D.R. Horton, Inc. (NYSE:DHI) came up with yet another stellar show in the third quarter of fiscal 2017. Both earnings and revenues beat the Zacks Consensus Estimate courtesy of a solid housing market scenario. The Texas-based homebuilder’s order trends remained strong in the quarter.

Earnings & Revenue Discussion

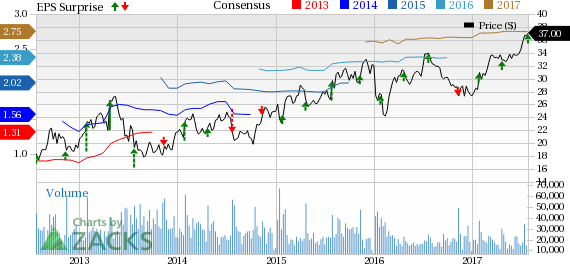

The company reported earnings of 76 cents per share, beating the Zacks Consensus Estimate of 75 cents by a penny. Earnings also increased 15.2% year over year driven by higher home sales.

Total revenue (homebuilding and financial services) of $3.78 billion beat the Zacks Consensus Estimate of $3.71 billion by 5.2%. Total revenue also increased 16.8% year over year.

Home Closings and Orders

Homebuilding revenues of $3.68 billion increased 17% year over year. Home sales increased 17.4% year over year to $3.66 billion, aided by higher home deliveries. Land/lot sales and other revenues were $22.2 million, down from $30.1 million a year ago.

Home closings increased 16% to 12,497 homes, while in value it increased 17%. The company registered growth across all the regions comprising East, Midwest, Southeast, South Central, Southwest and West.

Net sales orders rose 11% to 13,040 homes on continued improvement. Orders increased across all operating regions. The value of net orders grew 13% to $3.9 billion. Cancellation rate of 21% is the same as it was in the year-ago quarter..

The quarter-end sales order backlog (under contract) rose 3% to 15,161 homes. Backlog value increased 6% to $4.6 billion.

Revenues at the financial services segment increased 10.6% to $91.9 million.

Margins

Gross profit on home sales was $725.4 million, increasing 14.7% year over year. However, gross margin on home sales contracted 50 basis points (bps) year over year to 19.8%.

Homebuilding selling, general and administrative expenses (SG&A) were $309.5 million, reflecting an increase of 10.8% from the prior-year quarter. SG&A expenses, as a percentage of homebuilding revenues, were 8.4%, down 50 bps year over year.

Homebuilding pre-tax income rose 19.2% year over year to $415.2 million.

Consolidated pre-tax income was $444.5 million in the quarter, increasing 17% year over year. Pre-tax profit margin expanded 10 bps year over year to 11.8%.

Balance Sheet

D.R. Horton’s homebuilding cash, cash equivalents and restricted cash totaled $471.7 million as of Jun 30, 2017, compared with $1,281.3 million as of Sep 30, 2016.

Zacks Rank

D.R. Horton carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Release

PulteGroup Inc.’s (NYSE:PHM) second-quarter 2017 adjusted earnings of 47 cents per share beat the Zacks Consensus Estimate of 45 cents by 4.4%. Also, quarterly earnings reflected a solid 27% jump from the year-ago quarter’s adjusted figure of 37 cents (read more: PulteGroup Q2 Earnings & Revenues Beat, Backlog Strong).

NVR, Inc. (NYSE:NVR) , one of the country’s largest homebuilding and mortgage-banking companies, reported second-quarter 2017 earnings of $35.19 per share, surpassing the Zacks Consensus Estimate of $28.63 by 22.9%.

Upcoming Peer Release

Masco Corporation (NYSE:MAS) is slated to release its quarterly results on Jul 27. The Zacks Consensus Estimate for earnings is pegged at 60 cents, reflecting an increase of 29.8% year over year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Masco Corporation (MAS): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post

Zacks Investment Research