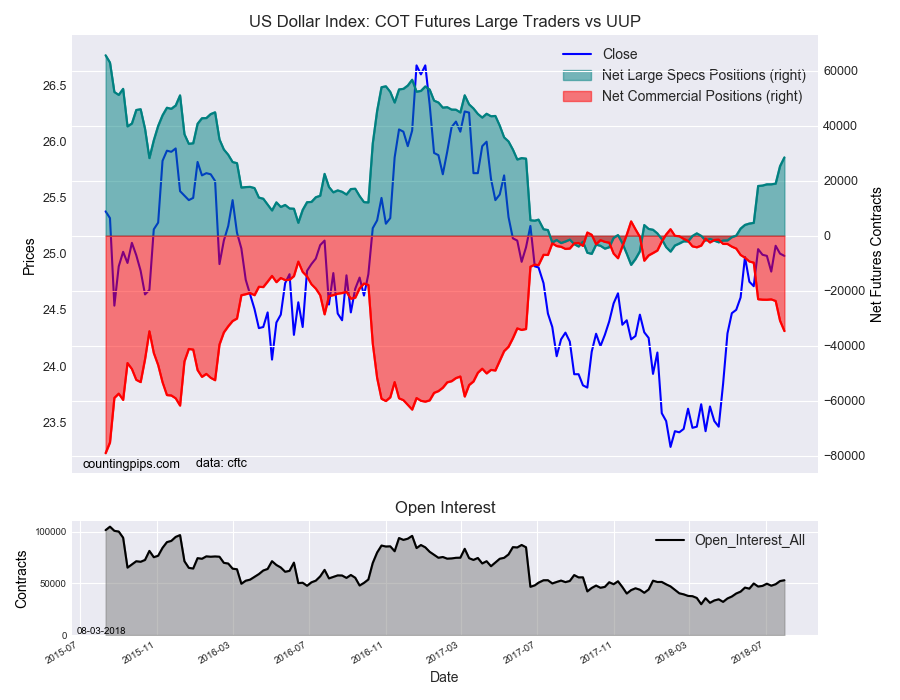

US Dollar Index Non-Commercial Speculator Positions:

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators increased their bets in favor of the US Dollar Index futures for a fifteenth consecutive week.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 28,456 contracts in the data reported through Tuesday July 31st. This was a weekly rise of 3,185 contracts from the previous week which had a total of 25,271 net contracts.

The speculative position in the Dollar Index futures has now risen for a fifteenth consecutive week to the highest overall bullish standing since May 23rd of 2017 (a span of 62 weeks).

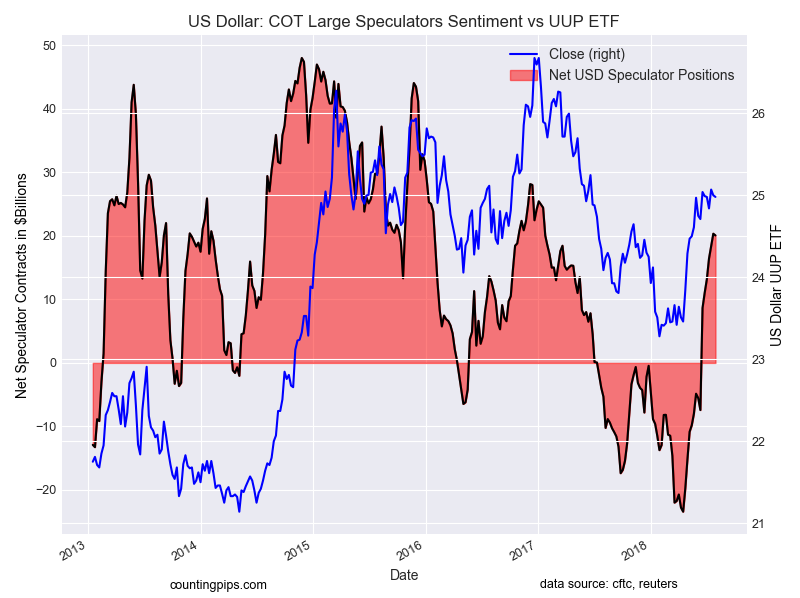

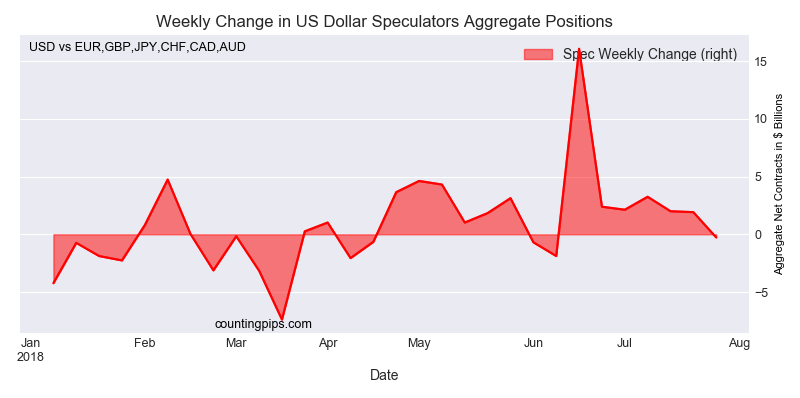

The Aggregate US Dollar Position edges slightly lower after 6 weeks of gains

US Dollar net speculator positions dipped to $20.06 billion this week

The aggregate US dollar position – totals of the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc – showed that large traders and currency speculators edged their overall bets lower to a total $20.06 billion bullish position this week, according to data from the CFTC and dollar amount calculations by Reuters.

This was a weekly decline of $-0.27 billion from the $20.33 billion total position that was registered last week, according to the Reuters calculation (totals of the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc).

The aggregate measure had advanced for six straight weeks before this week’s small decline and has now been in a bullish position for the past seven weeks.

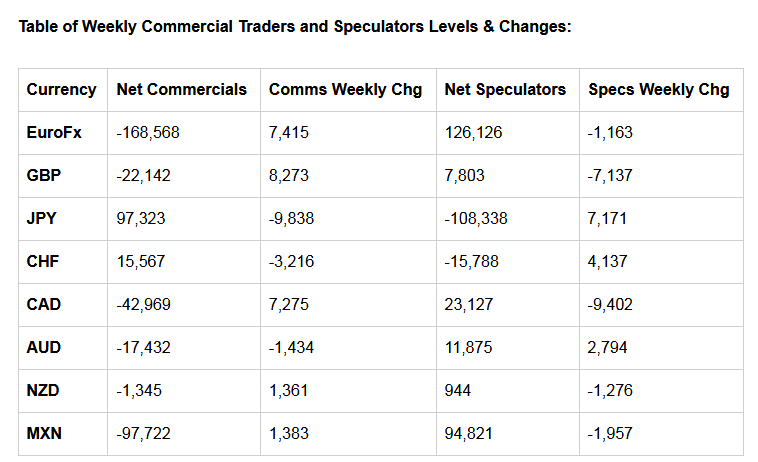

Individual Currency Contract Data this week

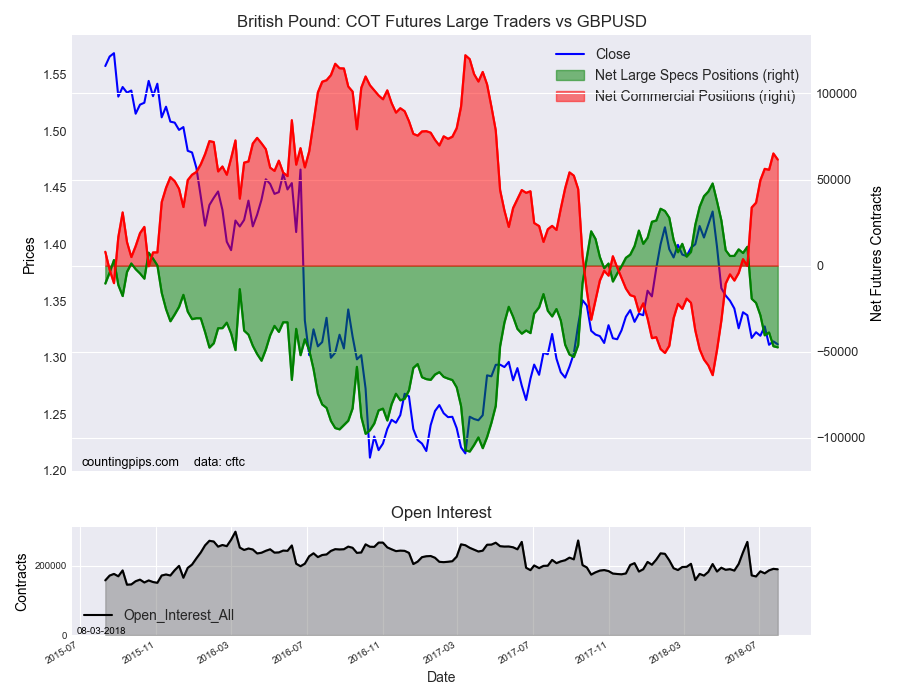

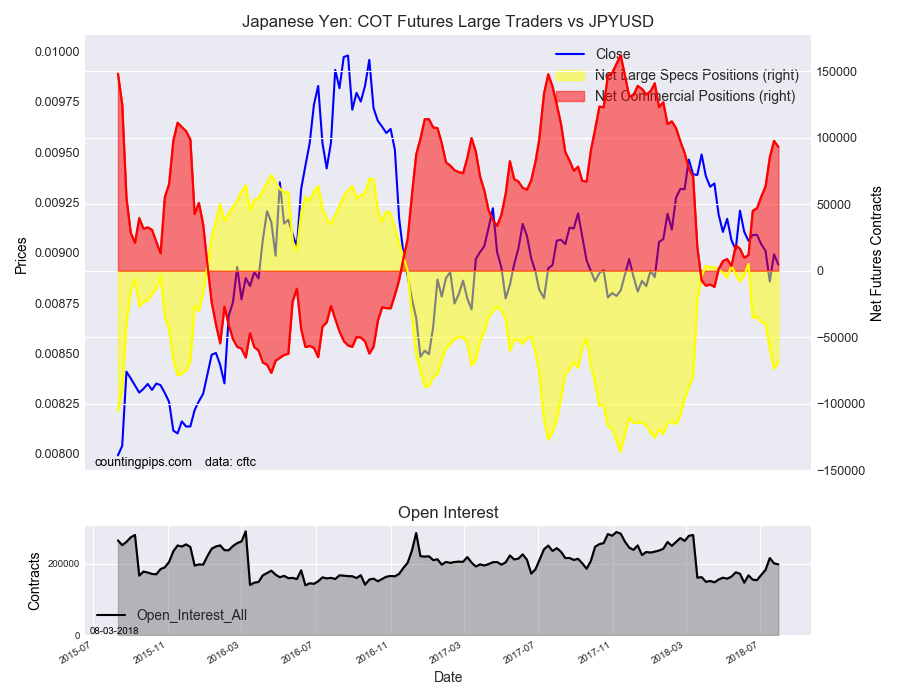

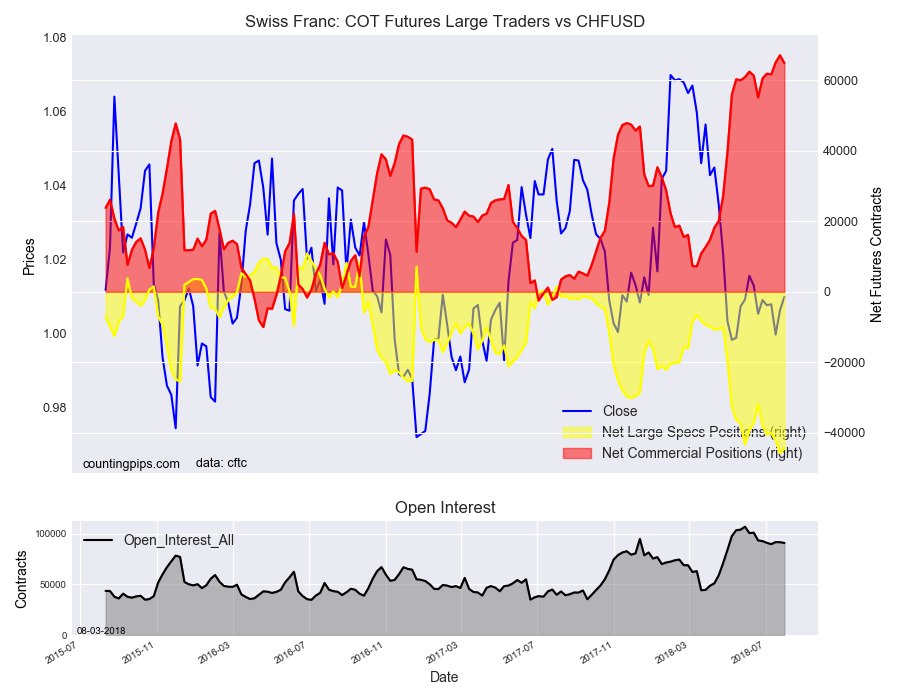

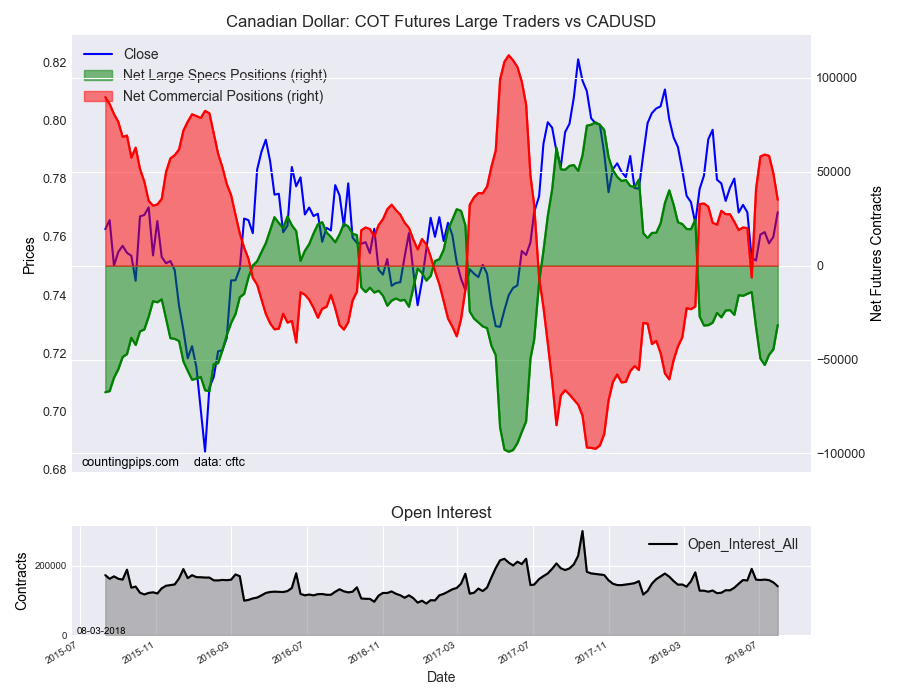

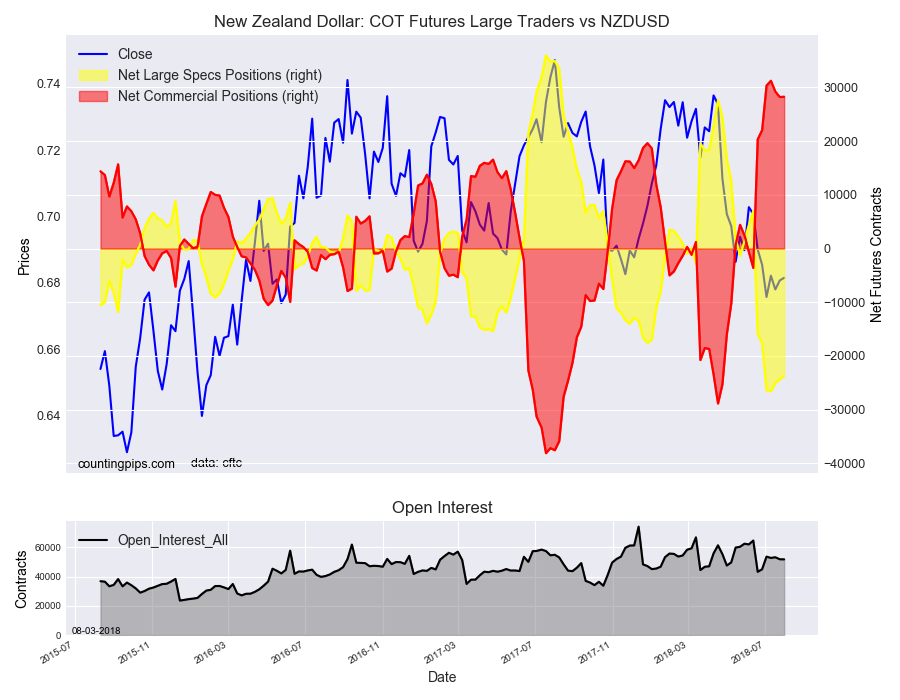

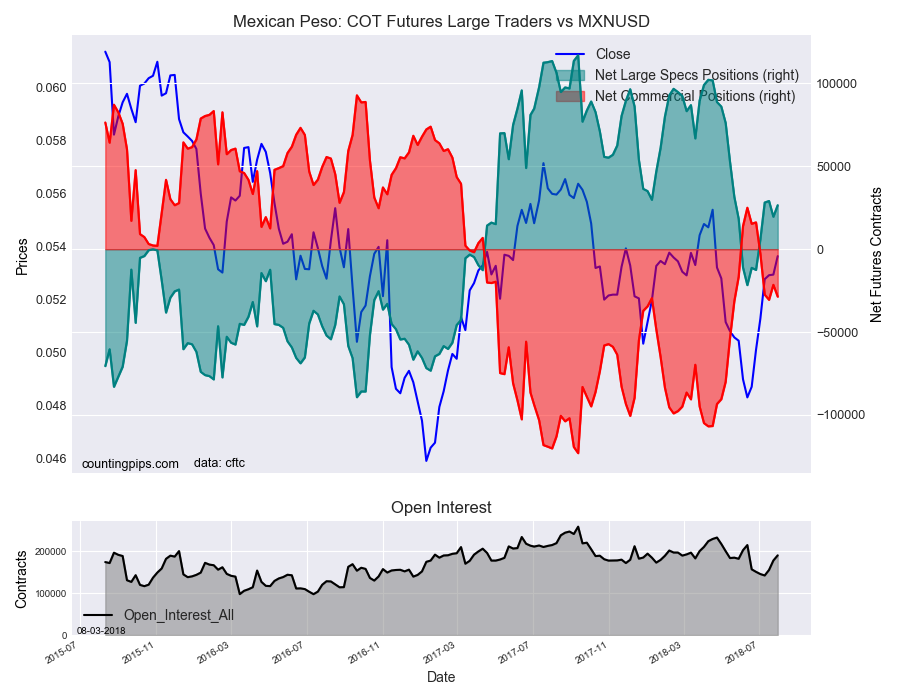

For individual currency contracts this week, the non-commercial large futures traders, including hedge funds and large speculators, bet in favor of the US Dollar Index (3,185 weekly change in contracts), the Japanese yen (5,312 contracts), Swiss franc (1,386 contracts), Canadian dollar (12,942 contracts), New Zealand dollar (690 contracts) and the Mexican peso (6,931 contracts).

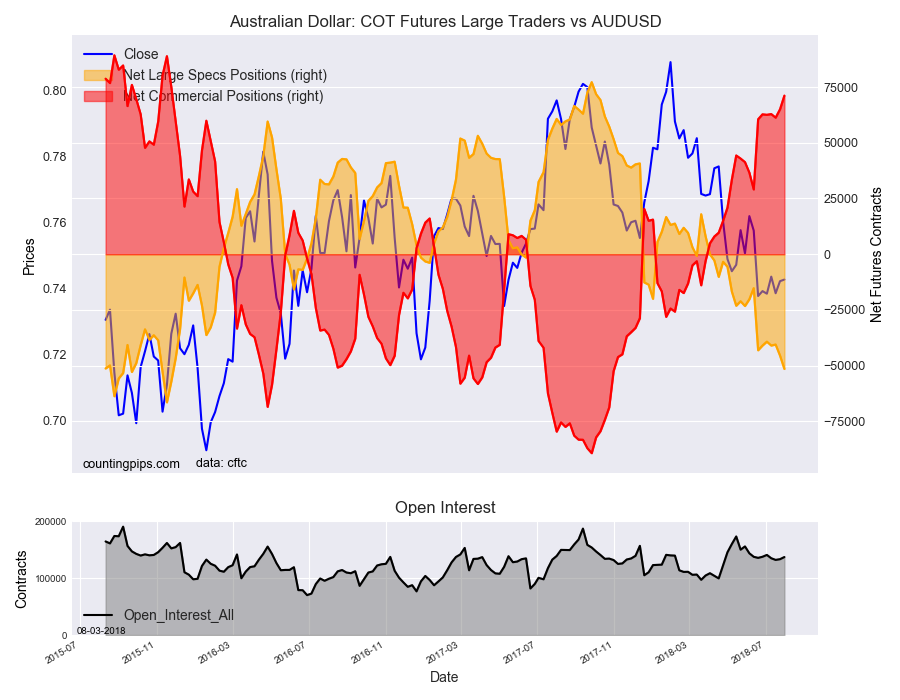

The currencies whose speculative bets declined this week were the euro (-6,815 weekly change in contracts), British pound sterling (-643 contracts) and the Australian dollar (-5,990 contracts).

Table of Weekly Commercial Traders and Speculators Levels & Changes:

Weekly Charts: Large Trader Weekly Positions vs Price

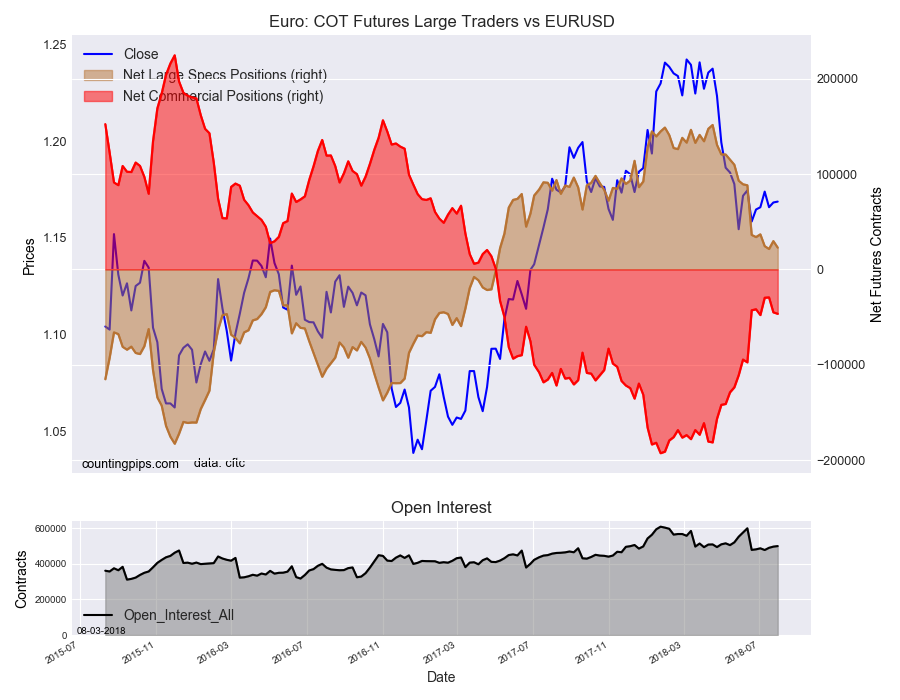

Euro FX:

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.