One of the most important decisions participants in the foreign exchange markets must make is whether to view the dramatic pullback in most of the major foreign currencies seen in the early days of the new year as a reversal of the trend or as simply an overdue correction. Our technical analysis sides with the latter and we anticipate renewed dollar weakness in the period ahead.

We would be forced to reconsider if the euro fell through the $1.2980 area or if sterling fell below $1.60. Although the dollar's sharp gains against the yen have left it over-extended, we see no compelling technical sign that a reversal is at hand. Just like ECB's Draghi wielding Outright Market Transaction scheme drove down Spanish and Italian yields, Japan's Abe's rhetoric has been sufficient to drive the yen down without lifting a finger or spending cent.

Reports indicate the new Japanese government wants to see the dollar firm to JPY90. The market seems quite happy to deliver it. However, perhaps, like a dog chasing a car that doesn't know what to do when it catches it, so too will Abe find that success is not all that it is cracked up to be. Japan will likely still be experiencing deflation, a weak economy and corporate governance challenges with the dollar at JPY90 as it did with the dollar at JPY80. Moreover, the export stimulus of a weaker yen may be more apparent than real. Ministry of Finance data shows that Japanese companies, like US multinationals, service foreign demand more through local production than from exports.

Euro: We think the fact that the euro held the $1.2980-$1.3000 area is important. It corresponds to retracement objectives and the 50-day moving average. It is also where the trend line drawn off the late July, Draghi-inspired, low and the early November low comes in. The euro recovery before the weekend was also constructive. It is true that the 5-day moving average has moved below the 20-day average for the first time since the third week in November. However, we suspect that it is giving a false sell signal, generated by the sharp losses in a few days. A move back above $1.3115 would strengthen our confidence and a move above $1.3150 would set up for another test on the $1.33 area.

Yen: The JPY88.80 area is the next immediate dollar target. As the JPY90 area is approached, it may be increasingly important to watch how the yen performs in Asia and whether Japanese corporates try to lock in profits or hedges. Buying dollars on modest dips is likely to be the preferred strategy of the trend following and momentum traders. We anticipate pullbacks to be limited to the JPY86.80-JPY87.30 range.

Sterling: The recovery before the weekend was not as impressive as the euro, but sterling did manage to hold above the $1.60 level. This is where the trend line drawn off the July and November lows comes in. A convincing break warns of potential for another 1% or so decline. On the other hand, a move above $1.6150 helps confirm that a low is in place and a push through $1.62 would encourage another run at $1.6400.

Swiss franc: The technical outlook is similar to the euro. The dollar did fray its downtrend line against the Swiss franc, but it did close poorly--near the session lows, setting up what appears to be a potential hammer in candlestick terms. Initial dollar support is seen near CHF0.9190. A break there could signal a retest on the recent lows just below CHF0.9100.

Canadian dollar: The technical considerations are not generating strong signals. Our bias is for a higher Canadian dollar. However, there are more effective ways to express a negative view of the US dollar, and we note that often in a weak US dollar environment, the Canadian dollar lags on the crosses.

Australian dollar: The huge rally on Wednesday was nearly completely retraced by Friday morning, confusing the near-term technical outlook. However, the strong close before the weekend and the fact that the $1.04 area largely held on the pullback, inclines us to look for follow through gains in the days ahead. The $1.0530 area may offer resistance on the way back to test $1.06.

Mexican peso: The technical outlook is constructive for the peso. However, the dollar is approaching the lower end of its 15-month trading range against the peso, which is found in the MXN12.55-65 area. This still gives the peso bulls some room to play. The MXN12.85 area looks to provide the near-term cap.

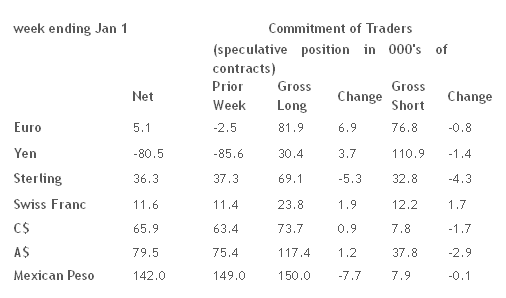

Turning to the Commitment of Traders (COT), we recognize that the participation has slackened over the holiday period and most positions were only marginally changed. Still, we share the following four observations:

1. In the latest CFTC reporting period, speculative participants in the futures market generally added to long futures positions (except for sterling and Mexican peso), while reducing short positions (except in the Swiss franc).

2. For the first time since August 2011 the net speculative euro position is long. That said, the gross euro short position is still substantial and is the second largest behind the gross short yen position.

3. For the third week in a row, the net short yen position was reduced. It is interesting to now why. It is more a reflection of trying to pick a bottom in the yen (gross longs have increased from 16.3k to 30.4k in the past three weeks) than taking profits on short yen positions (gross shorts have slipped from 117k to 111k).

4. The speculative community remains substantially long Canadian and Australian dollar and especially, Mexican peso positions. We think these large currency futures positions should be noted, but not acted upon, without other considerations. The foreign exchange market is more a cash than a futures market. As we have discussed, there are no compelling technical indications that a reversal is at hand.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Currency Outlook: Underlying Trends Are Intact

Published 01/06/2013, 12:14 AM

Updated 07/09/2023, 06:31 AM

Currency Outlook: Underlying Trends Are Intact

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.