Asian markets slid on Thursday as anxiety grew ahead of Friday’s European Summit. The Nikkei dropped .7% to 8645, pulling back from a 1-month high. The Kospi slipped .4% after the Bank of Korea held interest rates at 3.25%, and Australia’s ASX 200 declined .3%. China’s Shanghai Composite largely recovered from an earlier drop, closing down .1%, and the Hang Seng shed .7%.

European markets tumbled after ECB President Mario Draghi said the region’s economy faced significant risks, while offering no new bond purchase plan. The central bank cut interest rates to 1% from 1.25%. The CAC40 dropped 2.5%, the DAX lost 2%, and the FTSE fell 1.1%, with financials leading the declines. The European Banking Index closed down 3.1%.

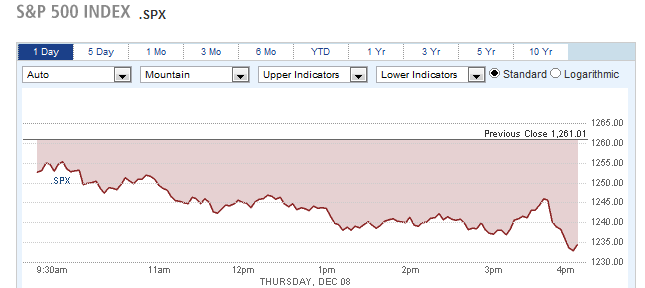

US stocks posted similar losses. The Dow fell 199 points to 11998, the S&P 500 skidded 2.1%, and the Nasdaq lost 2%. Selling accelerated in the last few minutes of the day after Germany rejected a draft proposal for the EU summit, casting doubts on the outcome of Friday’s meeting. The ongoing debate over whether to introduce stiffer budgetary requirements, or strengthen the bailout mechanisms, does not appear close to resolution.

S&P 500 Falls 2.1%

Despite earnings reports which exceeded estimates, Costco fell 2% and Smithfield Foods dropped 3.7%.

Currencies

The currency markets shunned risk on Thursday, pressuring the Australian and Canadian Dollar. The Australian Dollar fell 1.2% to 1.0168, and the Canadian Dollar dropped 1.3% to 1.0218. The Pound and Euro both lost .5% to 1.3348 and 1.5638 respectively, while the Yen closed flat at 77.67.

Economic Outlook

Weekly jobless claims were far better than expected, dropping by 23K to 381K. Wholesale inventories rose by 1.6%, more than forecast, posting their biggest gain in 5 months.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Analysis – Stocks Tumble on ECB Disappointment

Published 12/09/2011, 06:02 AM

Updated 05/14/2017, 06:45 AM

Daily Analysis – Stocks Tumble on ECB Disappointment

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.