Daily Briefing

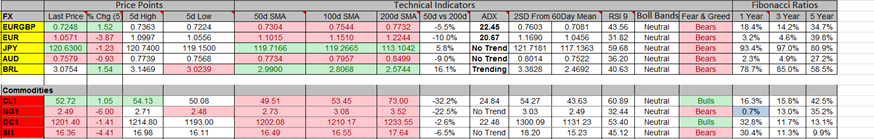

Currencies

- EUR/USD: The pair is trading near the support zone (1.0732-1.0711) on a 30 minute time frame. The next resistance is at 1.108 and the support is at 1.071.

- USD/JPY: The pair is in a correction mode on a 30 minute time frame. The next support is at 118.38 and resistance at 121.18

- GBP/USD: The pair is trading below its downward trend line on a 30 minute time frame. The resistance is near the 1.4846 and support is at 1.4526

Indicator

Indices

- Asian Markets closed mostly lower by erasing some of their gains from yesterday. The Hang Seng index was the worst performing index during the session and it closed lower with a loss of 1.63%. The index is up nearly by 10.36% in the past 5 days.

- European indices futures are trading lower during the early hours of trading. The FTSE MIB index is the worst performing index during the session and it is trading lower with a loss of 1.26%. The index is up by almost 3.05% in the past 5 days.

- US futures are also trading lower ahead of the economic data. Most indices closed lower during the last session and the Dow index was the worst performer with a loss of 0.45%.

TOP News

- The Chinese new home sales data came in at 1180B while the forecast was for 1050B.

- The UK PPI data came in much better than the forecast of -0.5%. The reading was at 0.3%.

- The UK CPI y/y data matched the forecast of 0.0%.

Things to Remember

Stop loss is your biggest friend so make sure you use it

Market Sentiment

- Gold: The precious metal is trading below the 1200 level on a 30 minute time frame. The next support is near the 1180 and the next resistance is near the 1240.

- Crude Oil: The black gold has spiked up on a 30 minute time frame. The near term support is at the $51.50 mark and the resistance is at 54.

- VIX: Volatility index dropped nearly -3.90% on the last trading day.

News Agenda For Today

08:30 GMT

GBP – CPI y/y

12:30 GMT

USD – Core Retail Sales m/m, USD – PPI m/m

USD – Retail Sales m/m

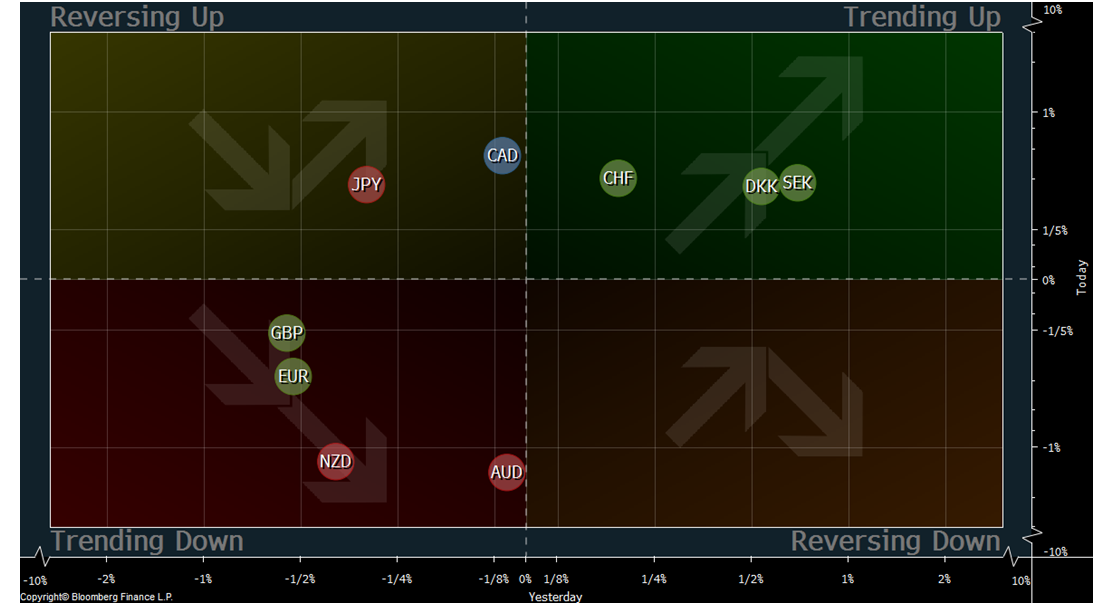

Trends

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.