AUD/USD Daily Outlook

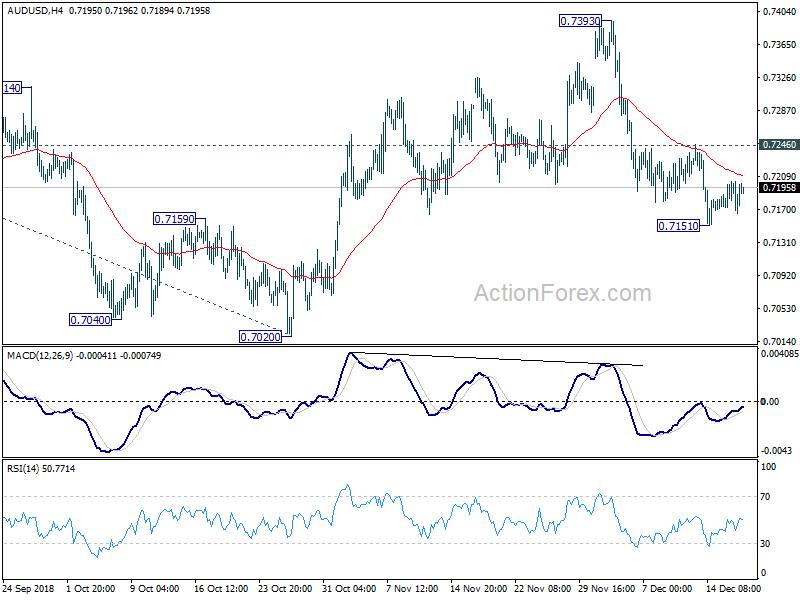

Daily Pivots: (S1) 0.7165; (P) 0.7185; (R1) 0.7204;

Intraday bias in AUD/USD remains neutral as it’s staying in consolidation above 0.7151 temporary low. Upside of recovery should be limited by 0.7246 resistance to bring fall resumption. Below 0.7151 will extend the fall from 0.7393 to retest 0.7020 low. Nevertheless, break of 0.7246 resistance will delay the bearish case and turn bias back to the upside. Rebound from 0.7020 could then probably head to 38.2% retracement of 0.8135 to 0.7020 at 0.7446 before completion.

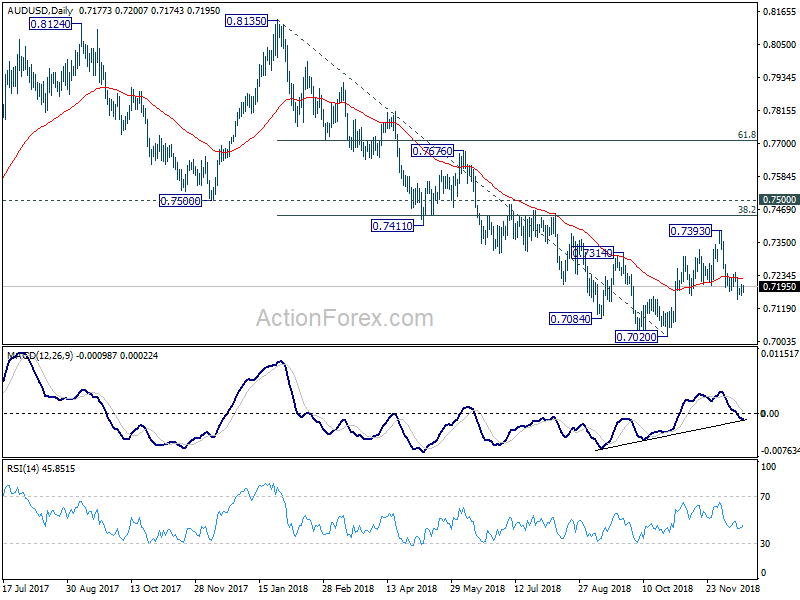

In the bigger picture, a medium term bottom is in place at 0.7020 ahead of 0.6826 key support (2016 low). Stronger rebound could still be seen to correct the whole fall from 0.8135 high. But we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should resume later and extend to take on 0.6826 low at a later stage, after the correction from 0.7020 completes.

EUR/CHF Daily Outlook

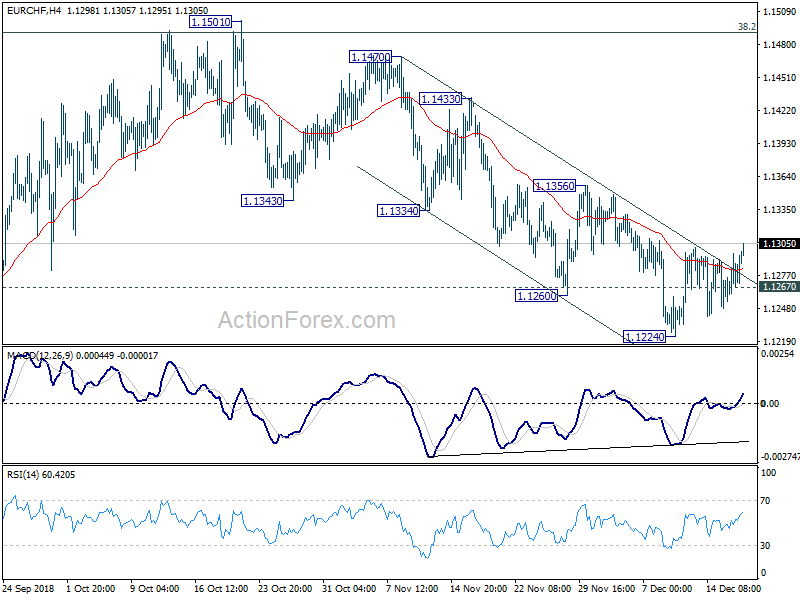

Daily Pivots: (S1) 1.1260; (P) 1.1279; (R1) 1.1301;

EUR/CHF’s rebound from 1.1224 short term bottom resumes today by breaking 1.1301 minor resistance. Intraday bias is turned back to the upside for 1.1356 resistance first. Decisive break there should confirm near term reversal. In that case, further rally should be seen back to 1.1501 resistance. On the downside, below 1.1267 minor support will dampen this bullish case and turn focus back to 1.1224 low instead.

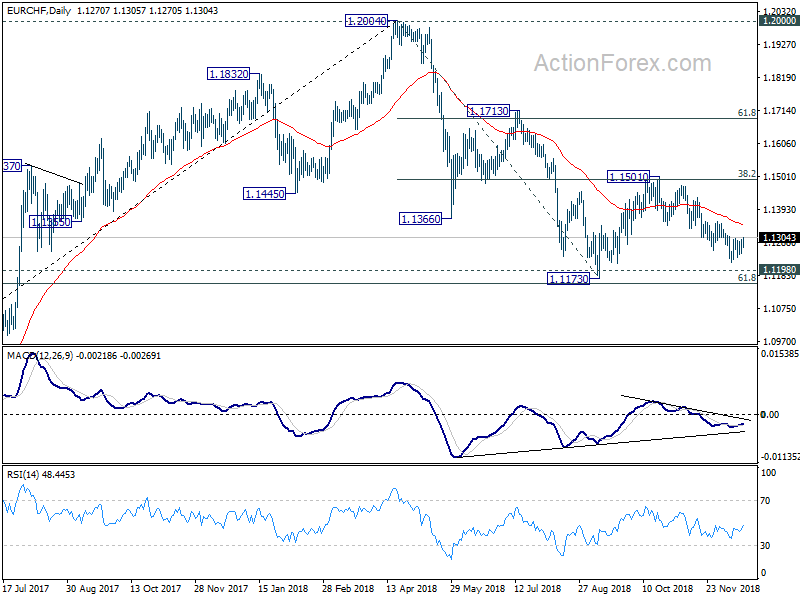

In the bigger picture, price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.