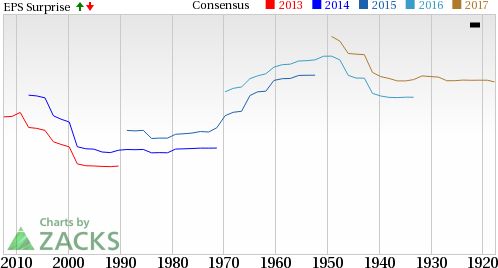

CVR Partners (NYSE:UAN) posted a loss of $3.5 million or 3 cents per share in the second quarter of 2017, lower than a loss of $17 million or 15 cents per share it logged a year ago. The reported loss per share was lower than the Zacks Consensus Estimate of a loss of 4 cents. The bottom line in the reported quarter was supported by the company’s cost management actions.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $32.3 million in the reported quarter, up from $29.1 million recorded a year ago.

Cost of sales fell roughly 26% year over year to $79.9 million in the reported quarter.

The company posted revenues of $97.9 million in the second quarter, down roughly 18% from $119.8 million recorded a year ago.

Operational Statistics

CVR Partners produced 215,300 tons of ammonia in the quarter of which 77,500 net tons were available for sale while the rest was upgraded to other fertilizers including 313,800 tons of urea ammonium nitrate (“UAN”).

Consolidated average realized gate prices for UAN and ammonia were $174 and $333 per ton, respectively, in the reported quarter, down 13% and 20% year over year, respectively.

The company’s East Dubuque fertilizer facility achieved high on-stream rates during the quarter with the ammonia plant attaining a record on-stream rate of 100%.

Financials

CVR Partners ended the quarter with cash and cash equivalents of $51.7 million, down around 32% year over year. Total debt was $624.5 million, essentially flat year over year.

The company noted that it will not pay a cash distribution for second-quarter 2017.

Outlook

CVR Partners said that nitrogen prices remain affected by additional production, in particular, in the U.S. The remaining large U.S. capacity expansions are expected to come on stream and enter production during the third quarter of 2017. The company will remain focused on operating its facilities at high on-stream rates and increasing its marketing and logistics efforts while managing costs and capital spending.

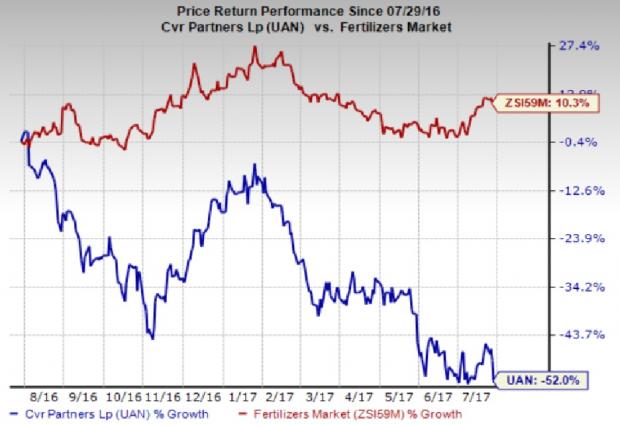

Price Performance

CVR Partners’ shares have lost 52% over the past year, underperforming the 10.3% gain of the industry it belongs to.

Zacks Rank & Key Picks

CVR Partners currently carries a Zacks Rank #3 (Hold).

Better-placed companies in the basic materials space include The Chemours Company (NYSE:CC) , Kronos Worldwide, Inc. (NYSE:KRO) and BASF SE (OTC:BASFY) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth of 15.5%.

Kronos has an expected earnings growth of 396.8% for the current year.

BASF has an expected long-term earnings growth of 8.8%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

CVR Partners, LP (UAN): Free Stock Analysis Report

Original post

Zacks Investment Research