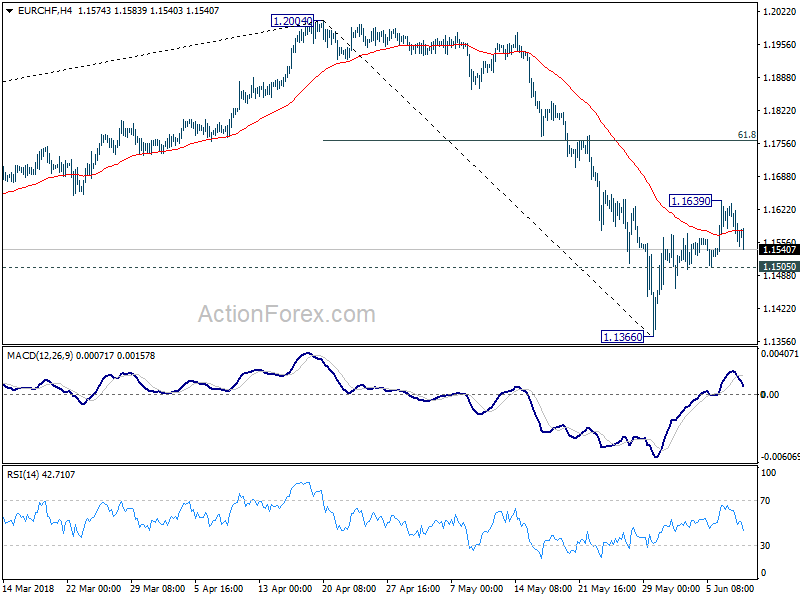

Daily Pivots: (S1) 1.1538; (P) 1.1588; (R1) 1.1616;

EUR/CHF lost momentum after hitting 1.1639 and intraday bias is turned neutral first. With 1.1505 minor support intact, rebound from 1.1366 is in favor to extend. Above 1.1639 will target 61.8% retracement of 1.2004 to 1.1366 at 1.1760. We’ll look for topping signal above there though. On the downside, however, break of 1.1505 will suggest that the rebound is completed. And intraday bias will be turned back to the downside for retesting 1.1366.

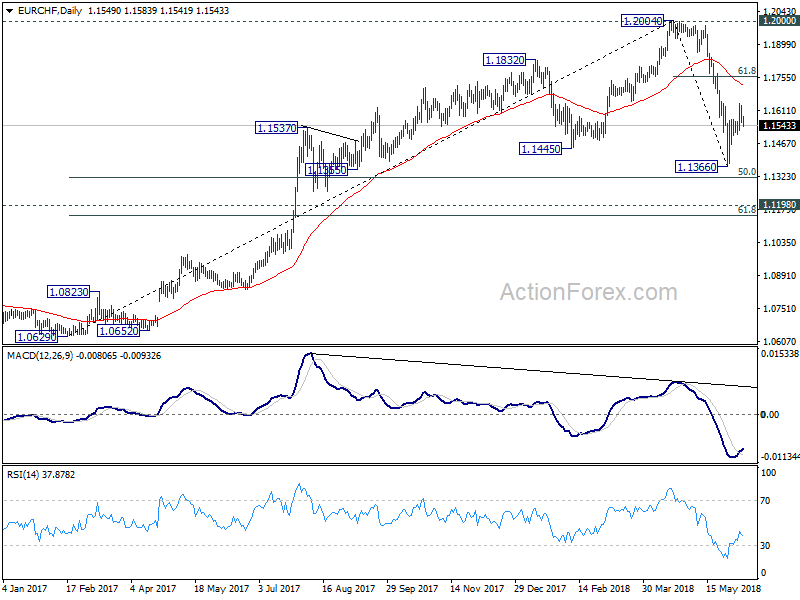

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.