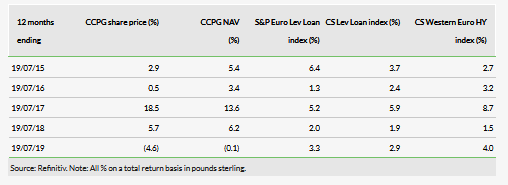

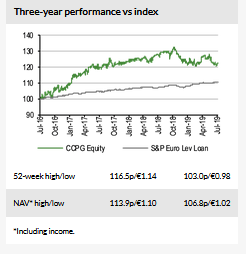

CVC Credit Partners European Opportunities (CCPEOL) aims to achieve a blend of capital growth and income (it targets gross total returns of 8–12% pa, with c 5pp from income). The portfolio is positioned defensively, mainly in senior secured debt of large issuers (average EBITDA above €500m) from Western Europe. Long-term NAV net total return (TR) performance remains broadly intact at 6.4% pa over three years (vs SP ELLI at 3.5% pa), despite weaker performance during the Q418 downturn. Currently both share classes offer a dividend yield in excess of 5%, largely covered by coupon income according to our estimates.

Portfolio developments: Increasing current yield

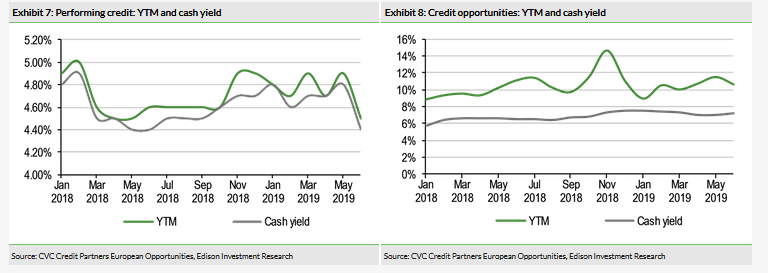

CCPEOL invests through CVC European Credit Opportunities (CEC) into two pools of assets: performing credit representing mainly senior secured loans from large and liquid European issuers and credit opportunities of assets priced below par with recovery potential. The portfolio manager has been taking advantage of the recent increase in high yield bond prices, shifting the allocation to primary performing credit, which currently offers more attractive spreads. This has helped to increase the yield of the portfolio to 6.1% at end-June 2019 from 5.8% in September 2018. CEC retained its defensive positioning, with 89% of the portfolio allocated to senior secured assets at end-June 2019.

Market outlook: Low interest rates to stay longer

The concerns over political tensions and global economic slowdown that triggered the late-2018 deterioration of market sentiment remain in place. However, the credit market’s performance should be supported by central banks’ recent dovish announcements suggesting a continuation in accommodative monetary policy. Although we note a degree of weakening credit quality as illustrated by the high proportion of covenant-lite debt, we also note that default rates remain at historically low levels and a corporate debt maturity cliff is not expected till 2024-2025.

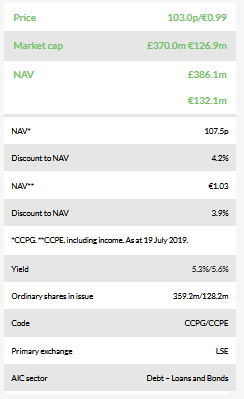

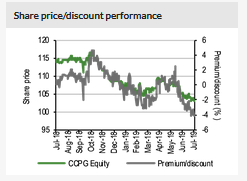

Valuation: Trading close to NAV, assisted by 5% yield

Both CCPEOL share classes have traded close to NAV on average since the fund was launched in June 2013. Following the Q418 sell-off, the discount widened slightly and currently stands at 4.2% for CCPG shares and 3.9% for CCPE. CCPEOL offers an above 5% dividend yield, which is largely covered by coupon income.

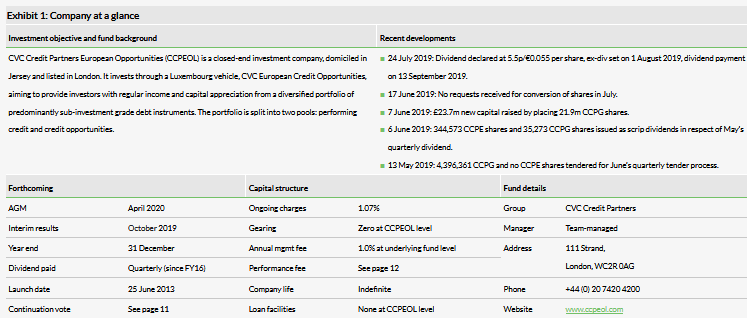

Fund profile: Daily traded fund with senior loans focus

CVC Credit Partners European Opportunities (CCPEOL) was launched in June 2013 and is a Jersey-domiciled, London-listed closed-end investment company with a focus on opportunities in leveraged credit. It invests in a Luxembourg-based investment vehicle, CVC European Credit Opportunities fund (CEC, or ‘the investment vehicle’) via preferred equity certificates (PECs). CEC was set up in 2009 and is an open-ended fund managed by CVC Credit Partners (the investment manager). CVC Credit Partners is a subsidiary of CVC Capital Partners, a global investment manager with nearly US$75bn of assets under management as at March 2019, specialising in private equity and private debt.

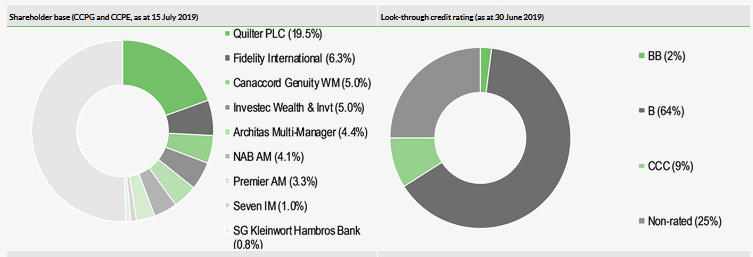

CCPEOL shares are quoted on the London Stock Exchange giving investors indirect access to the vehicle and providing daily pricing and liquidity. Two classes of share are quoted: sterling (CCPG) and euro (CCPE) with a monthly conversion facility between them. One euro-denominated share holds one voting right, whereas one sterling share holds 1.17 voting rights reflecting the £/€ exchange rate at inception. CCPEOL provides the majority of capital managed by CEC, with the structure allowing for a capped number of external investors to invest directly into CEC (usually at a minimum investment of €5m). As at 28 February 2019, all issued interests were valued at a total of €809m, of which €562m was attributable to CCPEOL and €200m to CVC persons. CCPEOL offers investors a quarterly tender facility by which investors can realise up to 24.99% of their investment (subject to an annual 50% maximum) at a price close to NAV. Moreover, CCPEOL may issue shares to meet the additional demand in the market. These facilities result in the fund trading historically close to NAV since launch. CCPEOL does not use gearing, but CEC can and does gear up to 100%. Currency exposure is hedged back to euros.

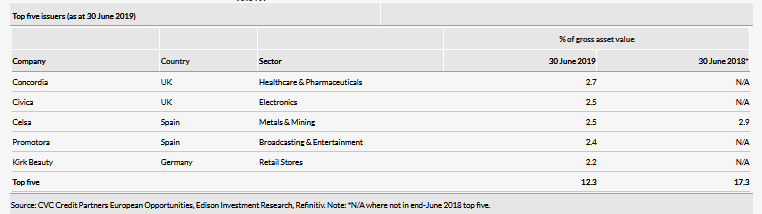

CVC Capital Partners has more than 250 investment professionals across 24 offices worldwide. The investment manager maintains a database of more than 4,000 credits from which it selects investment opportunities for its various portfolios on the basis of deep-dive fundamental analysis. CEC has an actively managed portfolio of sub-investment grade debt assets with annual turnover of c 100%, which also involves trading within an issuer’s debt structure (ie assets with different maturities, currencies and seniority). Its portfolio is divided into two main pools: performing credit (assets acquired at close to par with the intention of generating returns from recurring interest payments/coupons) and credit opportunities (discounted assets with revaluation potential). Returns come from a mixture of income and capital appreciation with target aggregate gross returns of 8–12% pa (4–7% pa from the performing portfolio and 7–20% pa from the credit opportunities portfolio), with around 5% pa expected from current income. The investment vehicle focuses mostly on assets that are senior in the capital structure of the issuer – first-lien loans and senior secured bonds (which currently represent 80% of NAV as at end-June 2019). The portfolio is skewed towards floating-rate assets and issuers domiciled (or having the majority of operations) in Western Europe. CEC invests in large-cap companies. These had a weighted average EBITDA of €513m at end-Q119, which we believe provides higher secondary liquidity and stronger credit fundamentals, leading to lower default rates in times of economic downturn.

A number of limits govern the construction of the investment vehicle portfolio:

- At least 50% of the portfolio must be in senior secured assets (this may include cash).

- At least 60% (70% until June 2018) must be in credits from issuers that are domiciled in or do most of their business in Western Europe.

- No more than 7.5% can be invested with a single issuer, subject to an exception whereby one issuer may make up 15% of the portfolio, as long as the holding is reduced to a maximum of 7.5% within 12 months of acquisition.

- No more than 7.5% of the portfolio may be invested in CLOs.

- The investment vehicle may borrow up to 100% of NAV; CCPEOL may borrow up to 15% of its NAV, but only for the purpose of purchasing or redeeming its own shares.

- Short positions may be used to offset industry-level risks to favoured issuers.

The manager’s view: Focus on fundamentals

The fund manager (CVC Credit Partners) believes that the current economic and financial markets outlook should translate into a significant amount of investment opportunities. The European economy remains robust (although growth prospects have weakened recently). Nonetheless, this environment should allow CEC to generate solid, stable risk-adjusted returns from the performing credit strategy. The continued accommodative monetary policy is likely to support low default rates, while supply of new credit is assisted by high corporate activity to finance growth and M&A. This includes in particular large-cap companies backed by private equity funds that have large amounts of investible capital at their disposal. At the same time capital requirements for banks should remain stringent, encouraging them to sell loans and thus remove them from their balance sheets. This should support the ongoing shift in leveraged loan market dominance from banks to institutional investors. The growing popularity of CLOs represents a source of market stability given their locked-up structures, which entails a buy-and-hold strategy being applied to a significant part of their portfolios. The scheduled departure of Mario Draghi as ECB president in October 2019 may have an effect on markets, should his successor indicate any radical changes in policy (although at present this is not expected).

The investment manager points out that the increase in covenant-lite debt should not adversely affect liquid sub-investment grade credit. Liquid sub-investment grade credit has always been relatively ‘covenant-lite’, and restrictive covenants would be more of an indication of fundamental weakness in the borrower. Having said that, reduced lender protections and higher leverage (fuelled by low interest rates) do present higher risks to investors across the broader credit investments spectrum. CVC Credit Partners recognises that this will translate into increased default risk once interest rates start to rise and loans approach their maturity (and thus will require refinancing). In this scenario, CEC should still achieve a steady and attractive investment pipeline for its credit opportunities portfolio as the market responds to the distressed nature of the underlying issuers. This is due to its flexible approach, covering both performing credit and credit opportunities, which means the fund is well placed to benefit from any market shocks causing downward pressure on loan prices.

Market outlook: Cheap money still readily available

The global economy has entered a slowdown phase, with central banks expecting a relatively subdued growth rate in the coming years. The ECB forecasts 1.2% growth of the euro area economy in 2019 (from 1.9% in 2018) and 1.4% in 2020–21 (following a recent downgrade). Similarly, the Federal Reserve expects the US economy to post 2.1% growth in 2019 (from 2.9% in 2018), which subsequently decelerates to 1.9% in 2020 and 1.8% in 2021. The markets are eyeing the tensions in international trade as one of the factors limiting growth.

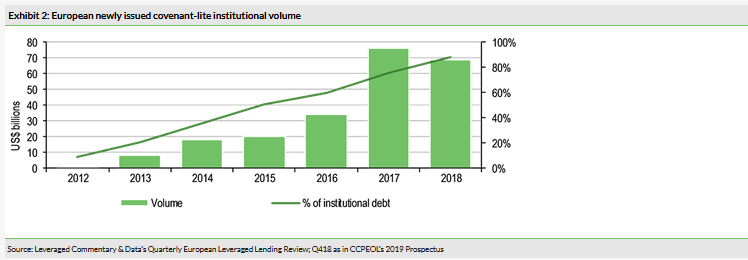

However, the slower growth has, so far, not resulted in higher corporate default rates, which have remained at low levels over the last 12 months in both the US and the European loan markets. According to Moody’s, the default rate in advanced economies fell to 1.6% in 2018 from 2.3% in 2017. At the same time, the default rate in the European leveraged loans market reached 0% in the second half of 2018 according to S&P, which may have been stimulated by the prevalence of covenant-lite loans. These represented well above 70% of newly issued institutional debt in 2017 and 2018. We are wary of the fact that we may be currently approaching the end of the credit cycle and that at some stage default rates should increase, with the dominance of covenant-lite loans translating into lower recovery rates. Having said that, loose covenants coupled with relatively distant maturity dates mean that this is less likely in the near term.

Dovish statements from major central banks to delay monetary tightening may support a longer environment with low default rates and tighter spreads upon loan refinancing, which is already reflected in the solid performance of credit markets over last weeks. The ECB announced in June 2019 that it intends to further stimulate the economy and drive inflation closer to its target of 2%. ECB President Mario Draghi specifically mentioned a fresh expansion of the bank’s €2.6tn quantitative easing programme coupled with rate cuts and the markets expect a continuation of the ECB’s current policy despite Draghi’s departure in October 2019. At the same time, the Fed cancelled its balance-sheet reduction programme and the markets price in a 25bp rate cut on the next meeting (31 July 2019) with 100% probability and assign a 92% chance of a further 25bp cut until the end of the year.

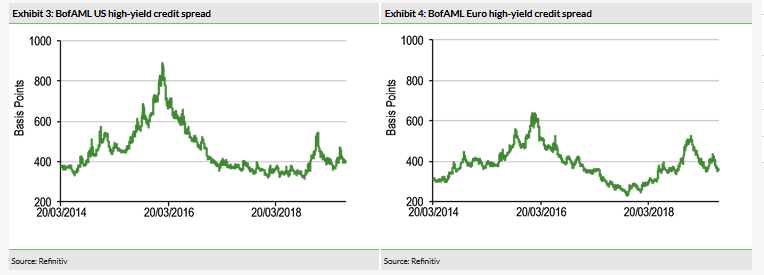

As the prospects of further rate hikes evaporated, investors started moving their capital into fixed-rate assets. According to Lipper, the week ending 3 July 2019 was the 33rd consecutive week with net outflow from US leveraged loan funds (US$18.3bn ytd), which was partially directed into fixed-rate high yield bonds posting a net inflow of US$12.8bn in the period. The high-yield credit spreads increased rapidly in Q418 reaching local peaks at 535bp in the US and 523bp in Europe, but have been narrowing ever since. Currently the spreads stand at around 402bp in the US, and 355bp in Europe. As a result, they are considerably below the 2016 peaks (over 800bp in US and over 600bp in Europe) and far from the 2008 credit crunch levels of over 2,000bp.

The current ‘cheap money era’ (which is likely to persist in the near term) results in a high degree of investible capital in private equity funds, which surpassed US$2tn (compared to c US$1tn in 2007–10), according to McKinsey (February 2019). Moreover, banks provide a steady supply of new leveraged loan investments as they remove loans from their balance sheets to meet the ever-tighter capital requirements. These factors promote growth of active debt markets and funds specialising in debt investments. Structured finance products are experiencing significant interest as well, with c 60% of total leveraged loans structured into collateralised loan obligations (CLOs) according to S&P.

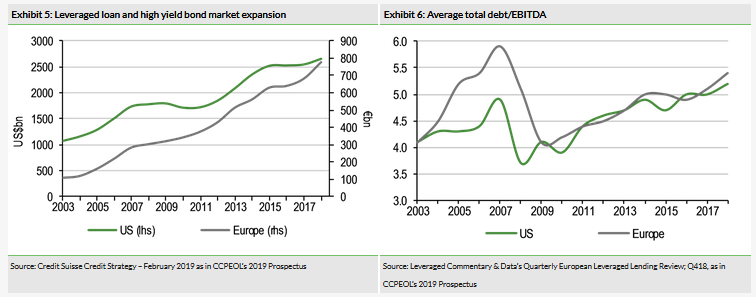

The high debt capital availability at historically low cost translated into the average issuer leverage reaching pre-crisis levels, with total debt to EBITDA at 5.2x in the US and 5.4x in Europe on average in 2018. This, together with the high proportion of covenant-lite loans (as discussed above), may be an indication of deteriorating credit quality. In this environment, prudent issuer selection becomes key. We believe that CVC Credit Partners is well positioned in this respect, given its large team of experienced investment professionals, extensive database of potential investments and in-depth fundamental approach.

During the first half of 2019, around €69bn of sub-investment grade debt was issued in Europe (down 29% y-o-y). The decrease was attributable both to loans (-34%) and bonds (-22%). At the same time, the spread on new issues remained at somewhat higher levels after increasing during H218 (benefiting players such as CEC). Term loan B’s new issue spreads in June 2019 were 391bp over Euribor on average, 16bp higher than in the corresponding period of last year.

Current portfolio positioning

Since the beginning of 2019, sub-investment grade credit markets rebounded significantly after the Q418 sell-off, only to offset part of year-to-date gains during the May shake-off fuelled by political risks concerning trade wars and Brexit. The primary credit market continues to price wider than in 2018 and CCPEOL’s investment manager is leveraging this to reallocate the performing credit portfolio at higher coupon rates, exiting positions that were trading close to historical highs (in particular fixed rate high-yield (HY) bonds benefiting from the perceived change in the Fed’s and ECB’s monetary policies).

As the latest market rebound was not uniform, the price recovery of CCPEOL’s credit opportunities pool was weaker than the performing credit portfolio. Simultaneously, the investment manager conducted opportunistic purchasing of credits that had sold off. Consequently, the average price of assets in the credit opportunities portfolio was 86.0% at end-June 2019 compared to an end-September 2018 level of 91.5%, providing scope for par building. This, together with the earlier mentioned purchases on the primary market, translated into an increase in current yield on the whole portfolio to 6.1% at end-June 2019 from 5.8% at end-September 2018.

At end-June 2019, the investment vehicle portfolio split was c 55% in performing credit and 45% in credit opportunities. Please note that performing credit includes cash, which stood at 8.9% of the portfolio. The proportion held in performing credit (net of cash) decreased to 46% from 52% in May 2019, returning to the 2018 average. Floating rate assets continue to represent the clear majority with an 85% share of the portfolio at end-June 2019, despite decreasing from 90% on average during 2018. Importantly, the investment manager was recently reducing its short positions, which were set up ahead of the market downturn (6.9% of portfolio in November 2018).