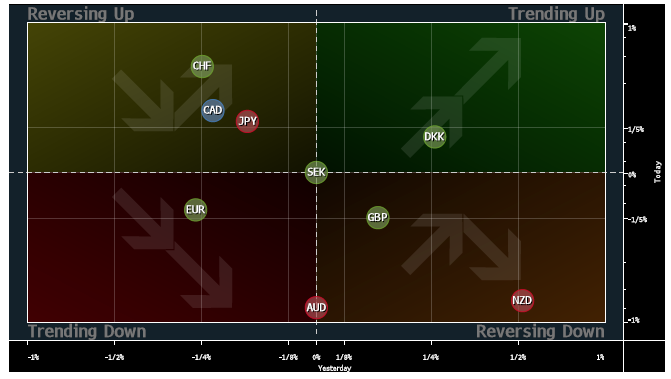

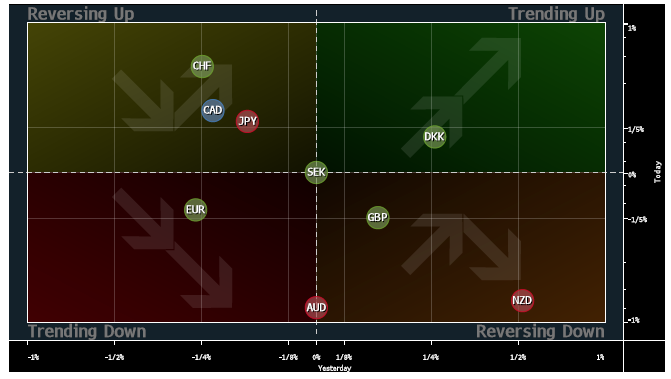

Currencies

12:30 GMT

DISCLOSURE & DISCLAIMER:

- EUR/USD- the pair has bounced from its support on a 30 minute time frame. The RSI is showing that the bias could be to the upside.

- USD/JPY- the price is trading in a bullish channel on a 30 minute time frame. The RSI is showing bias could be to the downside.

- GBP/USD- the price action is trading in downward channel a 30 minute time frame. RSI suggests bias could be towards the upside.

- Asian Markets closed mostly up today. The Nikkei index took a breather from its record highs, and closed with a loss of -0.39%

- European stocks are also trading off their highs which they made yesterday. The IBEX is leading the losses and it is down by almost -0.37%.

- U.S. Indices logged another day of record gains yesterday. The S&P500 closed with a gain of 0.52%

- Japanese economic data released today showed that the country’s economy grew at an annualized rate of 3.5% per quarter.

- George Osborne confirmed yesterday that he is sticking to his budget consolidation plan for the British economy.

- The Economic Research Department in Ireland have increased their forecast for the country’s economic growth for this year.

- Never move your stops in a losing position.

- Gold has broken the key level of $1400 yesterday and it is trading below the 50 day and 100 day moving average.

- Oil - The black gold has broken the ascending triangle pattern to the downside on a 30 minute time frame. The demand for the crude oil remains low

- VIX - Volatility index increased by 0.31% yesterday.

12:30 GMT

USD - Building Permits

12:30 GMT

USD - Core CPI m/m

12:30 GMT

USD - Unemployment Claims

14:00 GMT

USD - Philly Fed Manufacturing Index

14:30 GMT

USD - Natural Gas Storage

Earnings

- Walmart

DISCLOSURE & DISCLAIMER:

The Above Is For Informational Purposes Only And Not To Be Construed As Specific Trading Advice. Responsibility For Trade Decisions Is Solely With The Reader.

BY Naeem Aslam