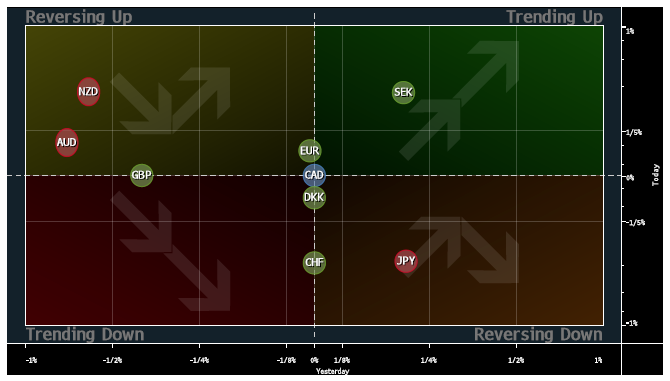

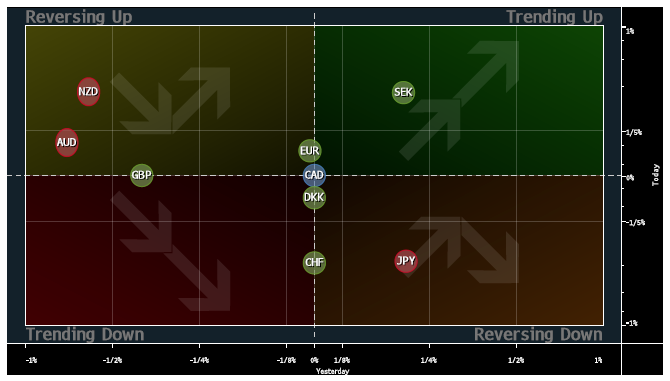

Currencies

Indices

09:00 GMT

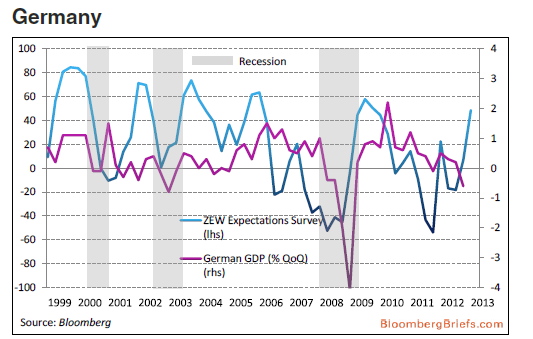

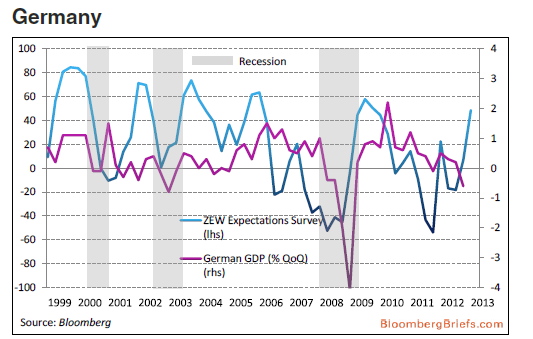

EUR – German ZEW Economic Sentiment

Earnings

by Naeem Aslam

- EUR/USD- the pair has broken its downward trend line. The RSI is showing that the bias could be to the upside.

- USD/JPY- the price fell from its resistance level on a 30 minute time frame. This resistance level was given in our analysis on Friday. The RSI is showing bias could be to the downside.

- GBP/USD- the price action has bounced from its support zone. The RSI suggests bias could be towards the upside.

Indices

- Asian Markets closed mixed. The Japan’s Nikkei built up further gains in the early hours of trading, but these gains were capped by a stronger yen later on during the session. The Nikkei index closed with a minor loss of 0.16%

- European stocks are returning to log further gains, ahead of an important economic data release. The FTSE MIB is leading the gains and is up by almost 0.61%.

- U.S. Indices logged another day of gain on Monday. The S&P500 recorded its another record close and finished the day with a gain of 0.02%

- European officials finished their meeting on a positive note, by approving the first emergency aid payment for Cyprus and Greece .

- David Cameron, British Prime Minister confirmed that he will back a bill authorizing the referendum by 2017 to decide Britain’s future in the EU

- The Yen came back from its four years low against the dollar.

- You can be wrong in trading and you will be but, you cannot afford to be stubborn.

- Gold has made a comeback on the back of a weaker dollar on Tuesday after three continuous down sessions.

- Oil - The black gold is in a sideways pattern on a 30 minute time frame.

- VIX - Volatility index dropped by -0.32% yesterday.

09:00 GMT

EUR – German ZEW Economic Sentiment

Earnings

- Intesa

- Banc pop

by Naeem Aslam