The Fed and other central banks are actively adding to the punch bowl and markets embrace the hunt-for-yield as long as this is the case. The TRY performance after the recent 425bp cut is the case-in-point for changing liquidity conditions.

Next week, the Fed can either remove or push markets closer to a H2 cyclical recovery. In the positive outcome, we see plenty of potential upside left in the CAD, AUD, NZD and Scandies against the USD. EUR/USD is also set to benefit but likely with a lower beta.

When punch bowl is being filled, just go with it

In FX Edge - H2 reflation set to drive high-beta currencies, support risk, 15 July 2019, we argued cross-asset moves are clearly showing a turning point around late May to early June. Yesterday, Turkey cut its one-week repo rate by 425bp and the TRY strengthened afterwards. It is worth reflecting on how this could even come about as it would have been unthinkable only a few months ago. To us, this clearly shows how sentiment towards EM has pivoted with central banks' signals of easing.

G10 high-beta FX is far from fully priced for macro rebound

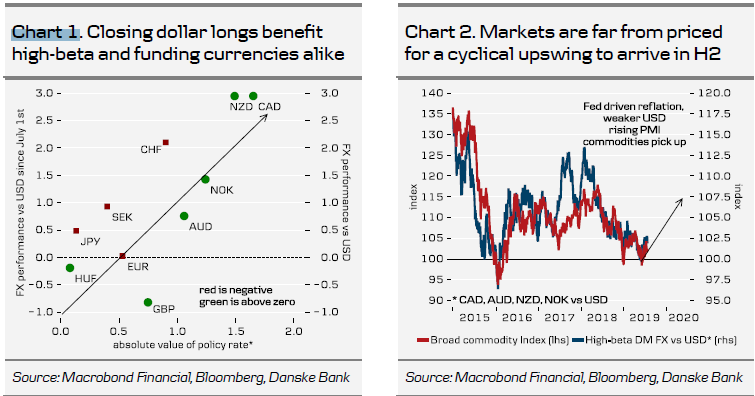

At the moment, we are seeing a near-linear relation between the carry element and its performance versus the USD since July. Though yields are meant to compensate for real risk, such is ignored when central banks are easing. For the negative yielders (SEK, CHF), there also appears to be somewhat of a short-squeeze in closing down USD-funding positions but tempered broad USD benefits both as well.

We expect a falling broad USD, rising commodities and ultimately rising activity levels to reinforce themselves in H2 and these are the key risk factors to drive profitable risk taking.

Should the Fed start reining in on the dovish pricing, dollar strength would materially and negatively affect the 3-6M outlook for DM and EM alike.

We expect the punch-bowl to keep being refilled and the CAD, AUD, NZD and NOK particularly stand to gain from the current market pricing, as the cyclical repricing appears to still be rather modest.