As predicted in our weekly analysis, the Asian stocks markets did indeed come tumbling down at the start of the trading week over the shocking Cyprus Bailout levy. Asian stocks declined more than any other trading session in the last eight months The EU will also pay a further EUR10billion to help the troubled tiny nation. Cyprus had a lot of investments in Greece when the crash happened, prompting a near bankrupt status. News of the bailout caused local bank customers to run to the cash machines and draw as much of their funds as possible.

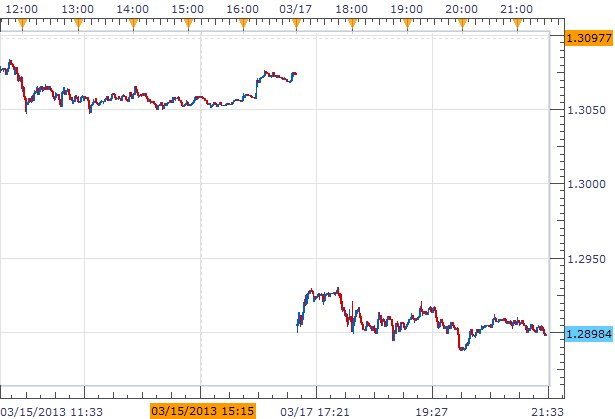

EUR/USD 1 minute chart post Cyprus bailout" title="EUR/USD 1 minute chart post Cyprus bailout" width="615" height="419" />

EUR/USD 1 minute chart post Cyprus bailout" title="EUR/USD 1 minute chart post Cyprus bailout" width="615" height="419" />

In all of the bailout requests to the EU, including Greece, Spain, Portugal and the Republic of Ireland, this is the first time money has come directly from the nationals.

The plan, which was delayed without any form of announcement or explanation, has the support of the new President of Cyprus Nicos Anastaisades.

This is how the Cyprus Bailout deal works:

Asian stocks tumbled in overnight trading with the Nikkei 225 shedding a huge 2.7 per cent. The Hang Sheng in Hong Kong was down 2.2 per cent to close at -2per cent, and the ASX200 in Australia lost 2.1per cent. Investors move away from stocks and the EUR to safe haven assets such as the dollar and yen.

Forex

The dollar had a field day during the Asian session, as investors moved quickly away from the euro. The EUR was down against the GBP by 1.29 per cent ,and obviously against the USD at a 3 month low – by 1.37 per cent. The USD also did well against the AUD, rising 0.45 per cent and the CAD with a gain of 0.41per cent, although the dollar was down against the YEN.

Commodities

Gold rose 0.21 per cent touching 1600 troy ounce before stabilizing at 1596, while Silver lost 0.59per cent and copper 2.35 per cent as the dollar got stronger. Crude oil dropped after news that oil production was increased by Saudi Arabia and Iraq in January. Natural gas further gained on ad supply data and weather outlooks.

Today

A riveting session today for binary options traders, especially in the European trading session. Not many economic events today. Expect the EUR/USD to continue dropping, even to 1.2750 and the same for Euro Stocks.

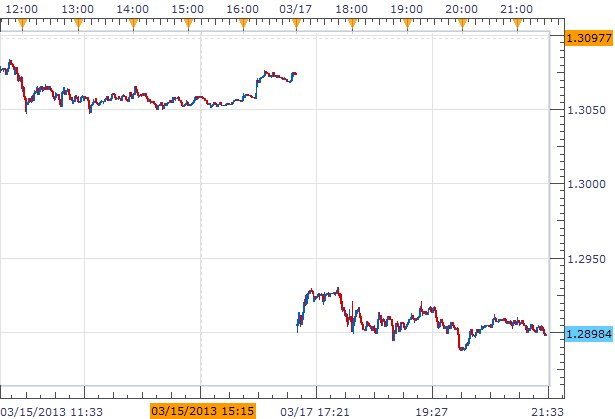

EUR/USD 1 minute chart post Cyprus bailout" title="EUR/USD 1 minute chart post Cyprus bailout" width="615" height="419" />

EUR/USD 1 minute chart post Cyprus bailout" title="EUR/USD 1 minute chart post Cyprus bailout" width="615" height="419" />In all of the bailout requests to the EU, including Greece, Spain, Portugal and the Republic of Ireland, this is the first time money has come directly from the nationals.

The plan, which was delayed without any form of announcement or explanation, has the support of the new President of Cyprus Nicos Anastaisades.

This is how the Cyprus Bailout deal works:

- People with under EUR100,000 in their account pay 6.75%

- People with over EUR100,000 in their account pay 9.9%

- In return, depositors will be given shares to the value of the levy in the bank

Asian stocks tumbled in overnight trading with the Nikkei 225 shedding a huge 2.7 per cent. The Hang Sheng in Hong Kong was down 2.2 per cent to close at -2per cent, and the ASX200 in Australia lost 2.1per cent. Investors move away from stocks and the EUR to safe haven assets such as the dollar and yen.

Forex

The dollar had a field day during the Asian session, as investors moved quickly away from the euro. The EUR was down against the GBP by 1.29 per cent ,and obviously against the USD at a 3 month low – by 1.37 per cent. The USD also did well against the AUD, rising 0.45 per cent and the CAD with a gain of 0.41per cent, although the dollar was down against the YEN.

Commodities

Gold rose 0.21 per cent touching 1600 troy ounce before stabilizing at 1596, while Silver lost 0.59per cent and copper 2.35 per cent as the dollar got stronger. Crude oil dropped after news that oil production was increased by Saudi Arabia and Iraq in January. Natural gas further gained on ad supply data and weather outlooks.

Today

A riveting session today for binary options traders, especially in the European trading session. Not many economic events today. Expect the EUR/USD to continue dropping, even to 1.2750 and the same for Euro Stocks.