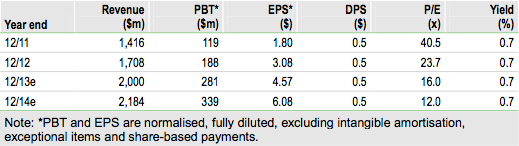

At the Q1 results Cytec highlighted that despite a difficult trading environment in certain markets (such as Industrial Materials in Europe), the refocusing of the group following the disposal of Coating Resins is set to bring greater clarity to drive operational performance. With the group restructured into market facing divisions following the integration of Umeco, the opportunity for significant value creation exists, and as the difficult Q112 comparators recede throughout the year and activity picks up, we remain confident that Cytec will deliver quarterly earnings progression for the remainder of the year. Given current market conditions, combined with slightly higher forecast interest and tax, we are easing our FY13 forecast to $4.57/share.

Modest Start To 2013 As Expected

Q1 results reflected the combination of a tough comparator period in Aerospace Materials, weakness in European Industrial markets and timing challenges in In- Process Separation. Despite this, Q1 net sales from continuing operations rose by 26% to $477m, while adjusted earnings from continuing operations were $34.2m, equating to $0.75 per diluted share, a rise of 15%. Due to a slightly weaker outlook in Industrial Materials and higher forecast interest and tax, we are easing our FY13 EPS estimates by 5% to $4.57/share.

Long-Term Strategy Expected To Pay Off

As set out in our recent initiation note, we anticipate that Cytec’s focus on growth markets in which it has a leading position is set to drive returns over the short-, medium-, and long-term. Near term drivers such as Aerospace are augmented by growing use of the group’s composite materials in areas such as automotive and the recovery in the wind energy market, while through In-Process Separation, the group has unique expertise in mining process chemicals. Some short-term volatility may be expected in Industrial Materials due to ongoing economic woes in Europe, we believe that the long-term potential from these markets is significant.

Valuation: Value Opportunity Remains

Given the new divisional structure, softer outlook in industrial markets and increased assumed tax rate, our 2013 sum-of-the-parts (SOTP) eases to $88/share. We remain convinced that a 2014 basis SOTP better reflects the ongoing “new Cytec” and this yields a fair value of $94/share, with further value uplift to come as industrial markets recover and build rates increase in Aerospace.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cytec Industries

Modest Q1, Accelerating Growth Through 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.