According to conventional wisdom, housing is a good investment…perhaps even a great investment.

Gallup conducts an annual poll asking a sample of Americans what they perceive to be the best long-term investment.

In the April 2014 poll, 24% of the respondents selected stocks/mutual funds. Gold also received 24% of the votes. Only 6% selected bonds, and 14% went with ultra-safe savings accounts/CDs.

Real estate was the clear winner with 30% of the votes.

Those with higher incomes were even more confident in the merits of real estate. Of respondents making $75,000 per year or more, 38% chose real estate as their favorite investment.

But what if I told you that housing was actually a poor long-term investment?

Whatever you do, don’t buy a house until you read this…

Famed economist Robert Shiller has shown that from 1890 to 1990, real U.S. home price appreciation was virtually zero.

In other words, house prices have historically generated returns that are in line with inflation.

But strictly looking at prices ignores the costs of homeownership.

In a whitepaper titled American Dream or American Obsession?, Wenli Li and Fang Yang examined the economic benefits and costs of homeownership. By making certain assumptions regarding depreciation (maintenance), property taxes, mortgage payments, and marginal income tax rates, they show that the actual real return of housing may be negative!

Granted, there are personal and social benefits to owning a home, and renting certainly isn’t free.

But why would real estate be viewed as the best investment by so many people? Naturally, because house prices have risen recently.

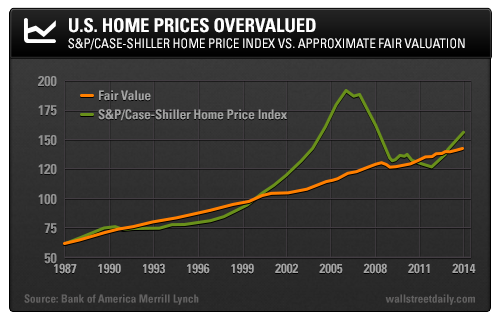

The following chart is from Business Insider’s The Most Important Charts in the World.

This fantastic chart puts the magnitude of the U.S. housing bubble into perspective and shows how prices have rebounded strongly in the past couple of years.

Interestingly, back in 2011, only 19% of respondents to the Gallup poll chose real estate as their pick for the best-performing long-term investment.

Now that prices have risen nationally, more people are bullish on housing. But as you can see, the S&P/Case-Shiller House Price Index tends to oscillate around fair value, which is estimated using household income.

Prices have once again risen above fair value. Michelle Meyer, Senior U.S. Economist at Bank of America Merrill Lynch, notes:

“The gain in home prices since 2012 has reversed nearly half of the cumulative decline during the downturn. Indeed, home prices have grown at a faster rate than income, leaving prices marginally overvalued. Without the return of easy credit, we think prices will have to converge back to the trend in income. This suggests that home price appreciation is set to slow. Double-digit home price appreciation is not sustainable.”

Put another way, any further price increases we see from here will likely lead to even lower expected returns for buyers.

Basically, now is not an optimal time to buy a home in most parts of the country.

Furthermore, unless you have a knack for identifying undervalued properties (very few actually do), then you probably won’t earn a positive real rate of return on your primary residences over the course of your life.

Conventional wisdom is wrong. A diversified portfolio of stocks and bonds is the best long-term investment – hands down.

Safe investing,

BY Alan Gula, CFA

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.