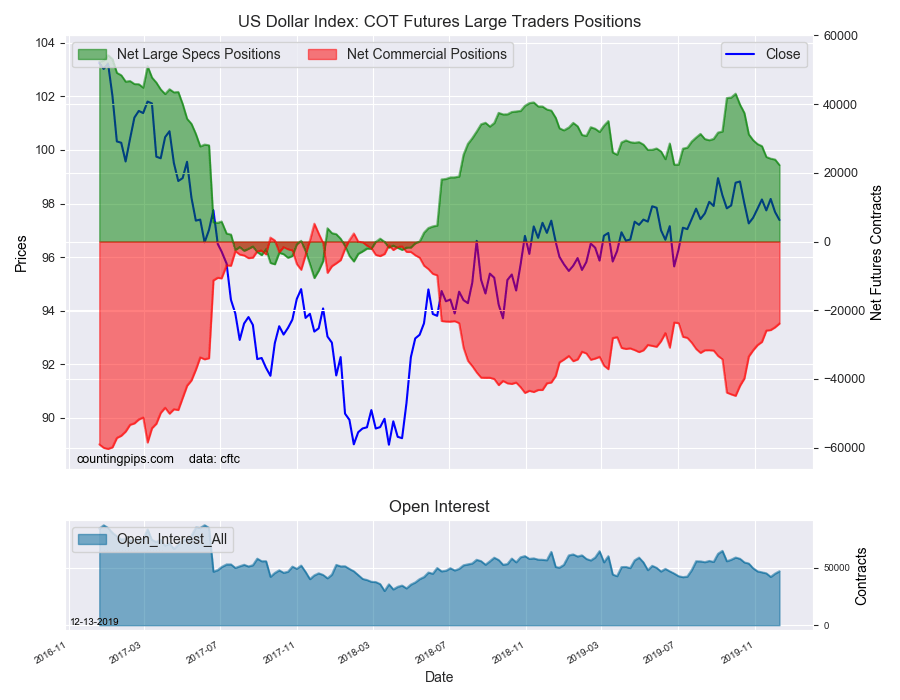

US Dollar Index Speculator Positions

Large currency speculators once again decreased their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 22,261 contracts in the data reported through Tuesday, December 10th. This was a weekly lowering of -1,616 contracts from the previous week which had a total of 23,877 net contracts.

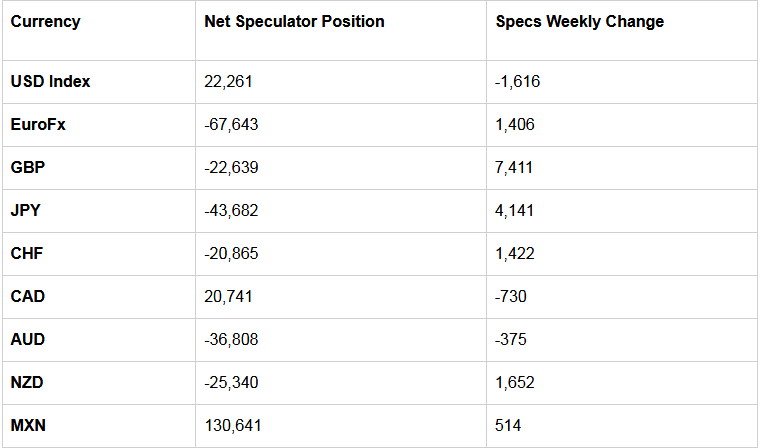

Individual Currencies Data this week:

This week’s net position was the result of the gross bullish position (longs) lowering by -428 contracts (to a weekly total of 30,754 contracts) compared to the gross bearish position (shorts) which saw a rise by 1,188 contracts on the week (to a total of 8,493 contracts).

Speculators continued to pare their bullish positions in the US Dollar Index for a tenth straight week and by a total of -20,767 contracts in that period. The current standing of bullish positions is now at the lowest level in seventy-three weeks, dating back to July of 2018. Despite the recent declines, the USD Index position has now remained in bullish territory for eighty-three consecutive weeks starting in May of 2018.

In the individual major currencies data, the currencies that saw improving speculator positions this week were the euro (1,406 weekly change in contracts), British pound sterling (7,411 contracts), Japanese yen (4,141 contracts), Swiss franc (1,422 contracts), New Zealand dollar (1,652 contracts) and the Mexican peso (514 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-1,616 weekly change in contracts), Canadian dollar (-730 contracts) and the Australian dollar (-375 contracts).

See the table and more currency charts below.

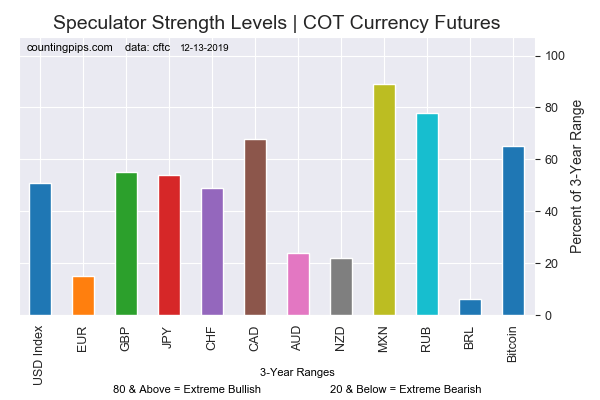

Chart: Current Strength of Each Currency compared to their 3-Year Range

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

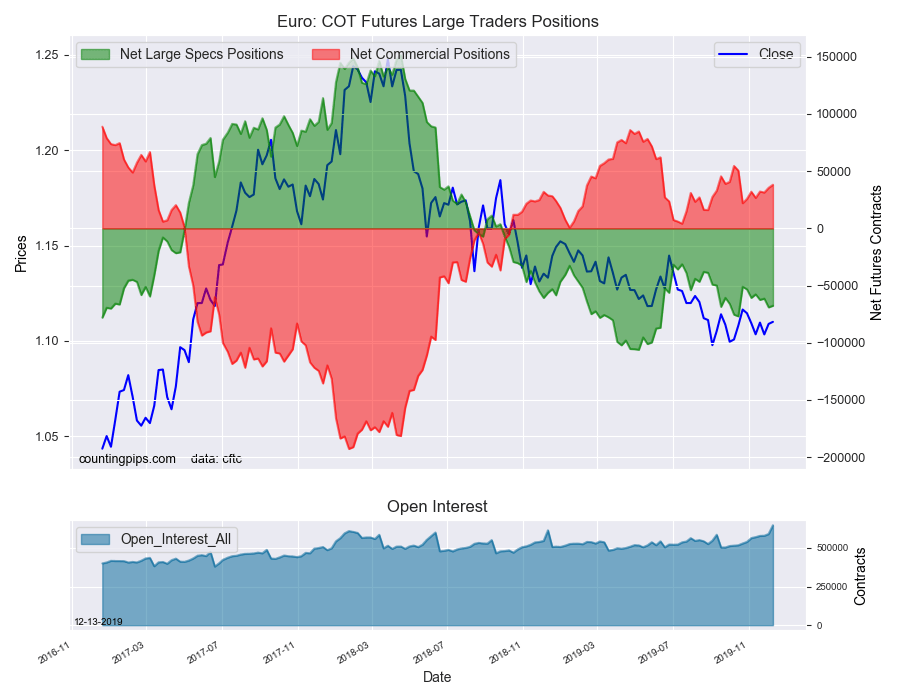

EuroFX:

The euro large speculator standing this week was a net position of -67,643 contracts in the data reported through Tuesday. This was a weekly increase of 1,406 contracts from the previous week which had a total of -69,049 net contracts.

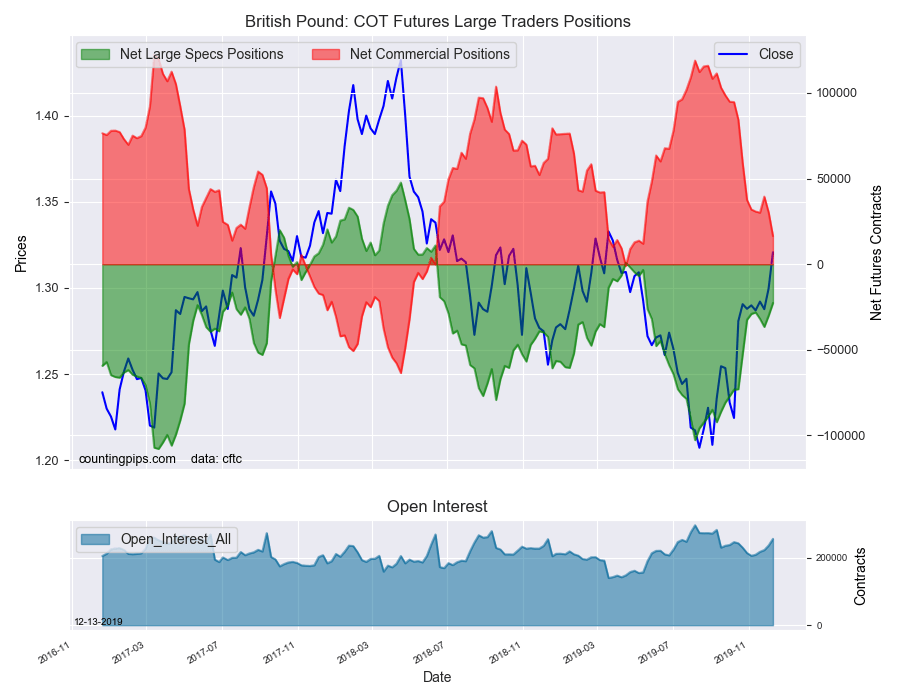

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -22,639 contracts in the data reported this week. This was a weekly boost of 7,411 contracts from the previous week which had a total of -30,050 net contracts.

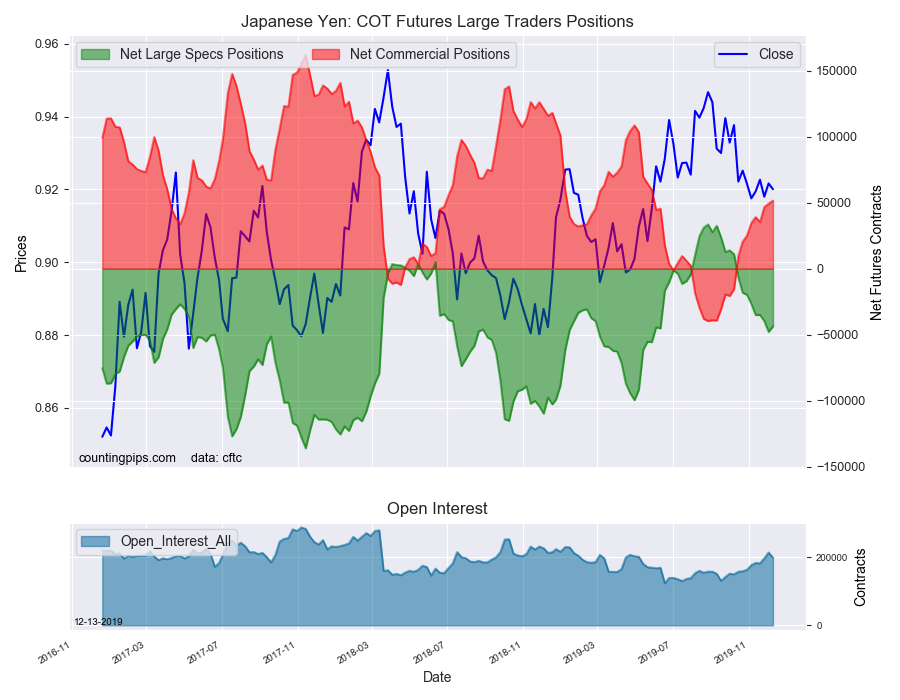

Japanese Yen:

Large Japanese yen speculators totaled a net position of -43,682 contracts in this week’s data. This was a weekly boost of 4,141 contracts from the previous week which had a total of -47,823 net contracts.

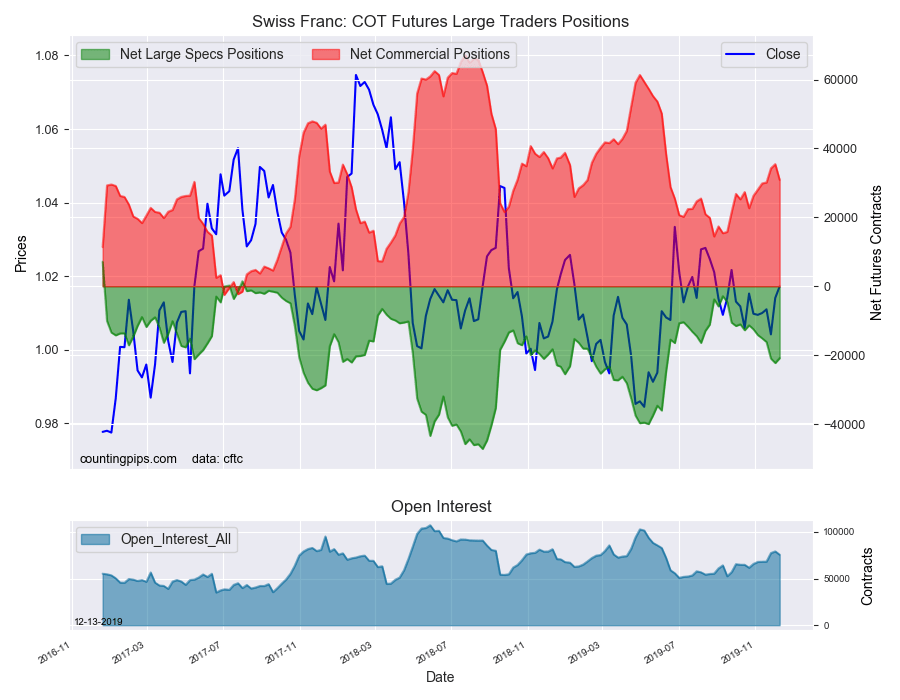

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -20,865 contracts in the data through Tuesday. This was a weekly increase of 1,422 contracts from the previous week which had a total of -22,287 net contracts.

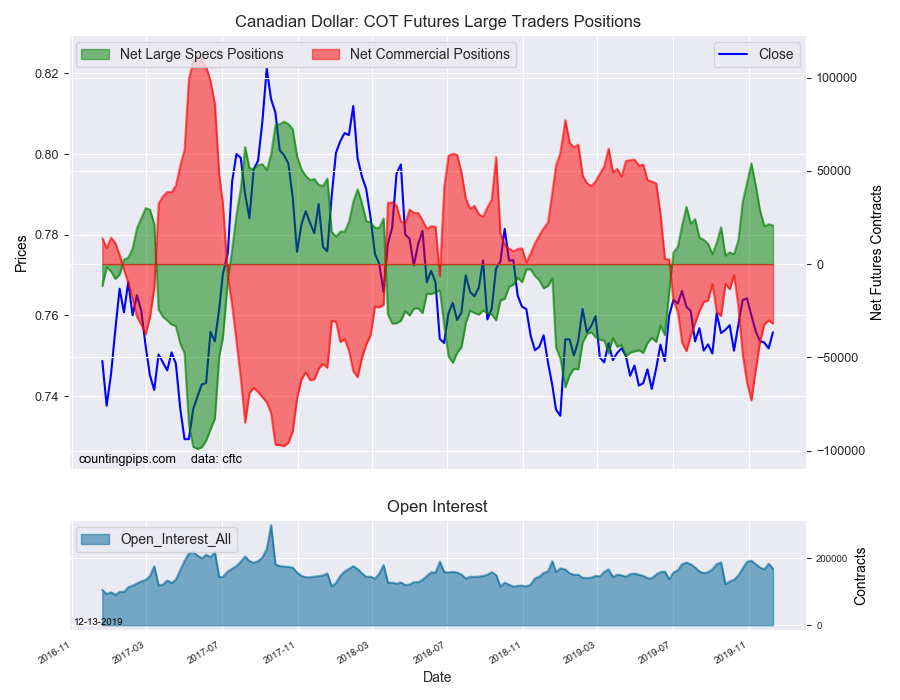

Canadian Dollar:

Swiss franc speculators resulted in a net position of 20,741 contracts this week. This was a decline of -730 contracts from the previous week which had a total of 21,471 net contracts.

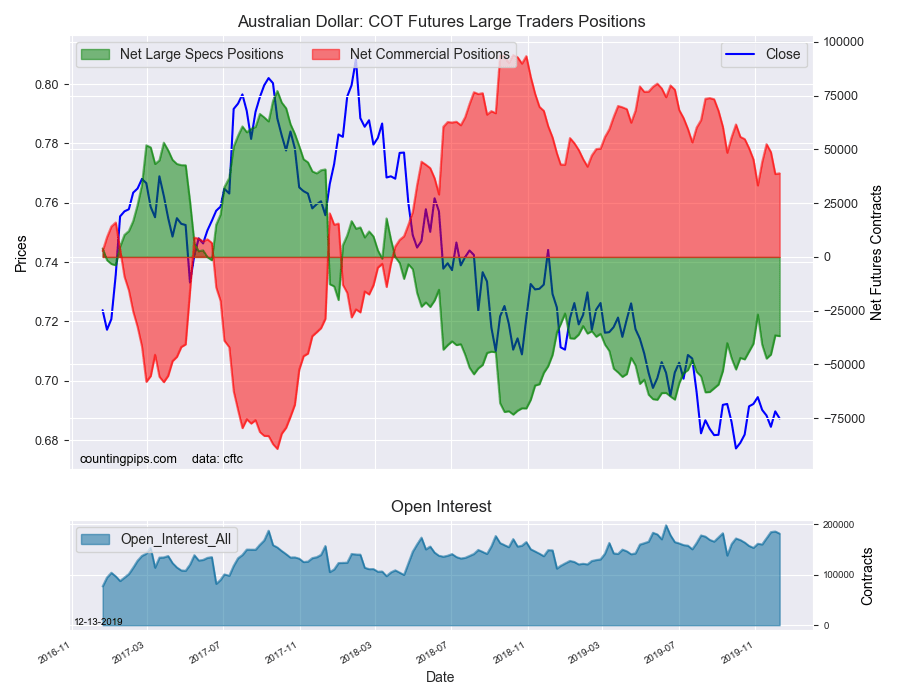

Australian Dollar:

The large speculator positions in Australian dollar futures was a net position of -36,808 contracts this week in the data ending Tuesday. This was a weekly reduction of -375 contracts from the previous week which had a total of -36,433 net contracts.

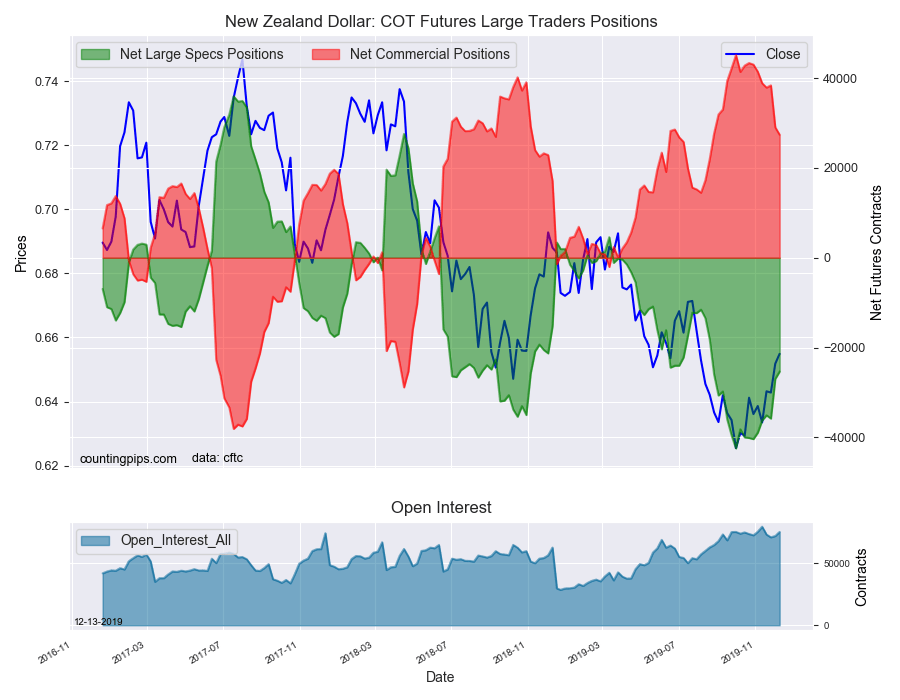

New Zealand Dollar:

The New Zealand dollar speculative standing totaled a net position of -25,340 contracts this week in the latest COT data. This was a weekly advance of 1,652 contracts from the previous week which had a total of -26,992 net contracts.

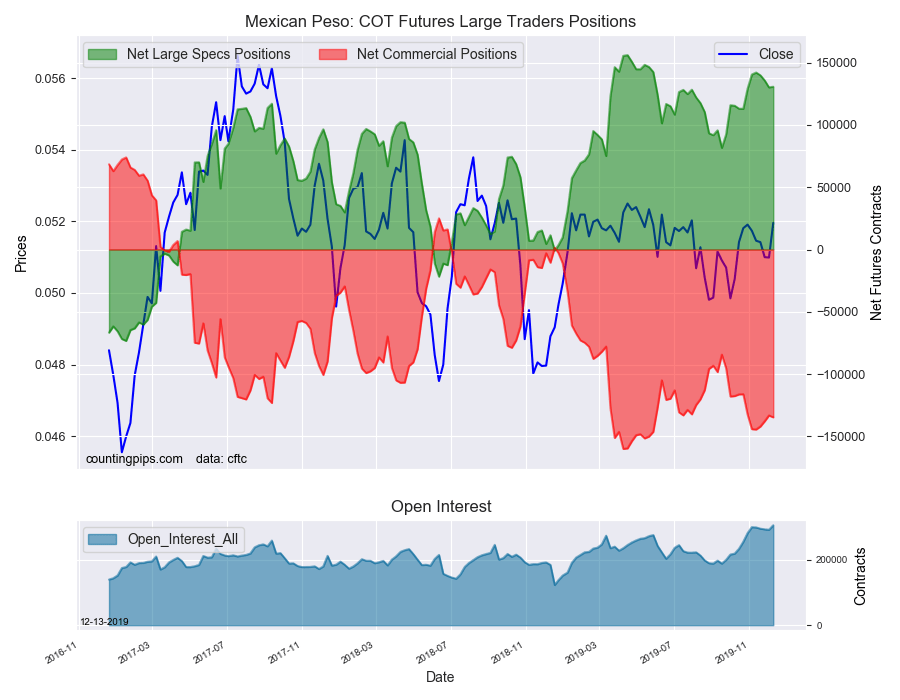

Mexican Peso:

Mexican peso speculators was a net position of 130,641 contracts this week. This was a weekly advance of 514 contracts from the previous week which had a total of 130,127 net contracts.