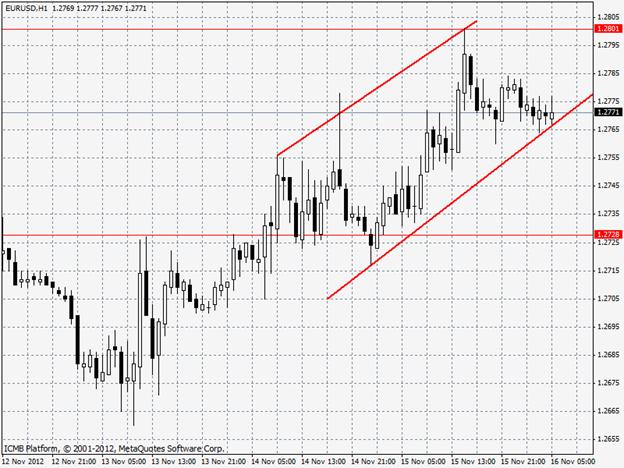

The euro traded higher against the U.S. dollar Thursday as the release of weak U.S. data weakened greenback demand although sustained euro zone debt concerns continued to weigh on the single currency. The U.S. dollar came under pressure after the Federal Reserve Bank of Philadelphia said that its manufacturing index tumbled by 16.5 points to minus 107 in November from October’s reading of 5.7, contracting at the fastest rate in four months. A separate report showed that the New York Federal Reserve’s index of manufacturing conditions improved unexpectedly in November, but remained in contraction territory for the fourth consecutive month. Earlier in the session, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending November 10 rose by 78,000 to a seasonally adjusted 439,000, the highest level since April 2011, compared to expectations for an increase of 14,000 to 375,000. In addition, data showed that consumer price inflation in the U.S. rose in line with expectations in October, while prices excluding food and energy costs increased more-than-expected. Core CPI which excludes food, energy, alcohol, and tobacco costs held steady at 1.5%, unchanged from a preliminary estimate and matching forecasts. EUR/USD" title="EURUSD" width="624" height="468">

EUR/USD" title="EURUSD" width="624" height="468">

GBP/USD

The pound erased losses against the U.S. dollar on Thursday bouncing off a two-month low as disappointing U.S. economic data weighed broadly on demand for the greenback, although euro zone debt concerns remained. Cable was likely to find support at 1.5778, the low of August 31 and resistance a1.5916, the high of November 13. The greenback weakened after the Federal Reserve Bank of Philadelphia said that its manufacturing index tumbled by 16.5 points to minus 107 in November from October’s reading of 5.7, contracting at the fastest rate in four months. Meanwhile, the pound's gains were limited after official data showed that U.K. retail sales fell more-than-expected in October, ticking down 0.08% after a 0.5% rise the previous month. Analysts had expected retail sales to fall by 0.1% in October. Investors were also cautious after official data released earlier showed that the region’s economy shrank 0.1% in the third quarter, following a contraction of 0.2% in the preceding quarter. A technical recession is defined as two straight quarters of contraction. GBP/USD" title="GBPUSD" width="624" height="468">

GBP/USD" title="GBPUSD" width="624" height="468">

USD/JPY

The U.S. dollar rose to a fresh six-and-a-half month high against the yen on Thursday after the release of a flurry of U.S. economic data, while mounting speculation that the Bank of Japan may be pressured into implementing additional easing measures continued to weigh on the yen. The pair was likely to find support at 80.12, the session low and resistance at 81.69, the high of. April 24. The safe haven greenback gained ground after official data showed that the number of people who filed for unemployment assistance in the U.S. last week surged to the highest level since April 2011. Meanwhile, the yen remained under pressure after Shinzo Abe, the head of Japan's main opposition party and frontrunner in next month's election, called for aggressive monetary easing by the BoJ to support growth. Abe said he wants the central bank to set interest rates at zero or below zero to enhance lending and added that he wants to work with the BOJ to reverse the trend of a stronger yen, as it hurts the competitiveness of small firms. USD/JPY" title="USDJPY" width="624" height="468">

USD/JPY" title="USDJPY" width="624" height="468">

USD/CAD

The U.S. dollar was lower against its Canadian counterpart on Thursday as higher oil prices supported demand for the commodity-linked loonie, although disappointing U.S. jobless claims data lent support to the safe haven greenback. The loonie found support as light sweet crude futures for delivery in January traded at USD87.09 a barrel on the New York Mercantile Exchange, rising 0.41%.Raw materials, including oil account for about half of Canada’s export revenue. In addition, official data showed that manufacturing sales in Canada rose more-than-expected in September, ticking up 0.40% after a 0.90% increase the previous month. Analysts had expected manufacturing sales to rise 0.30% in September.  USD/CAD" title="USDCAD" width="624" height="468">

USD/CAD" title="USDCAD" width="624" height="468">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Currency-Pair Analysis

Published 11/16/2012, 06:20 AM

Updated 04/25/2018, 04:40 AM

Currency-Pair Analysis

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.