Options Traders, Analysts Optimistic On CVS

CVS Health (NYSE:CVS) stock is 0.8% higher at $65.85 in today's trading as investors gear up for the drugstore giant's second-quarter earnings report, scheduled for before the market opens, tomorrow, Aug. 8. Below, we will take a look at how CVS has been faring on the charts, and what the options market is pricing in for the stock's post-earnings moves.

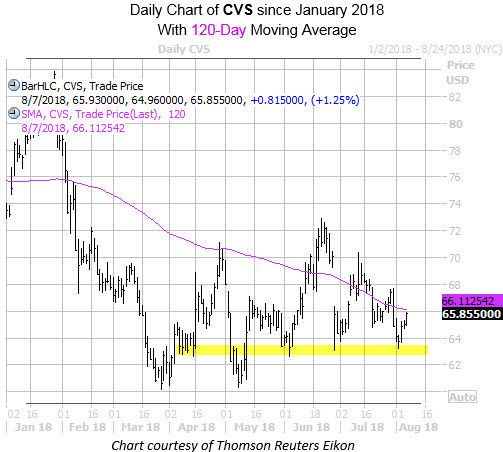

Start with technicals, CVS Health has been on a downtrend since hitting a year-to-date peak in late January and more recently has been stuck in a series lower highs. More recently, losses have been limited by a floor of support found at the $63 mark and today's breakout attempt has been capped by the 120-day moving average – a trendline that has acted as a ceiling of resistance for the shares in the past.

Looking toward earnings, CVS has closed lower the day after the company reports in six of the last eight quarters, including the last five in a row. Looking back eight quarters, the shares have moved 4.1% the day after earnings, on average, regardless of direction. This time around, the options market is pricing in a slightly larger-than-usual 6% move for tomorrow's trading.

Options traders have been leaning bullish on the drugstore chain ahead of earnings. This is per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), showing CVS Health stock with a 10-day call/put volume ratio of 2.52, ranking in the 77th percentile of its annual range. This shows that during the past two weeks of trading, calls have been bought over puts at a faster-than-usual clip.

Analysts are echoing this optimistic sentiment toward the security. Of the 15 brokerage firms covering the stock, 12 sport "buy" or "strong buy" recommendations. Plus, the stock's average 12-month price target comes in at a more than 30% premium to current levels.

Lastly, short interest on CVS Health rose 7% during the most recent reporting period, and now represents nearly 5% of the stock's total available float. At the average daily trading volume, it would take well over a week for shorts to cover their bearish bets.