Summary

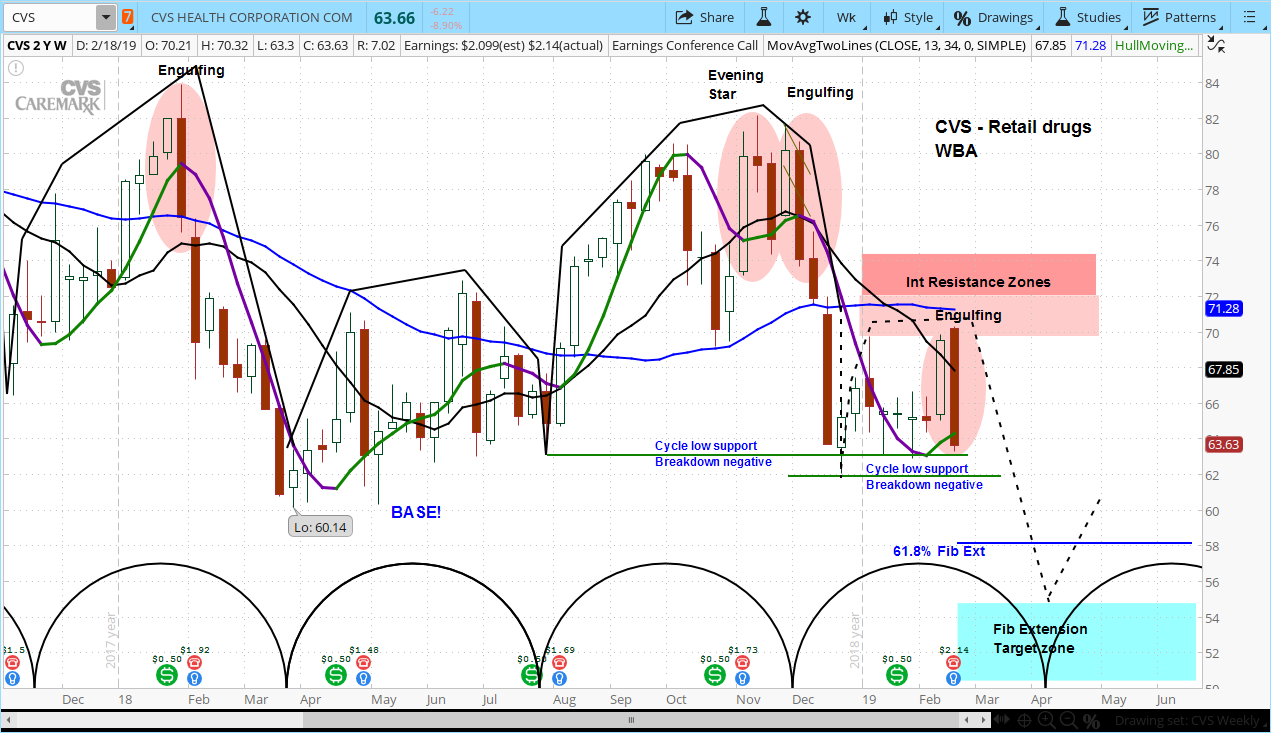

CVS Health (CVS) Stock Weekly Chart

The retail pharmacy company reported earnings per share of $2.14 and total revenue of $54.4 billion, compared to analyst estimates of $2.09 and $54.6 billion. For the current year, management expects earnings of $6.68-6.88, below the consensus of $7.41 per share.

CEO Larry Merlo cautioned that, “This will be a year of transition as we integrate Aetna (NYSE:AET) and focus on key pillars of our growth strategy. We are aware of the need to address the impact of headwinds that exerting a disproportionate impact.”

In analyzing the market cycles for CVS, we can see it is likely now in the declining phase of its current cycle. The stock had a negative intermediate cycle pattern and failed in resistance. Our projection is for the stock to fall to $58, and as low as $55 by late March.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.